Bullish View

Buy the GBP/USD pair and add a take-profit at 1.3850.

Add a stop-loss at 1.3660.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.3700 and a take-profit at 1.3600.

Add a stop-loss at 1.3750.

The GBP/USD was little changed on Tuesday morning as the market reflected on the impacts of the ongoing challenges in the global economy. The pair is trading at 1.3735, which is slightly below this week’s high of 1.3772.

Global Risks Rise

The GBP/USD pair is holding steady as investors reflect on the rising global risks in the market. In the UK, energy prices is rising even after Russia’s president, Vladimir Putin hinted that the country will increase the amount of gas it pumps to Europe.

In a statement, Gazprom said that it will not send gas through pipelines in Ukraine in November, which means that prices could remain higher for a while. Similarly, the price of crude oil continued rising, meaning that the country’s inflation will rise above the Bank of England (BOE) estimate of 4%.

Therefore, analysts believe that the BoE could move as soon as in its November meeting. Such a move could include a combination of the first tapering of asset purchases and higher interest rates. In his recent statements, Andrew Bailey has not pushed back the notion that this tightening could happen soon.

Meanwhile, the GBP/USD held steady after the relatively weak economic data from the United States. Data by the statistics office showed that manufacturing production declined to -0.7% in September while industrial production fell to 1.3% during this period. This was the biggest decline since February this year.

The report cited several reasons for the decline, including the challenges facing the auto sector. It also cited the recent Hurricane Ida that affected several parts of the economy.

On Tuesday, the pair will react to the latest US building permits and housing starts data from the US. Analysts expect the data to show that building permits declined from 1.72 million to 1.68 million in September while housing starts rose from 1.615 million to 1.62 million.

GBP/USD Forecast

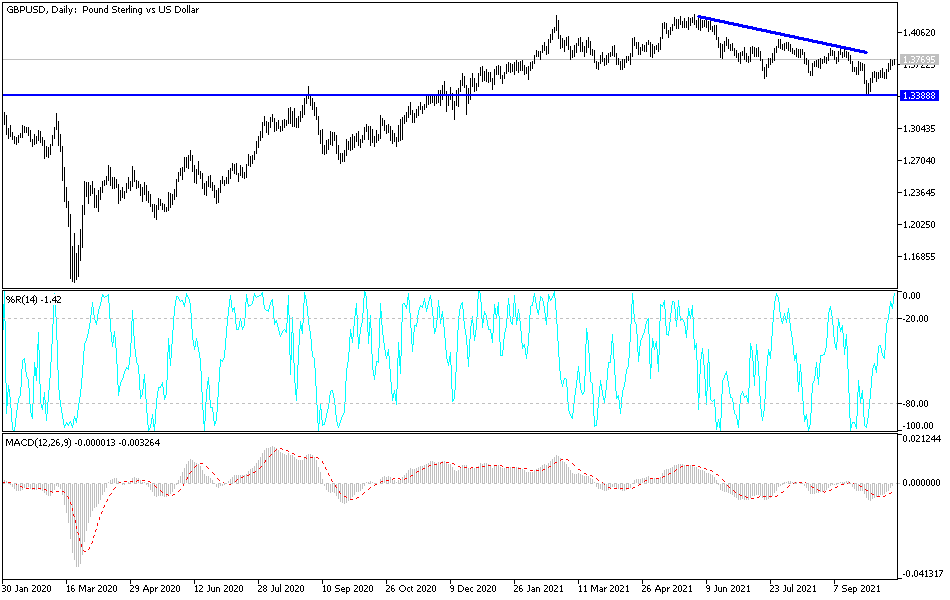

The four-hour chart shows that the GBP/USD pair has been in a bullish trend in the past few weeks. Precisely, it has risen by more than 2.4% this month. It has moved above the 61.8% retracement level and is being supported by the 25-day and 50-day moving averages. The price has also moved above the ascending trendline shown in blue. Therefore, the pair will likely resume the bullish trend as bulls target the next key resistance at 1.3850.