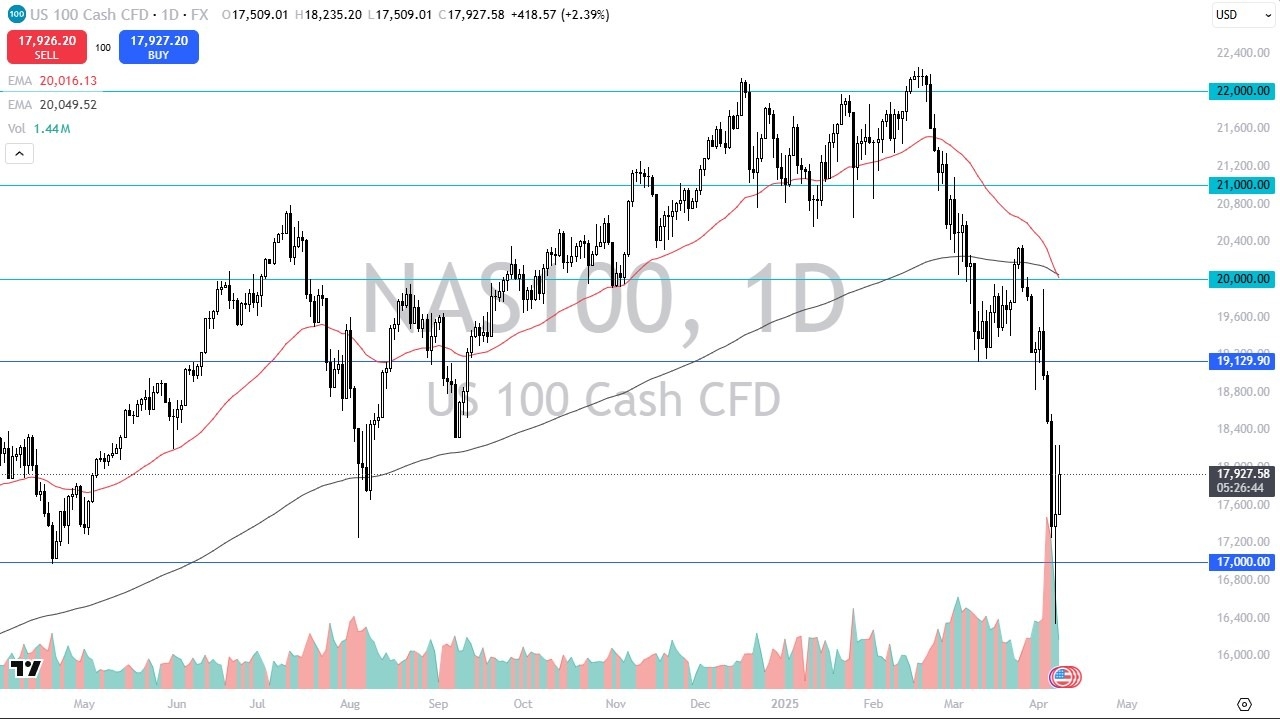

- You can see that the Nasdaq 100 was very noisy during the trading session on Tuesday as we did start off the day with a bit of a relief rally.

- With that being said, I think you have a scenario where traders will continue to look at this as a market that is volatile.

- I think it is a market that will be moving on the latest headline or noise coming out of Trump and of course world leaders.

- We are beyond the idea of trying to figure out what happens next in this market due to fundamentals other than the technicals.

This has been a nice opportunity for those who have decided to cover their shorts to allow short-term scalpers to come in and pick this market up, but I just don't see how you would get aggressive here. The 18,250 level seems to have acted like a pretty significant barrier. If we can break above there, then we may make a run towards $19,000. That being said, it would not surprise me at all to see this market turn right back around and fall towards the $17,000 level.

Headlines Are the Only Thing

Top Forex Brokers

During the session on Monday, we had found out that if Trump were to actually announce a pause on tariff, the market will scream straight to the upside. So, there is that risk and therefore it's difficult to be short. That might be part of what you're seeing here. Or like I was saying, you have a massive sell-off. People who are short of this market want to take their profit.

Ultimately, I think that is part of what's going on. $17,000 is a major support level, and if we were to break that with any consistency whatsoever, we could see this market drop to $15,000. Position sizing is going to be crucial, regardless of which direction you believe you should be trading. Right now, I still favor fading rallies until something truly changes.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.