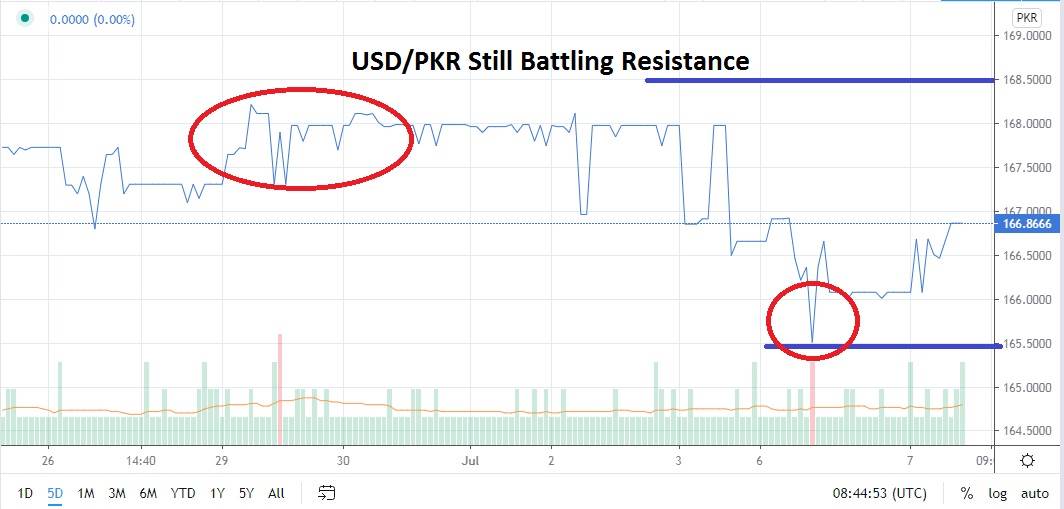

After battling higher resistance the past week of trading, the USD/PKR has produced a rather weak reversal in early trading today showing the forex pair remains a speculative bet. The 168.5000 level up above remains a likely target for traders who believe the USD/PKR will continue to sustain its mid-term bullish trend and test vulnerable resistance levels. However, trading is never a one-way street and the sudden emergence of selling today has put the Pakistani Rupee in an interesting middle of the road range juncture in which speculators may believe - now may be the time to buy the USD/PKR again.

The Pakistan government faces economic and political challenges. Last week the government made it clear it will continue to spend on the development of the new trading infrastructure it is creating with the help of China. Faced also with a certain amount of skepticism about its economic transparency, the Pakistani government will face hurdles ahead as it fights to maintain its stature internationally and prove it is a stable nation.

The past five days of trading have produced a rather consolidated range for the USD/PKR but it has tended to lean heavily up against resistance near the 168.1000 to 168.2000 levels regularly. Speculators who perceive the 168.1000 as a potential lynchpin for reversals downward may have valid perceptions, but they need to make sure they are trading with limit orders on their forex trading platforms. A lack of volume within the USD/PKR opens itself to volatile gaps which can cause havoc with positions. Even if limit orders are being executed traders need to acknowledge volatility can leave them feeling rather odd about prices they are having their positions ‘filled’ at regarding value.

Trading the USD/PKR remains a purely speculative position. The mid-term range of the currency pair has produced a strong bullish trend and has pulverized resistance regularly. Going against the current trend of the stronger USD against the Pakistani Rupee may prove unwise.

Again selling may be an opportunity at the current values for the USD/PKR, but if a trader believes support will be tested they need to be agile and use their limit orders carefully to take advantage of sudden reversals like the one which happened this morning. This because there appears to be a larger amount of room for the USD/PKR to move upwards and break resistance compared to short tests of support, which may not have much room to escalate under the current dynamics facing Pakistan’s economic outlook.

Pakistani Rupee Short Term Outlook:

Current Resistance: 168.0000

Current Support: 166.0000

High Target: 168.4000

Low Target: 165.5000