Potential signal:

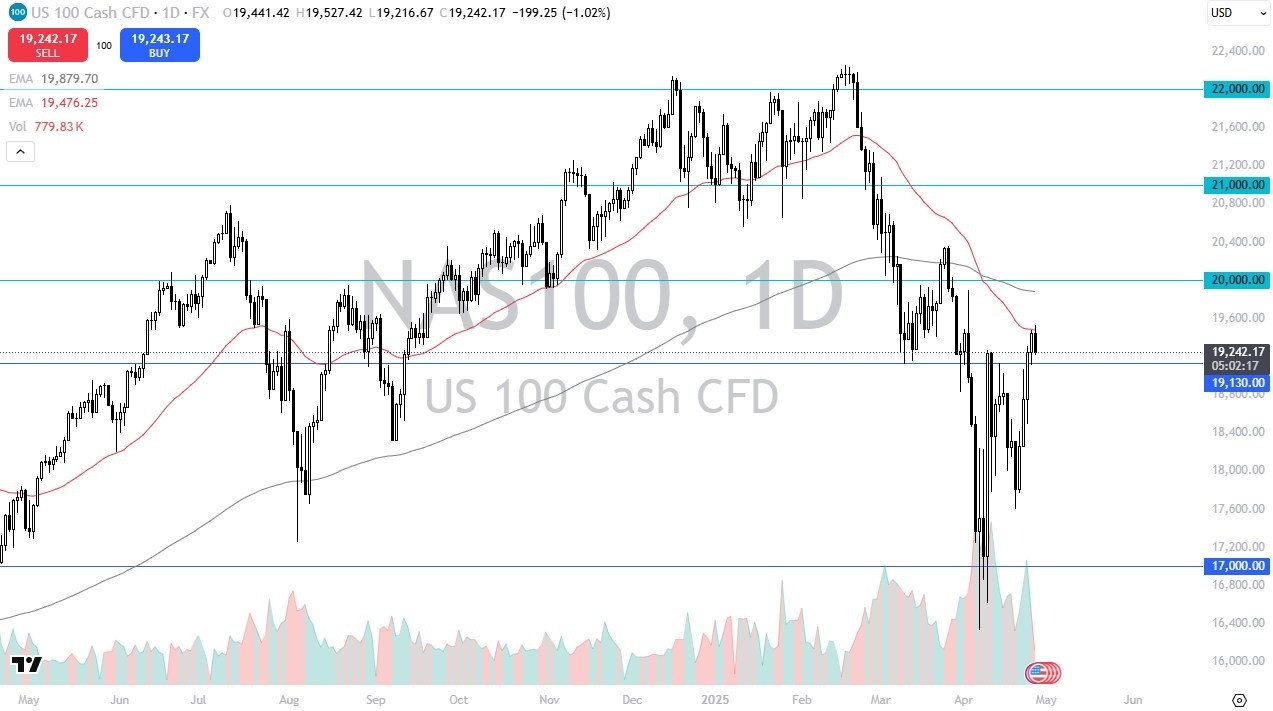

- This one is somewhat easy. I would get long of NASDAQ 100 on a break of the high price for Monday.

- I would have a stop loss at the 19250 level.

The NASDAQ 100 initially did try to rally during the trading session on Monday, but we sold off as we have tested the 50 day EMA, and we probably are a little overdone at this point. That being said, we are dancing around above the top of the massive candlestick that Donald Trump kicked off when he suggested that tariffs were going to be paused.

So, it'll be interesting to see how this continues. Unfortunately, the NASDAQ is mainly traded by computerized programs that will read headlines in the news and every little tweet is a potential landmine. So, with that, I suspect some of this might have to do with whether or not the United States and China are talking, which I think eventually won't be an issue, but right now it still has the ability to cause some chaos.

Top Regulated Brokers

Support Below

The 19,130 level is an area that previously had been support and resistance. And as we approach that, I become interested. It'll be interesting to see whether or not we can bounce from here because we have made a breakthrough significant resistance. If we can break above the top of the candlestick for the day on Monday, then it's likely we will go looking at the 200 day EMA, possibly even the 20,000 level.

If we break down below the 19,000 level, then I think you've got a situation where traders will eventually get involved. I don't think we make a new low, but you never know, it is possible. I'd be very interested in 18,400 below, and then again, the 18,000 level. In general, this is a market that I think continues to be very noisy and dramatic. And as such, you should always keep your position size reasonable, regardless of whether or not you agree with the idea that we will probably continue to grind higher or not. Either way, being cautious is the most important thing.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.