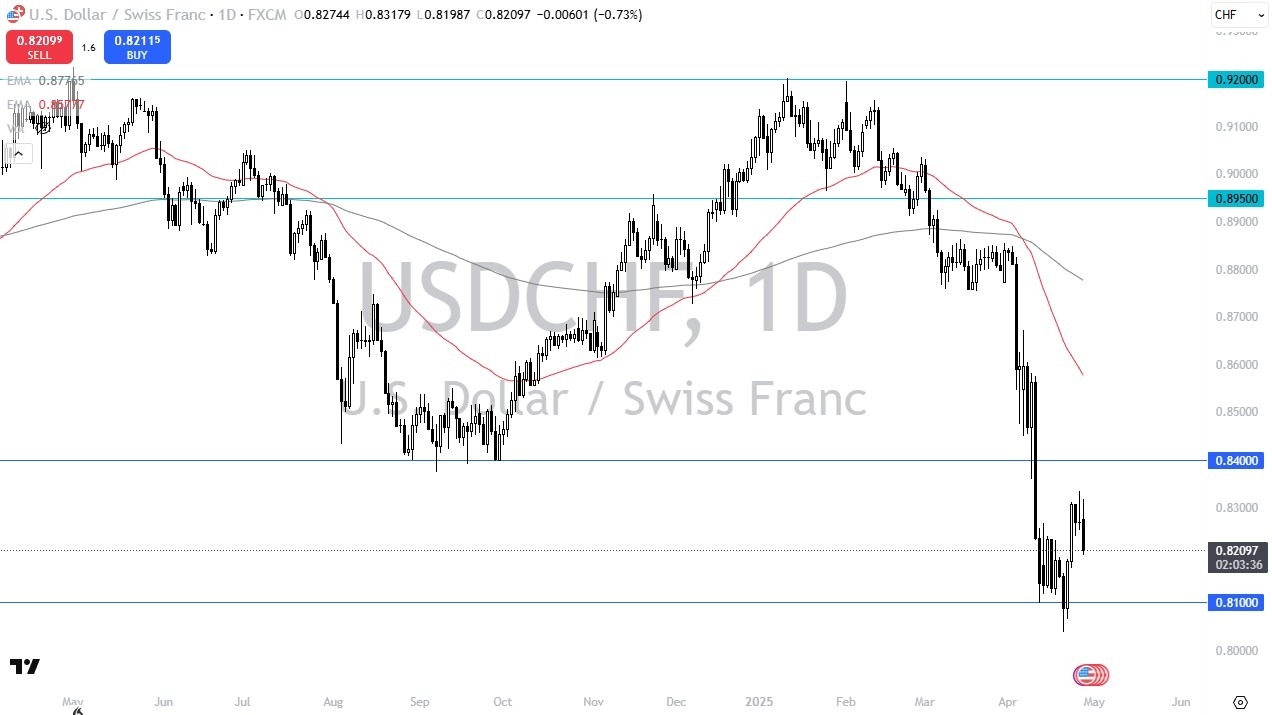

- The US dollar fell against the Swiss franc during the trading session on Monday, as we have seen the US dollar give back some of the gains that it has recently enjoyed.

- It’ll be interesting to see how this plays out though, because the weekly candlestick is somewhat of a different look.

- After all, we have seen a very strong move to the upside last week, so it does suggest that there are at least some buyers down here that are willing to get involved in a market that has been oversold.

However, you should also keep in mind that traders love to panic. That’s essentially what we have seen for several weeks now, as people are out there shouting at the sky and suggesting that it’s the end of the world. The reality of course is completely different, and you should always keep in the back of your mind that most people are trying to sell you something. While it is true that this market could fall from here, I also recognize that if we see a complete turnaround in the global drama that is the tariff situation, this pair probably spiked to the upside in a ferocious short covering rally.

Top Forex Brokers

Swiss National Bank

The Swiss National Bank is known to get involved in the currency markets, and we may have even seen a little bit of that last week, although nobody really knows. The reality is that the Swiss eventually get sick of this and start shorting the Swiss franc and the open markets. This is especially true if the EUR/CHF starts to fall too drastically. Europe is the biggest trading partner of Switzerland, so they don’t like the idea of their currency getting too strong. That of course, can have a major influence on what happens over here and the USD/CHF pair.

When I look at this chart, the 0.81 level is obviously an area of significant support, just as the 0.83 level seems to be somewhat resistant. I think we are in the process of trying to find some type of bottom here, but this will depend more on the US dollar than the Swiss franc. It is because of this that you need to pay close attention to currency pairs involving the US dollar around the world as it will typically move in the same direction overall.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.