- The US dollar saw another rally during Friday's trading session, particularly against the Japanese yen, which exhibited weakness against most major currencies.

- This continues to be a major theme in the markets, so make sure you are aware of this.

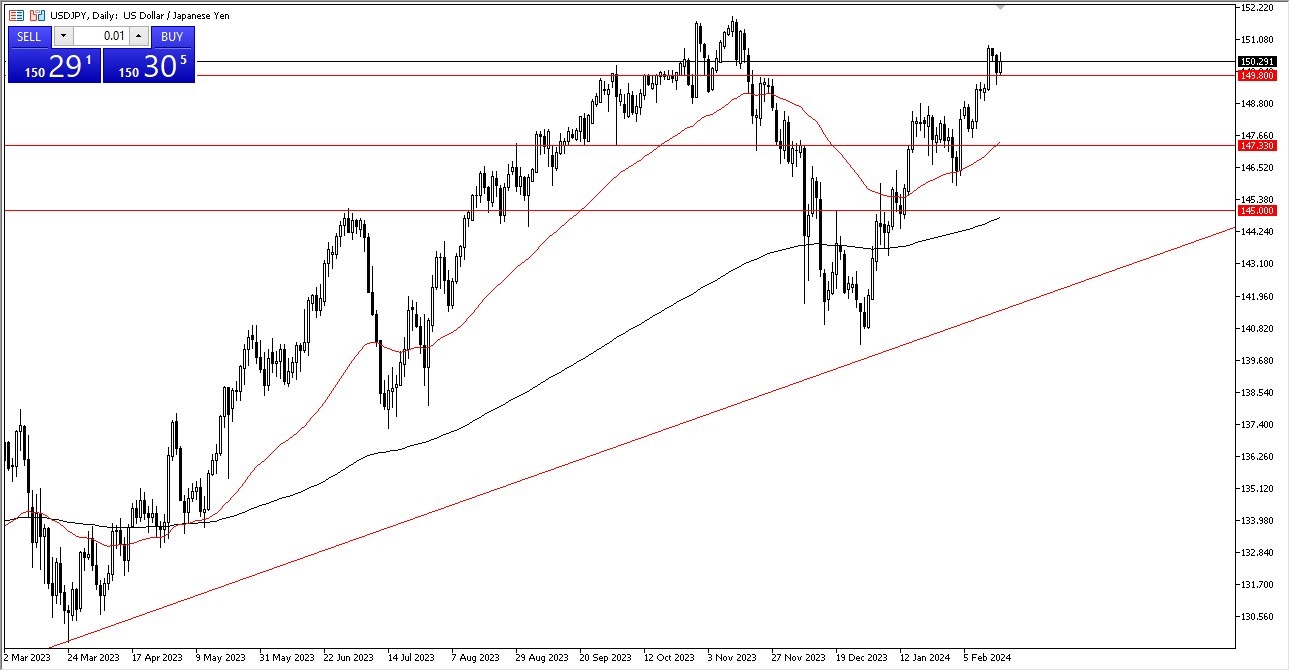

The USD/JPY pair experienced a slight uptick early on Friday, rebounding from the key support level at 149.80 yen. This level has proven significant on multiple occasions, suggesting that market participants are likely to view it as a pivotal point for price movements. However, it isn’t the “be all end all” of levels, just a road sign on the highway so to speak.

Top Regulated Brokers

The prevailing interest rate differentials between the United States and Japan continue to favor the US dollar, providing traders with an incentive to maintain long positions in this currency pair. Consequently, short-term corrections in price are being perceived as buying opportunities by many market participants.

At present, the 50-day Exponential Moving Average is positioned around the 147.33 yen level, acting as another layer of support for the US dollar against the Japanese yen. Considering the Bank of Japan's stance on monetary policy, which remains accommodative due to Japan's significant debt burden, the case for selling the Japanese yen against other currencies, including the US dollar, remains compelling.

Looking ahead, the 200-day EMA, located at approximately 145 yen, serves as a critical long-term indicator. A substantial sell-off of 500 pips or more would be necessary to test this level, indicating the strength of the prevailing upward trend in the pair.

On the upside, significant resistance is anticipated around the 152 yen level, with a breakthrough potentially paving the way for further gains towards the 155 yen mark over the longer term. Given the absence of a clear resistance point, market participants are inclined to follow the established uptrend until a reversal becomes evident.

At the end of the day, the US dollar's strength against the Japanese yen persists, supported by favorable interest rate differentials and a lack of tightening in Japanese monetary policy. While short-term fluctuations may occur, the overall outlook suggests a continuation of the upward trend in the USD/JPY pair. Investors are advised to monitor key support and resistance levels for potential trading opportunities while remaining cautious of any significant shifts in market sentiment.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.