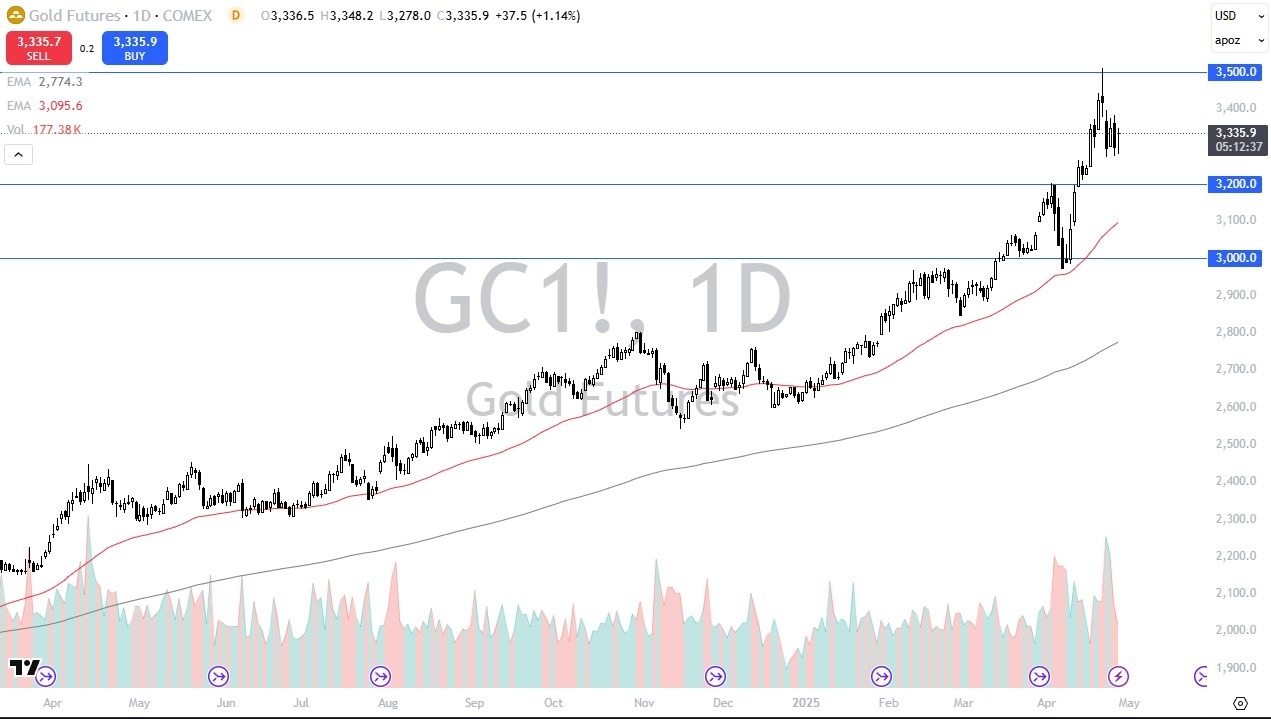

- Gold has initially fallen pretty significantly during the trading session on Monday, reaching the lows that we had tested a couple of times over the last few days before bouncing.

- By bouncing, it does suggest that the uptrend is still intact, but it's also worth noting that the weekly candlestick from the previous week was a very ugly shooting star.

I think what we are looking at is a market that might be trying to stabilize instead of fall. After all, this is a market that is overextended and therefore a little bit of sideways action or a pullback might be in order here. The $3200 level is an area that I'd be very interested in, assuming that we pull back that far, but we could just simply kill time. That's something that you have to be cognizant of.

I Won’t Sell or Short Gold

Top Regulated Brokers

Even with the nasty shooting star candlestick from last week, I'm not looking to get short of the gold market. I think that is a very dangerous game to play because there are millions of reasons right now why gold should be rising. We have tariff wars, have recessions around the world and central banks cutting.

We also have concerns about geopolitics, and then quite frankly, we just have the momentum, the gold has been rising so steadily for so long that markets do take some time to turn around. If we were to break down below the $3,200 level, then I think you start talking about $3,000 as a potential floor as well.

It's really not until we break down below there that I even begin to question the trend. To the upside, I see the $3,500 level as a significant ceiling and breaking above there would kick off the next leg higher. But quite frankly, I think most buyers would appreciate a little sideways action working off some of the momentum that has recently been thrown into the marketplace.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.