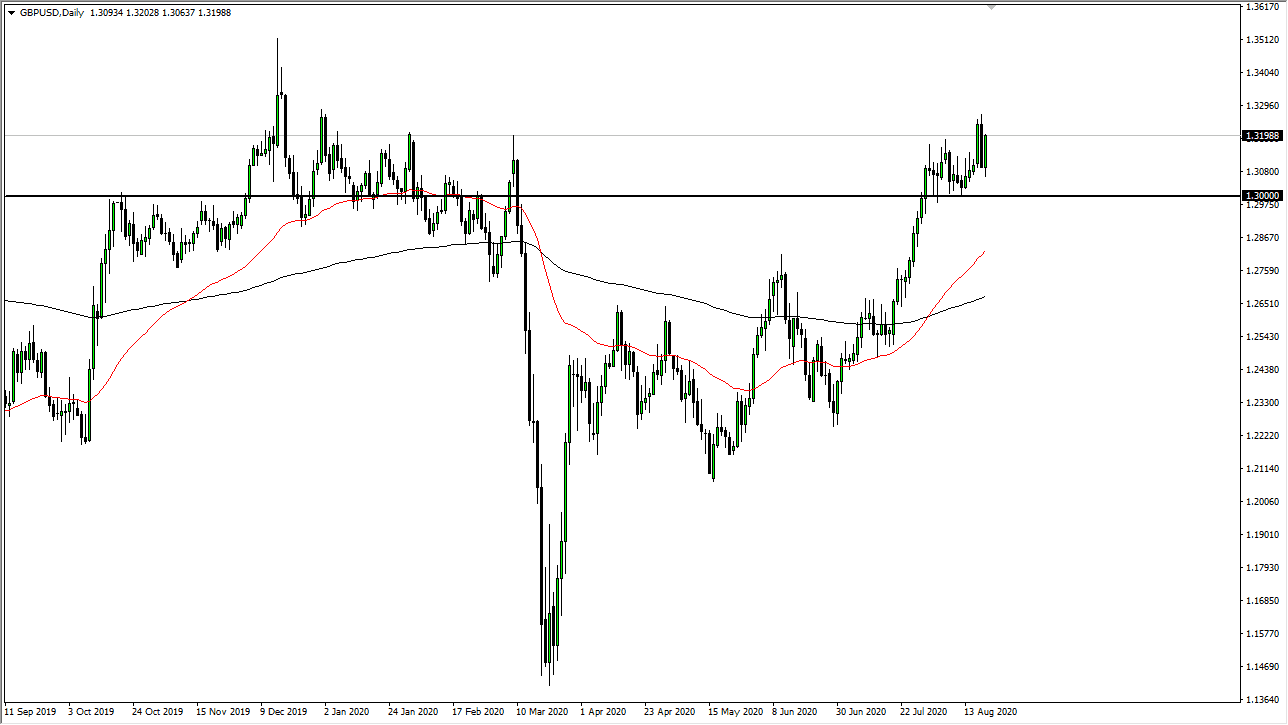

The British pound has rallied significantly during the trading session on Thursday, reaching towards the 1.32 level after initially falling during the day. This shows a continued interest in trying to build up a significant amount of momentum, and this is a sign that there are plenty of buyers underneath to lift this market. I believe at this point in time the 1.30 level underneath will be a massive floor in the market, at least for the time being. After all, the Federal Reserve is flooding the markets with greenbacks and that has been benefiting other currencies.

All of that being said, I look at this market as one that is likely to go back and forth in the short term, until we can get above the highs. If we can break above the recent highs, I believe that it is only a matter of time before the British pound goes looking towards the 1.35 level longer term. I have no interest in shorting the British pound, at least not anytime soon unless of course the Federal Reserve is suddenly going to change its complete attitude. That being said, I think that we will continue to see a lot of pushing back and forth but ultimately the chipping away at this resistance, which of course is a sign of strength.

To the downside, I believe that the 1.30 level will offer a significant floor, but if we were to break down below there then the 1.2750 level would be a major support area that I think it extends down to at least the 1.2650 level after that. All things being equal, I believe that the market is likely to see buyers based upon value down there. Having said that, I do not have any interest in shorting this market, even if you told me at was going to reach down towards that area. The 50 day EMA is just above there, so that could also come into play as well. Regardless, it seems like this pair is more about the US dollar than the British pound, and as long as that is the case we should continue to rise over the longer term. The US dollar seems to be struggling against almost everything else, so this of course should translate higher prices for the British pound, despite the fact that people are ignoring Brexit.