- The US dollar has been grinding back and forth during the course of the trading session on Monday, as we continue to see a lot of effort being applied to this market in order to work off some of the previous momentum.

- Furthermore, we also have to pay close attention to the fact that the Bank of Japan has a meeting early on Tuesday morning in Asia.

USD/JPY

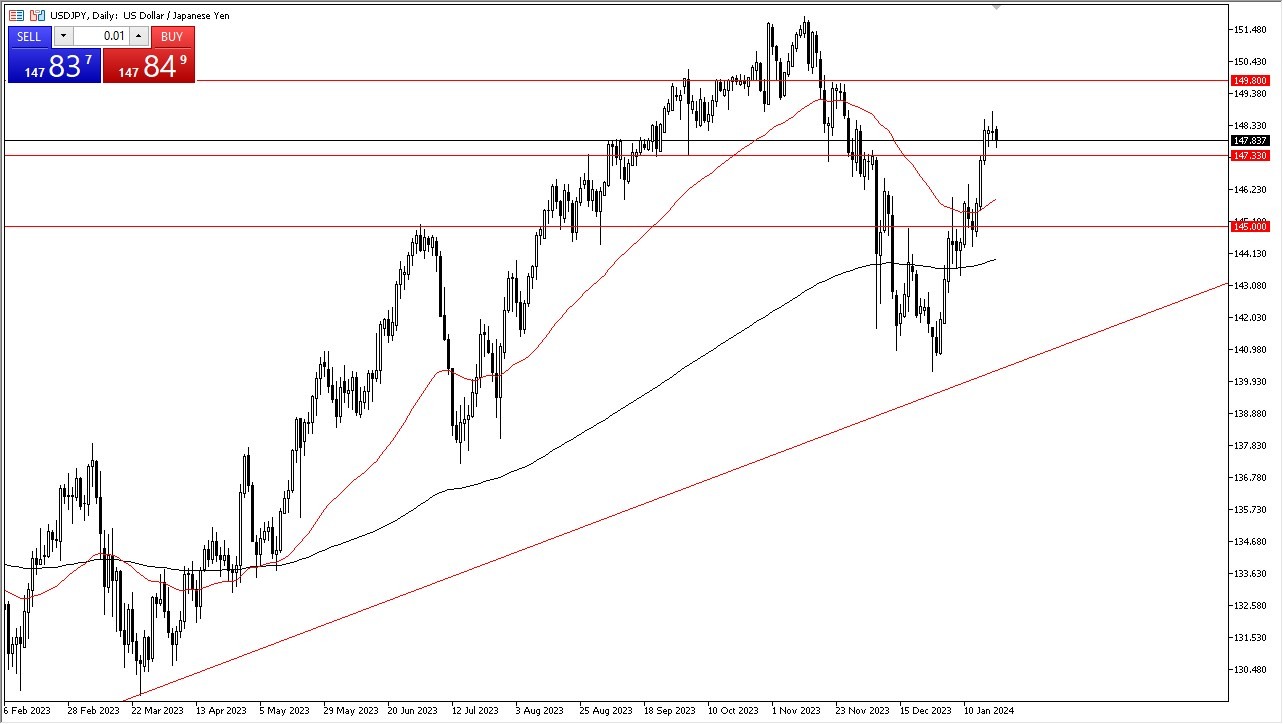

The US dollar drifted a little bit lower during the trading session on Monday, but really at this point, this is a market that we have seen a lot of upward trajectory recently. And therefore, we have to work off a little bit of froth. The 147.33 level is an area underneath that will continue to be supported, I believe, and if we do bounce from there, it's likely we could go higher. On the other hand, if we break down below the 147.33 level, then it's possible that we could go down to the 50-day EMA. Underneath the 145 yen level offers a significant amount of support as well.

Short-term pullbacks will continue to be a major issue. And I think at this point, you're just looking for some type of value. While I don't necessarily want to short this market, I would be a bit cautious about buying into it all the way up here. I do think that you will eventually get some type of value that you can take advantage of, but right now we just don't see it.

Top Regulated Brokers

Given enough time, I believe that this is a market that will eventually have to figure itself out from a longer term perspective, but right now it just looks a bit heavy. Longer term, I think that we could reach the all-time highs again, but again, that is going to be something that takes a lot of effort and therefore I’m not putting too much money into this pair somewhere closer than 50 ema per day; however I’d be far happier buying somewhere close by earlier today as opposed to selling right now because upward trend still exists even though Japan has an interest rate decision overnight and a press conference, which I believe is going to be a bit of jawboning that might give you some selling opportunity.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.