- The S&P 500 is still behaving erratically; it marginally declined during Tuesday's midnight trading hours before turning around and showing some life.

- If everything stays the same, it appears that we will continue to see purchasers in the long run.

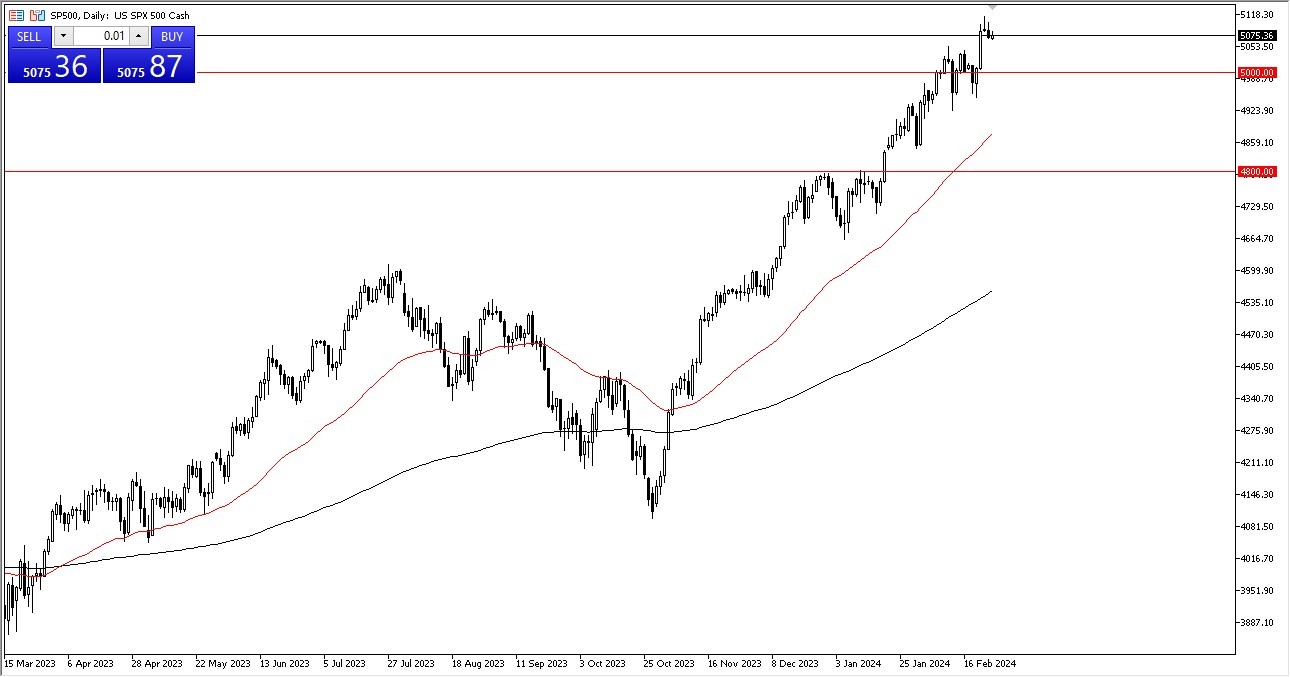

The S&P 500 saw a minor bump higher during Tuesday's early trading session as it appears that we may attempt to reverse course and set even higher records. The 5100 level is currently a topic that a lot of people are interested in, but I believe this is only temporary. To be honest, surpassing the 5,000 mark was the true highlight, and the fact that we were able to do so does imply that possibly there are still increases to come. Furthermore, why not? All of this has to do with a few stocks and central banks. Recall that the S&P 500 ought to be referred to as the S&P 7, since it consists of a small number of stocks that dominate the market. This “Magnificent Seven” continues to warp reality in a lot of ways.

Top Forex Brokers

A Lot Going On at 5,000

Due to market memory and, of course, psychology, short-term pullbacks at this point in time are likely to be bought into, with the 5,000 level serving as a crucial support level. Although I've been able to state that the market is a little bit stretched for a solid month now, every time we draw back, it appears that there are still plenty of traders eager to participate. In light of that, I fail to see any justification for shorting this market.

In addition, I see support at the 50-day EMA at 4,900, as well as at 4,800 below the previously cited 5,000 level. Regarding the target, the 5,100 level above is the next barrier and target, but it appears that we will likely break over it. That's about all I have to go on. Since the market does tend to move in increments of 100 points, 5200 might be a feasible aim for you. In either case, you are either flat, remaining neutral, or buying dips because the trend is well entrenched in this area, and I don't see any practical way to fight the trend – so don’t.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.