Trump’s trade war remained the most dominant force in the markets this week, though matters improved for some assets after a 90-day pause was placed on the high tariffs issued against most US trading partners to allow time for negotiations.

Top Forex Brokers

After bottoming out near $74,500 last Wednesday, cautious dip-buyers wasted back into the crypto market, pushing Bitcoin (BTC) back above $83,000.

At the time of writing, King Crypto trades near $83,600, just below its 50-day moving average. Many are hopeful that the worst of the pullback is over, and if the signs from bulls hold true, more upside could be ahead.

CryptoQuant analyst Darkfost provided evidence that bulls are starting to get more active, noting that “Binance Bulls are coming back” in a post on Tuesday.

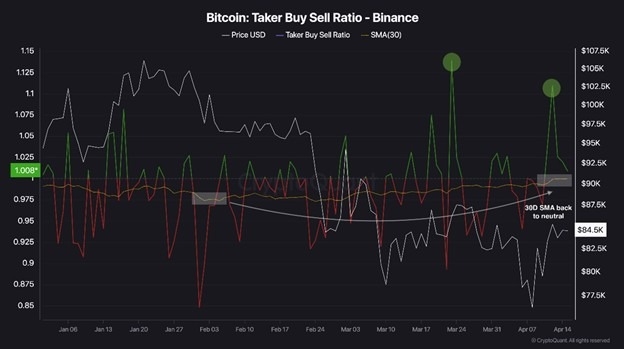

Darkfost highlighted that the Binance taker buy-sell ratio suggests that Binance bulls are re-engaging with the derivatives market.

“The taker buy-sell ratio reflects which side, bulls (longs) or bears (shorts), is dominating in terms of volume,” he noted. “When the ratio is above 1, it indicates that buyers (bulls) are in control. When it drops below 1, sellers (bears) are dominating volumes.”

“Since the beginning of 2025, the 30 EMA ratio on Binance had consistently remained below 1, indicating sustained bearish pressure,” Darkfost underscored. “However, as of today, the ratio has returned to neutral territory. Over the past few days, the ratio has been mostly positive, suggesting that bullish sentiment is picking up again on Binance’s derivatives market.”

Solana Surges Higher

Solana (SOL) was the best performing token in the top 20 over the past week, increasing nearly 21% amid the widespread market bloodbath.

The primary reason for the bullish momentum is the pending launch of multiple spot SOL ETFs on the Canadian market, which are expected to feature SOL staking.

Canada is readying spot Solana ETFs to launch this week after regulator gave green light to multiple issuers incl Purpose, Evolve, CI and 3iQ. ETFs will include staking via TD pic.twitter.com/FSw149Xkm4

— Eric Balchunas (@EricBalchunas) April 14, 2025

As claimed in the private client note from TD Bank shared by Bloomberg analyst Eric Balchunas in the above X post, the Ontario Securities Commission (OSC) greenlighted asset managers Purpose, Evolve, CI, and 3iQ to issue ETFs holding Solana, and the ETFs are permitted to stake a portion of the SOL holdings for added yield.

The pending approval of spot SOL ETFs in Canada has renewed optimism for the approval of similar products in the U.S., providing a further boost to Solana’s price.

Another factor exciting market watchers is the appointment of Paul Atkins as SEC chair. Atkins is well known in the crypto community for his crypto-friendly stance, and previous comments from Gary Gensler’s replacement have sparked speculation that several altcoin ETFs, including Solana, could soon be approved.

Multiple asset managers, including VanEck, Grayscale, 21Shares, Bitwise, and Canary Capital, have already submitted applications for a Solana ETF, and with a pro-crypto administration in the White House, crypto proponents think it's only a matter of time until the altcoin ETF dam breaks.

According to data provided by Polymarket, the odds of a SOL ETF approval in the US in 2025 now stand at 82%.

As for what this all means for Solana’s future price performance, market analyst BitBull says Solana in 2025 is going to be like Ethereum in 2021.

“Just like Ethereum's run in 2021, Solana is setting up for a massive move in 2025,” BitBull wrote. “$ETH in 2021 followed a clear accumulation and breakout pattern on the CME chart. $SOL is now showing a similar structure on the CME Futures chart.”

BitBull identified the range between $120 and $130 as the accumulation zone, setting SOL for a price target of $300.

Crypto analyst il Capo Of Crypto shares a similar outlook, though he expects a bull trap-like rally to take SOL above $180 before one final capitulation event to the low $100s before the altseason starts and Solana soars above $400.

$SOL pic.twitter.com/LhTJMenTCj

— il Capo Of Crypto (@CryptoCapo_) March 15, 2025