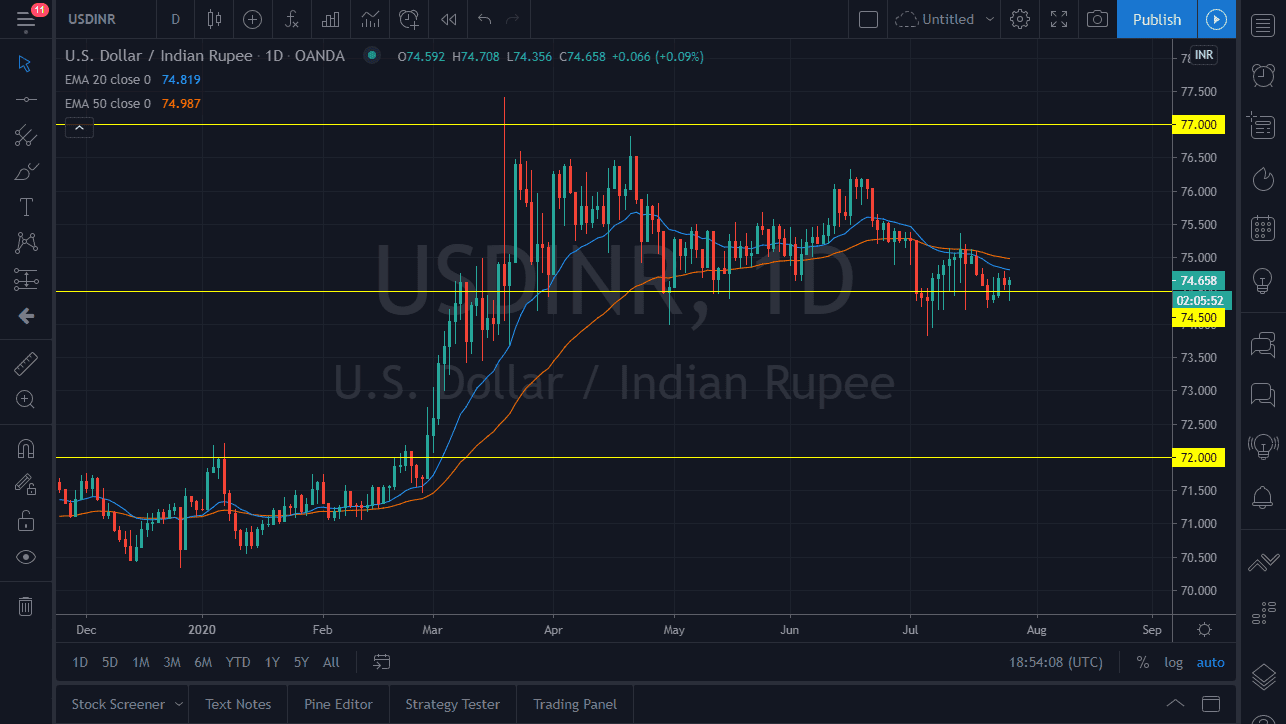

The US dollar has initially dipped a little bit against the Indian rupee on Monday to kick off the week, but we continue to see a lot of the same back-and-forth action that we have over the last couple of weeks. It is not a huge surprise, because there is an area that seems to be right around the ₹74.50 level that attracts price like a magnet. If the market was to break down below the ₹74 level, then it is likely that we could drop down towards the ₹72 level. On the other hand, if the market was to break above the ₹75 level, then it is likely that we will go looking towards ₹76, perhaps even ₹77.

Keep in mind that the market is very noisy right now, and the fact that the US dollar has been on its back foot again with so many other currencies which have been helping the Indian rupee a bit, or at least keeping it from collapsing. The question now is whether or not there is enough anti-dollar sentiment out there to send the Indian rupee higher? There might be, but I have a sneaking suspicion that it will only be for so much. I think the ₹72 level will end up with massive support, but that could be a decent target if we could get that breakdown. On the other hand, the grind higher would probably have a lot to do with the US dollar strengthening in general. Ultimately, that would probably be a “risk-off” type of move.

We have had several hammers form right around the ₹75.50 level, but also, we have seen the occasional shooting star. At this point in time, it is likely that we will continue to see a lot of noise. Looking at the moving averages, the 20 moving averages sitting just above and above there we would also have the 50 day EMA at the ₹75 level. Obviously, the 50 day EMA is something that a lot of people will pay attention to for the longer-term move, if we can break above there then it sends a bit of a technical signal to the upside. There are a lot of moving pieces out there right now, not the least of which will be the coronavirus pandemic, so it could make this very noisy but we have a couple of areas that we can pay attention to as to whether or not we are buyers or sellers for a bigger move.