Bullish view

- Buy the BTC/USD pair and set a take-profit at 99,000.

- Add a stop-loss at 92,000.

- Timeline: 1-2 days.

Bearish view

- Sell the BTC/USD pair and set a take-profit at 92,000.

- Add a stop-loss at 99,000.

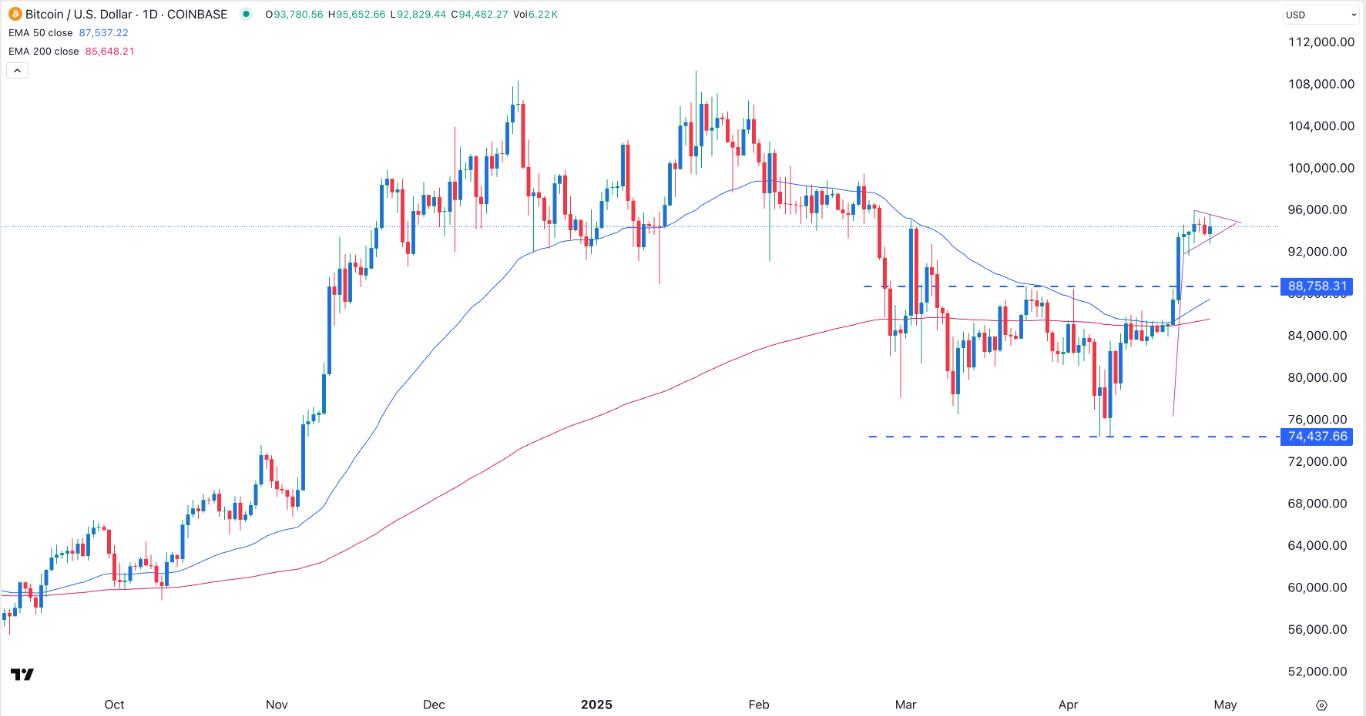

Bitcoin price held steady this week as its demand continued rising. The BTC/USD pair remained above 94,000 on Tuesday, much higher than this month’s low of 74,437. Technicals suggest that the coin may keep rising in the coming days.

Bitcoin demand continues rising

The BTC/USD pair remained steady after Standard Chartered delivered another bullish forecast. In the report, the analysts noted that Bitcoin will continue rising, and possibly hit the resistance at $120,000 in the second quarter and $200k by the end of the year. The key catalyst will be increased allocation away from US assets.

Other analysts have cited other catalysts for the ongoing Bitcoin demand. For example, they noted the rising risks in the banking sector, as US banks have accumulated over $482 billion in unrealized losses because of their long-term government bonds.

Top Regulated Brokers

Further, there is a risk in the rising government debt, which has soared to over $36.8 trillion, a trend that may continue this year. Cathie Wood’s Ark Invest cited this reason last week when they predicted that it would jump to $2.4M over time.

Bitcoin also jumped afte Michael Saylor’s Strategy announced a new acquisition. It bought coins worth over $1.4 billion last week, bringing its hoard to over 538,000 valued at $50 billion.

More data shows that crypto investors in Wall Street acquired coins worth over $3.2 billion last week. That increase happened as investors predicted that Bitcoin would mirror gold’s performance.

BTC/USD technical analysis

The BTC/USD pair has jumped sharply in the past few days, moving from a low of 74,437 on April 9 to a high of 96,000 last week. It has formed a bullish pennant pattern, a popular continuation sign.

Bitcoin has moved above the 50-day and 200-day Exponential Moving Averages (EMA). it also jumped above the key resistance level at 88,760, the neckline of the double-bottom chart pattern.

Therefore, the pair will likely keep rising as bulls target the next key point at 99,000. A drop below the support at 92,000 will invalidate the bullish outlook.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.