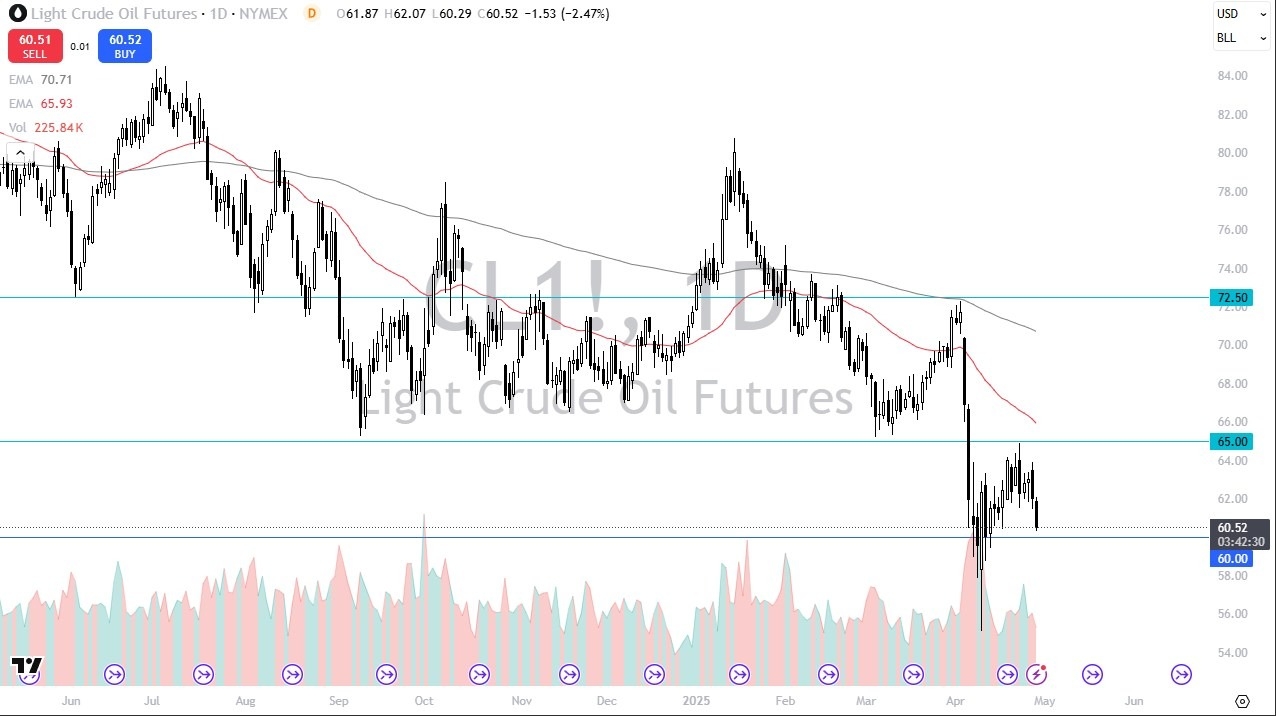

- During the early hours on Tuesday, the Light Sweet Crude Oil market started falling, and it never stops.

- At this point in time, it looks as if the market is trying to test the crucial $60 level, which is a large, round, psychologically significant figure, and an area that had been important previously.

- With that being the case, the market is trying to sort out where to go next, and as things stand right now, we are still very much in the same trading range that we had been in previously.

Technical Analysis

Top Regulated Brokers

The technical analysis for this crude oil market of course is very negative, and it is probably worth noting that oil markets look miserable. However, it’s also worth noting that the area below the $60 level has been crucial for multiple years, and it is probably worth noting that there was a lot of volume once we broke down below there, so I think you’ve got a situation where you have to look at this through the prism of a market that’s at least trying to form some type of bottom and is that historical support.

All of that being said, the reality is that there is not any clarity at the moment, because people are worried about tariffs and trade wars. Obviously, a trade war would be horrible for crude oil, because it does have a negative influence on demand for crude oil. However, I have found through my experience that the more dramatic the market gets, the closer you are to the bottom, or the top and a market that is shooting for the moon.

That being said, this is not a market that you go into with a lot of leverage, nor do you have a lot of size. While it is likely to find some buyers in this area, it’s also in a pretty wicked downtrend over the last couple of months, so you need to see some type of bounce so that you can trade the “right side of the V.”

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.