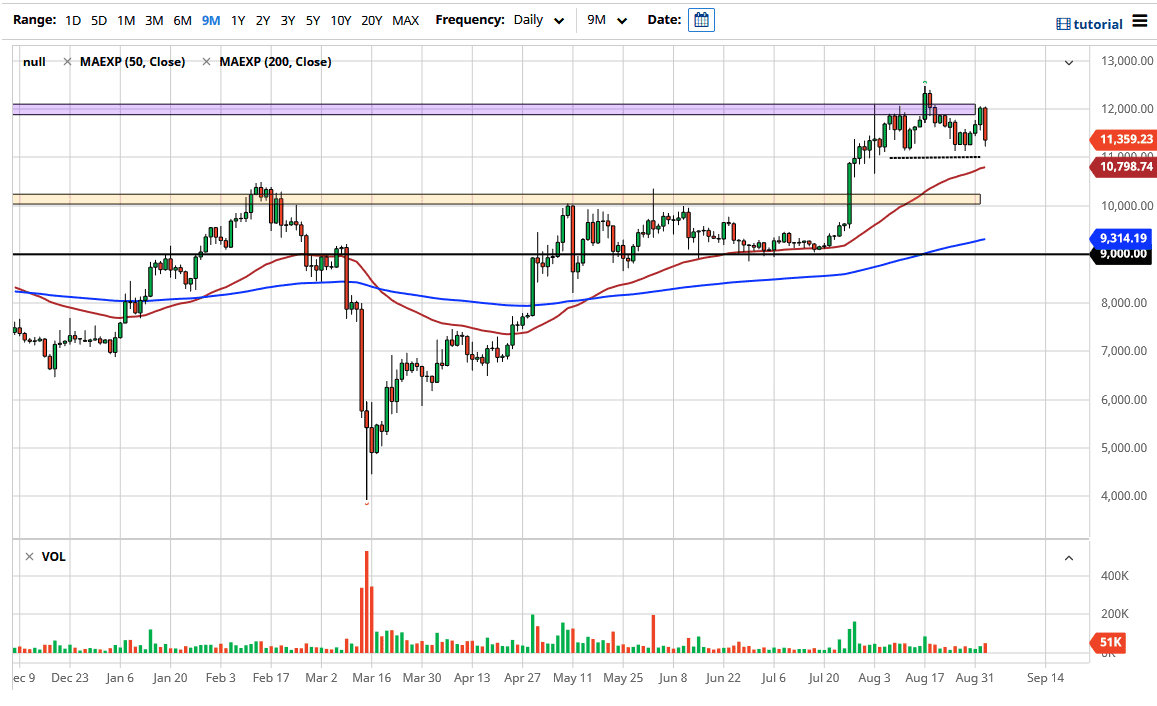

BTC/USD: Plenty of room for price to fall

Yesterday’s signals were not triggered as there was no bullish price action when the support level at $11,557 was reached.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be taken prior to 5 pm Tokyo time Friday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 time frame following the next touch of $10,696.

- Put the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 time frame following the next touch of $11,804, $11,959, or $12,105.

- Put the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday I thought the support level at $11,557 would be a great place at which to seek a long trade due to its confluence with the lower trend line of the bullish price channel.

I also noted that the outlook would become more bearish if the price got established below $11,557.

I was correct to see this level as pivotal, as once the price broke below it, there was a continued stronger fall.

The technical picture is now much more bearish after this price channel breakdown. There are no key support levels until $10,696.

The price has plenty of room to fall and is showing every sign that it will fall further soon.

If we get two consecutive hourly closes below $11,200, I will take a bearish bias until $10,696 is reached.

Concerning the USD, there will be a release of ISM Non-Manufacturing PMI data at 3 pm London time.