.Last Wednesday’s GBP/USD signal may have produced a losing long trade from the small bullish bounce which happened to the support level of 1.3502 that day.

Today’s GBP/USD Signals

Risk 0.75%.

Trades may be taken between 8am and 5pm London time today only.

Short Trade Ideas

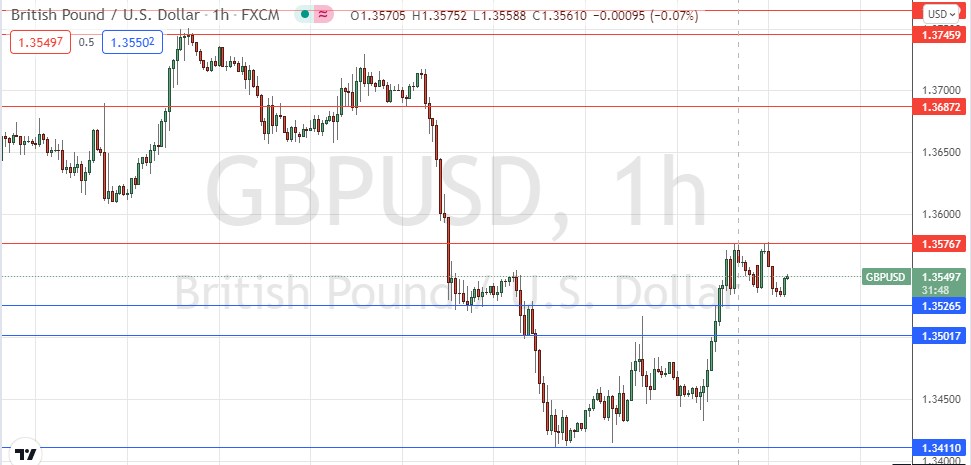

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3577 or 1.3687.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame mmediately upon the next touch of 1.3527, 1.3502, or 1.3411.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Wednesday that the technical picture had become more bearish, hitting a new 8-month low price. I expected a high probability of a down day on Thursday, with 1.3560 as the best candidate for a short trade entry.

This was an accurate and profitable call, as the Thursday was a down day, although the day’s high was put in 6 pips below 1.3560.

Friday saw a strong bullish reversal after a long-term low price was reached at 1.3411.

The bullish reversal has been enough to disrupt the bearish trend, but as the USD is strong, the trend still looks valid.

Bulls and bears are quite evenly balanced over the short to medium term, with key support holding at 1.3527, and key resistance holding at 1.3577 – the latter looks likely to be today’s pivotal point.

I see the best strategy for trading this currency pair today as waiting for two consecutive higher hourly closes above 1.3577 to trigger a bullish bias, or two consecutive hourly closes below 1.3527 to trigger a bearish bias.

If a bearish bias is triggered, traders may find that going short of the EUR/USD currency pair to be better than being short of GBP/USD, as the technical picture in EUR/USD is more bearish.

As there are no major data releases scheduled today and as Monday is typically a quiet trading day, it may be that we don’t get much from a breakout even if it does happen today.

There is nothing of high importance scheduled today concerning either the GBP or the USD.