India is the third-most infected country with Covid-19, trailing the US and Brazil, and the most-infected in Asia. Unless the present trajectory changes, it is on course to overtake Brazil in approximately four months or less. With the economy facing a 2020 plunge between 5% to 10%, the government of Prime Minister Modi seeks fresh ideas to kick-start the economy. It represents a challenge as the virus is spreading rapidly. The willingness on all government levels to find a sustainable solution adds a bullish catalyst for the India Rupee, adding to downside pressure on the USD/INR after the breakdown below its short-term resistance zone.

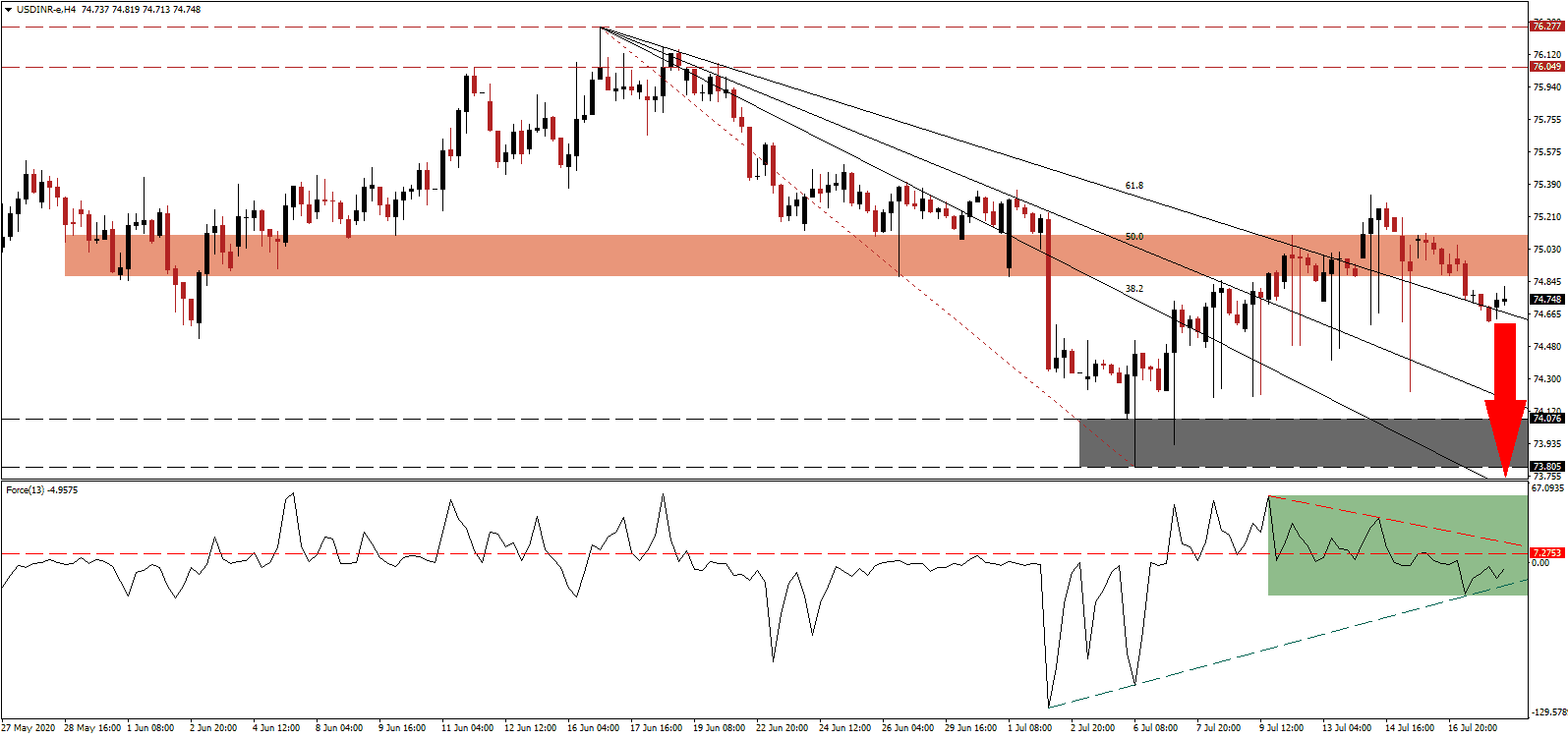

The Force Index, a next-generation technical indicator, shows the presence of a negative divergence before the breakdown in price action. It remains below its horizontal resistance level in negative territory, as marked by the green rectangle, and the descending resistance level is increasing downside pressures. Bears wait for this technical indicator to correct below its ascending support level to regain complete control over the USD/INR.

Pronab Sen, the Country Director for the India Programme of the International Growth Centre (IGC), urged the government to approve an extensive spending program to modernize healthcare facilities across the country. It will combine infrastructure jobs with necessary improvements to tackle the Covid-19 pandemic. India requires more solutions to address multiple issues at once. Confirming the dominant bearish pressures in the USD/INR is the downward revised short-term resistance zone, presently located between 74.872 and 75.108, as identified by the red rectangle.

Prime Minister Modi is under increasing pressure to abandon fiscal responsibility, which is a double-edged sword. While it may relieve short-term stress, it is likely to add to long-term issues, a scenario the government cannot afford. Pending permanent global supply-chain adjustments provide another long-term catalyst with a minor domestic manufacturing revolution, amid growing tension between India and China, magnifying the positive economic impact. The USD/INR is well-positioned to collapse below its descending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance. From there, it is clear to accelerate into its support zone located between 73.805 and 74.076, as marked by the grey rectangle, with more downside anticipated.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 74.750

Take Profit @ 73.300

Stop Loss @ 75.200

Downside Potential: 14,500 pips

Upside Risk: 4,500 pips

Risk/Reward Ratio: 3.22

In case the Force Index pushed above its descending resistance level, the USD/INR is likely to follow suit. With the US under intensifying economic pressures and a growing healthcare crisis, Forex traders should consider any advance as a selling opportunity. Localized shutdowns are favored to expand as hospitalization surge across the country. The upside potential remains reduced to its resistance zone located between 76.049 and 76.277.

USD/INR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 75.500

Take Profit @ 76.050

Stop Loss @ 75.200

Upside Potential: 5,500 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 1.83