- The USD/JPY pair maintains its bullish stance, with the US dollar showing resilience against the Japanese yen despite minor fluctuations observed during Wednesday's trading session.

- This resilience is largely attributed to the ongoing influence of interest rate differentials, which continue to be a key driver of movements in the forex market.

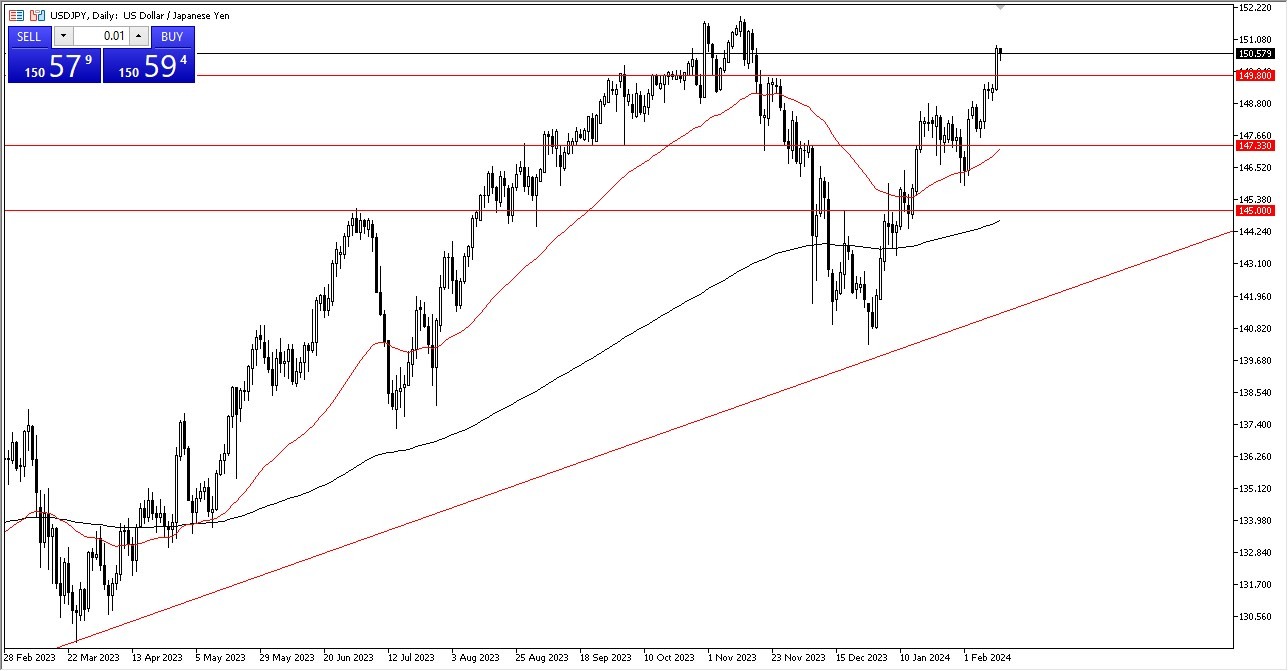

Presently, the 149.80 level is of significant importance as it serves as a crucial support level, having previously acted as a strong resistance barrier. Should the pair experience downward pressure, it is expected that buyers will intervene to defend this level. In the event of a breach, attention may then shift towards the 50-day Exponential Moving Average around the 147.33 mark, potentially providing further support to the pair's price action. This is an area that I would be very interested in buying if I got that chance as well.

Top Regulated Brokers

Volatility Will Continue to Be a Feature

The USD/JPY market remains characterized by its inherent volatility and noise, reflective of broader market sentiment. Despite these fluctuations, the overall trend remains bullish, supported by factors such as the Bank of Japan's limited capacity to implement significant monetary tightening measures, given Japan's substantial debt burden. In contrast, the Federal Reserve has adopted a more cautious approach to interest rate adjustments, contributing to the US dollar's strength. In other words – the markets will be waiting for those cuts longer than anticipated previously.

Looking ahead, investors will be closely monitoring the 152 yen level, as a breakout above this threshold could signal further upside potential for the pair. Despite the inherent uncertainty in the market, holding onto the USD/JPY pair offers investors tangible returns akin to those of traditional investments. Shorting the pair remains unattractive, with a breakdown below the 145 yen level warranting a reassessment of the prevailing trend.

At the end of the day, the USD/JPY pair continues to highlight the US dollar's dominance over the Japanese yen, driven by interest rate differentials and investor sentiment. While volatility is to be expected, the overall bullish trajectory presents strategic buying opportunities for investors with a long-term outlook. As market participants navigate through the noise, maintaining discipline remains crucial, with the potential for further gains as the trend unfolds to the upside. This is a pair that has only one direction, but that doesn’t mean that you trade it recklessly.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.