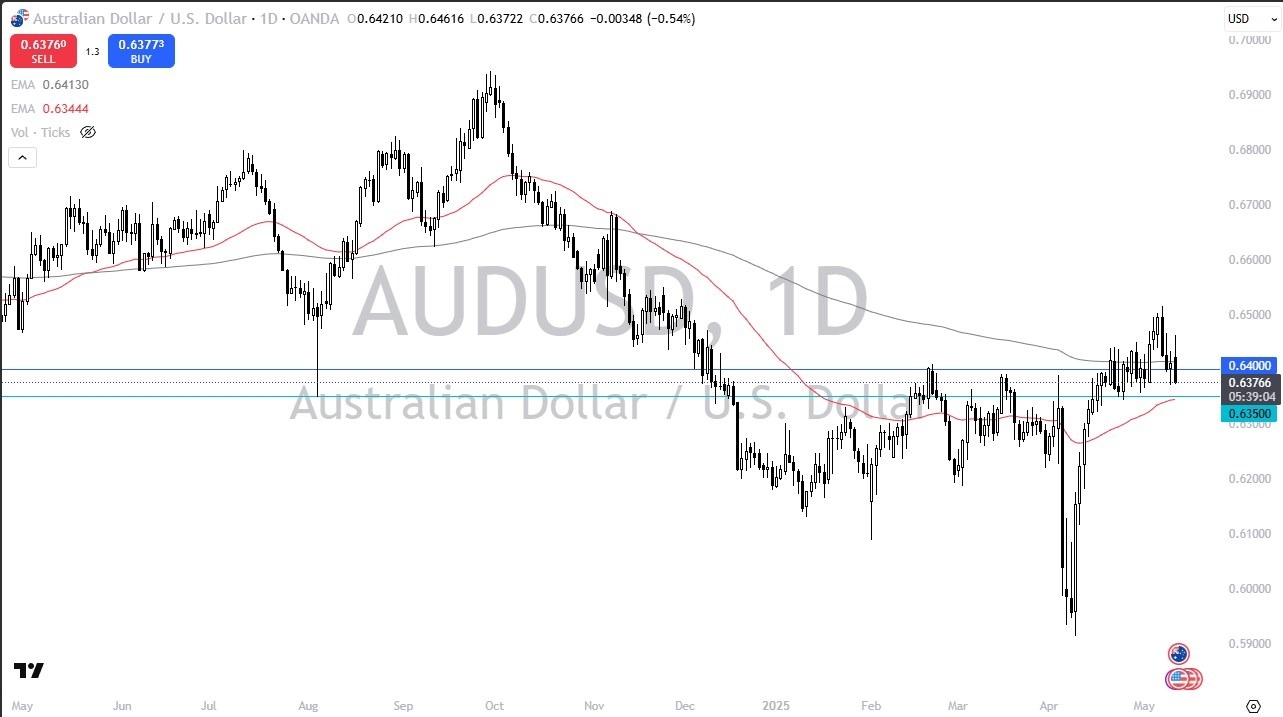

- The Aussie dollar initially did try to rally a bit during the trading session on Monday but gave back gains to show signs of capitulation.

- Keep in mind, this is a currency pair that has a lot of ties to China, so it's interesting to see that the US dollar strengthens quite nicely after the announcement of tariffs being reduced between America and the Chinese.

- This isn't necessarily a trade deal, but it's a pause and a little bit of a ceasefire.

Under normal circumstances, you would expect the Australian dollar to skyrocket after that. And it did in the very first part of the day, but we've seen a complete turnaround. So, I think at this point in time, markets are starting to come to the conclusion that the United States may be better off with some of the deals that they're talking about, and China may not. It doesn't necessarily mean that China will be destroyed and nothing like that. But I do think that leveling out the playing field does help the United States. And I think the markets are starting to say that as well.

On the Breakdown

Top Regulated Brokers

Breaking down below the 50 day EMA and the 0.6350 level could send the Australian dollar lower. But at the very best I see for the Australian right now dollar right now is that we may see a little bit of sideways action. If that ends up being the case, then fine, whatever we are dancing around the 200 day EMA and that in and of itself makes a certain amount of sense.

But it is worth noting that we've seen the US dollar rise quite significantly against multiple currencies around the world. This isn't just an Australian dollar thing. We've seen it against the Canadian dollar, the euro, etc. So, with that being said, I am looking for a shorting opportunity once we break through the next support level.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.