- The US dollar has rallied a little bit against the South African Rand in a bid to recover during the trading session here on Tuesday.

- Ultimately, this is a market that of course is an emerging market currency and therefore it does tend to be rather noisy.

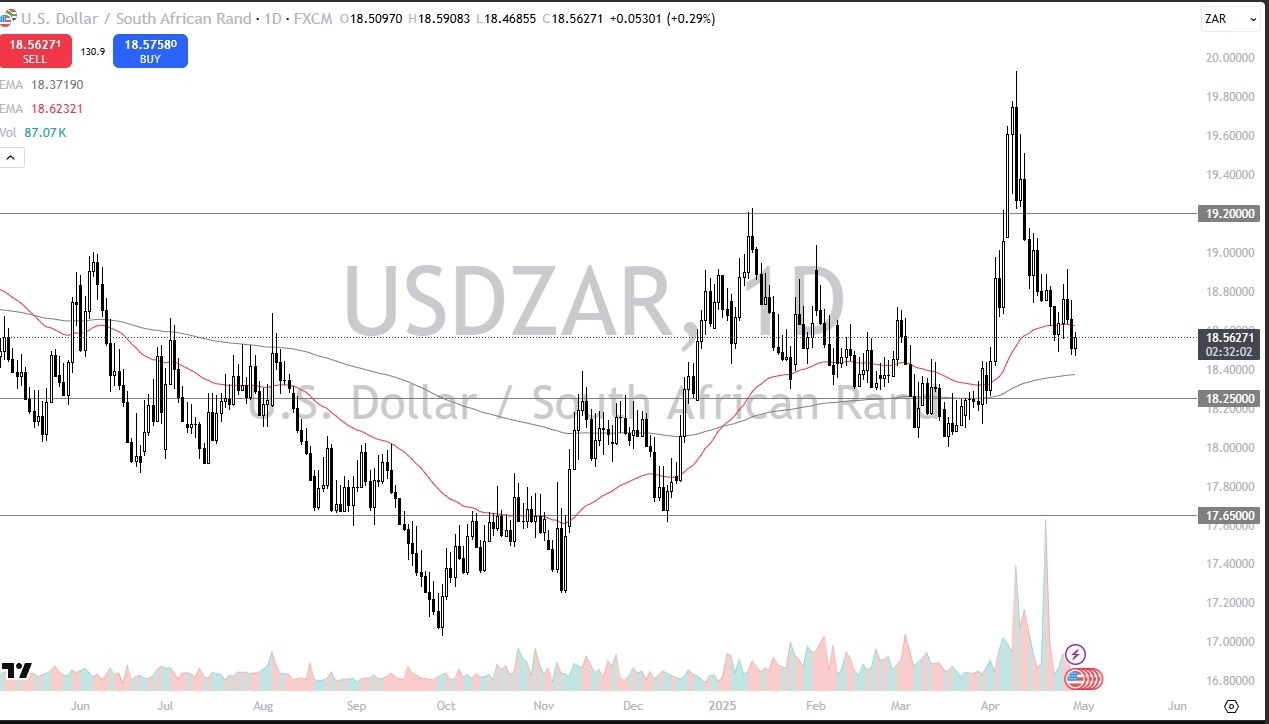

- I suspect that the 200-day EMA underneath will be crucial, right along with the 18.25 ZAR level.

If we can turn around and rally to get above the 18.80 ZAR level, then the dollar will more likely than not continue higher. When you look at the longer-term charts, you can see that we have been in somewhat of a sideways market over the last two and a half years or so with the area near 17.25 Rand being the floor and 20 Rand being the ceiling.

Looking for Momentum at the Moment

Top Forex Brokers

Right now, we're just kind of stuck in the middle, but the sell-off has been exaggerated. So, if we can recapture this 50 day EMA, I do think that the 18.80 Rand level will be targeted. After that, then you have the 19.20 Rand level. I do expect a lot of volatility, and I expect a lot of sideways action, and that makes sense considering just how much trouble there could be for the global economy.

After all, South Africa is an emerging market, and the United States is considered to be a safety currency. The US dollar is at least, and that might come into play here. Under normal circumstances, that probably would have already happened. And you can see that previously this pair did spike. So, I would not be surprised at all. If we do bounce from here, I'm looking for momentum to the upside to take advantage of at the moment.

Ready to trade our daily Forex forecast? Here’s some of the best trading platforms in South Africa to check out.