Singapore secured three of the Top Five private equity and venture capital deals across South-East Asia in the first quarter of 2020. While the 141 total deals worth $1.4 billion is down 9.0% and 65.0% in both metrics, respectively, as compared to the first quarter of 2019, it does confirm confidence in the economy of Singapore moving forward. Available cash for future deals reached a record of $439 billion by May 15th. The funding was in consumer-facing companies and alternative energy. It allowed the USD/SGD to maintain its corrective phase following the rejection by its short-term resistance zone.

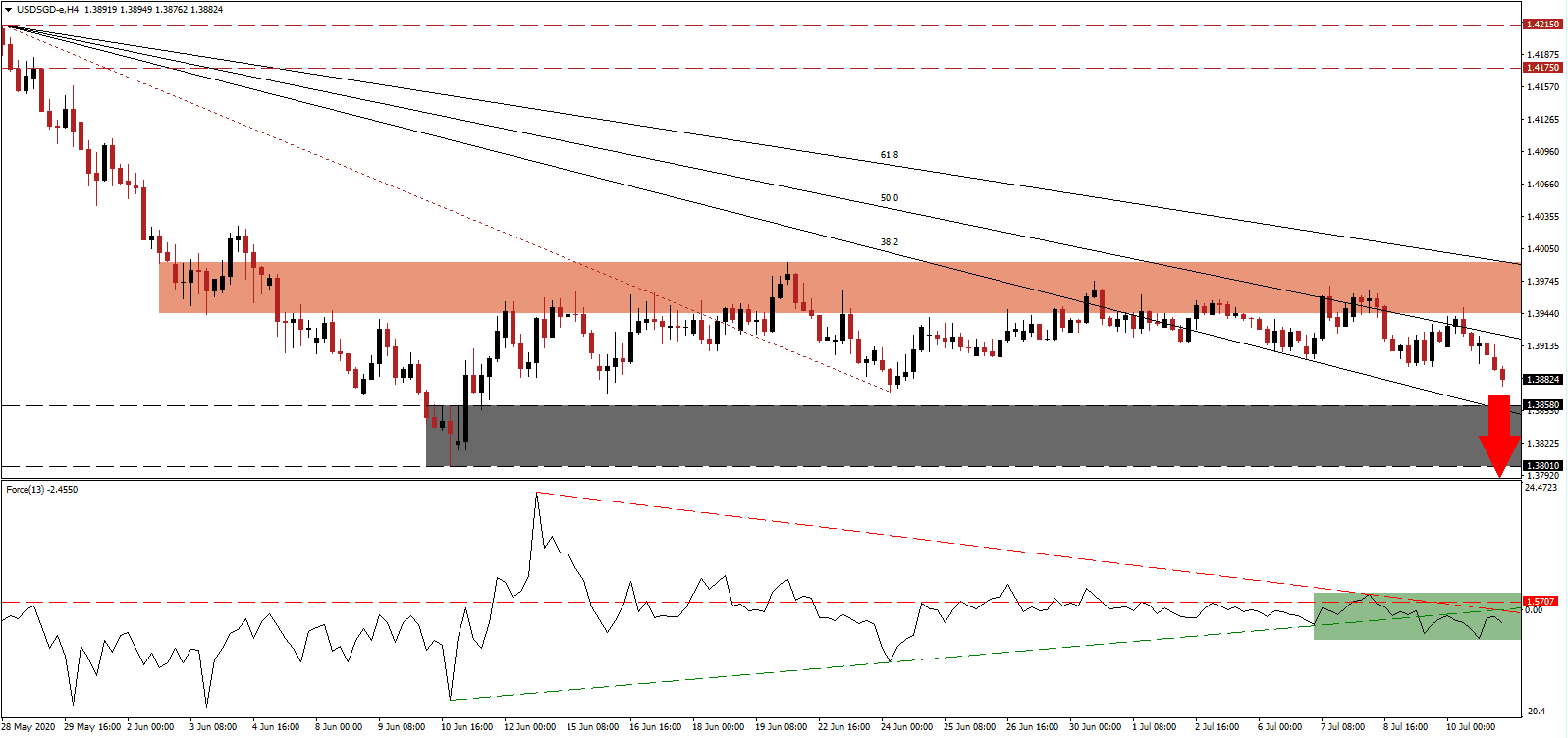

The Force Index, a next-generation technical indicator, confirms dominance in bearish momentum after sliding below its ascending support level below its horizontal resistance level, as marked by the green rectangle. Increasing downside pressures is the descending resistance level. Bears are in complete control of the USD/SGD with this technical indicator below the 0 center-line.

Prime Minister Lee Hsien Loong was re-elected on Friday, but the results indicated a growing divide among voters. The People's Action Party (PAP), ruling Singapore since becoming independent in 1965, secure 83 out of the 93 seats, representing a record showing for the opposition party. All opposition seats were won by the Worker’s Party, as voter turnout slumped to 61.2%, and the margin of victory for PAP across constituencies narrowed. The USD/SGD breakdown below its resistance zone located between 1.3944 and 1.3992, as marked by the red rectangle, is poised to extend farther to the downside.

Adding to bearish progress is the out-of-control Covid-19 pandemic across the US, where several states consider reimposing lockdowns. Government subsidies for initial jobless claims and a moratorium on evictions are both near expiration. Experts forecast an avalanche of homelessness unless assistance and protection are extended. Either scenario is bearish for the US Dollar. The descending 50.0 Fibonacci Retracement Fan Resistance Level is favored to pressure the USD/SGD below its support zone located between 1.3801 and 1.3858, as identified by the grey rectangle, and into its next support zone between 1.3690 and 1.3752.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3880

Take Profit @ 1.3690

Stop Loss @ 1.3925

Downside Potential: 190 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 4.22

A breakout in the Force Index above its descending resistance level is likely to inspire the USD/SGD to seek more upside. Forex traders should consider any advance from current levels as a secondary selling opportunity, with the US outlook increasingly bearish. Hospitals are reaching maximum capacity, and the federal government shows little desire to implement a nationwide response. Any price spike is confined to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/SGD Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 1.3950

Take Profit @ 1.3990

Stop Loss @ 1.3925

Upside Potential: 40 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 1.60