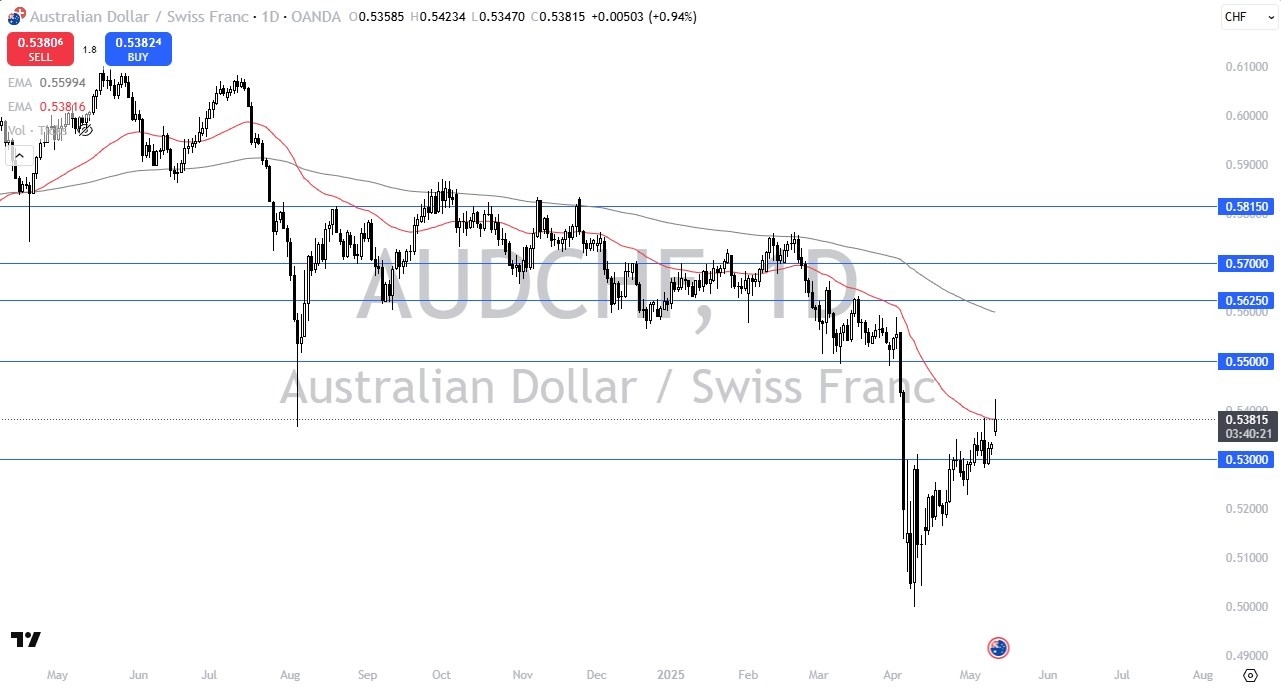

- During the trading session on Monday, we have seen the Australian dollar gap higher against the Swiss franc, as the “risk on” attitude has come back into the picture.

- The 50 Day EMA has offered a little bit of resistance, but at this point in time it still looks as if we are ready to go higher.

- The 0.53 CHF level underneath is an area that I’d be watching very closely, because it has been important multiple times, and if we are in fact breaking out to the upside, we will need to leave that level far behind his.

Technical Analysis

Top Forex Brokers

The technical analysis for this AUD/CHF pair is a bit of a mixed picture, because we have seen such a massive move to the upside over the last couple of weeks, but at the same time we also have to keep in mind that we are hanging around the 50 Day EMA which of course has been very negative. Furthermore, the 0.55 level above is an area that I’d be watching, as it has been important previously and it could offer a bit of resistance. That being said, this is a market that will continue to be very noisy, and I think you have to keep in mind that this is a market that is heavily influenced by external factors as well.

When the overall attitude of markets starts to shift, this is one of the more interesting currency pairs to watch, as the Australian dollar is considered to be a “risk on currency”, while the Swiss franc is considered to be a “safety currency.” With that being said, if we start to see other risk-based assets start to climb, then you see this market truly take off to the upside. Ultimately, that’s what I’m getting at here, that this could be a pair that will be very interesting to pay close attention to, because it could give you an idea as to how other markets may get moved during the trading session. If we can break above the high of the trading session on Monday, that leads to more “risk on behavior”, and a move to the 0.55 CHF level. If we turn around and break down below the 0.5280 level, then we could see the Australian dollar dropped significantly.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.