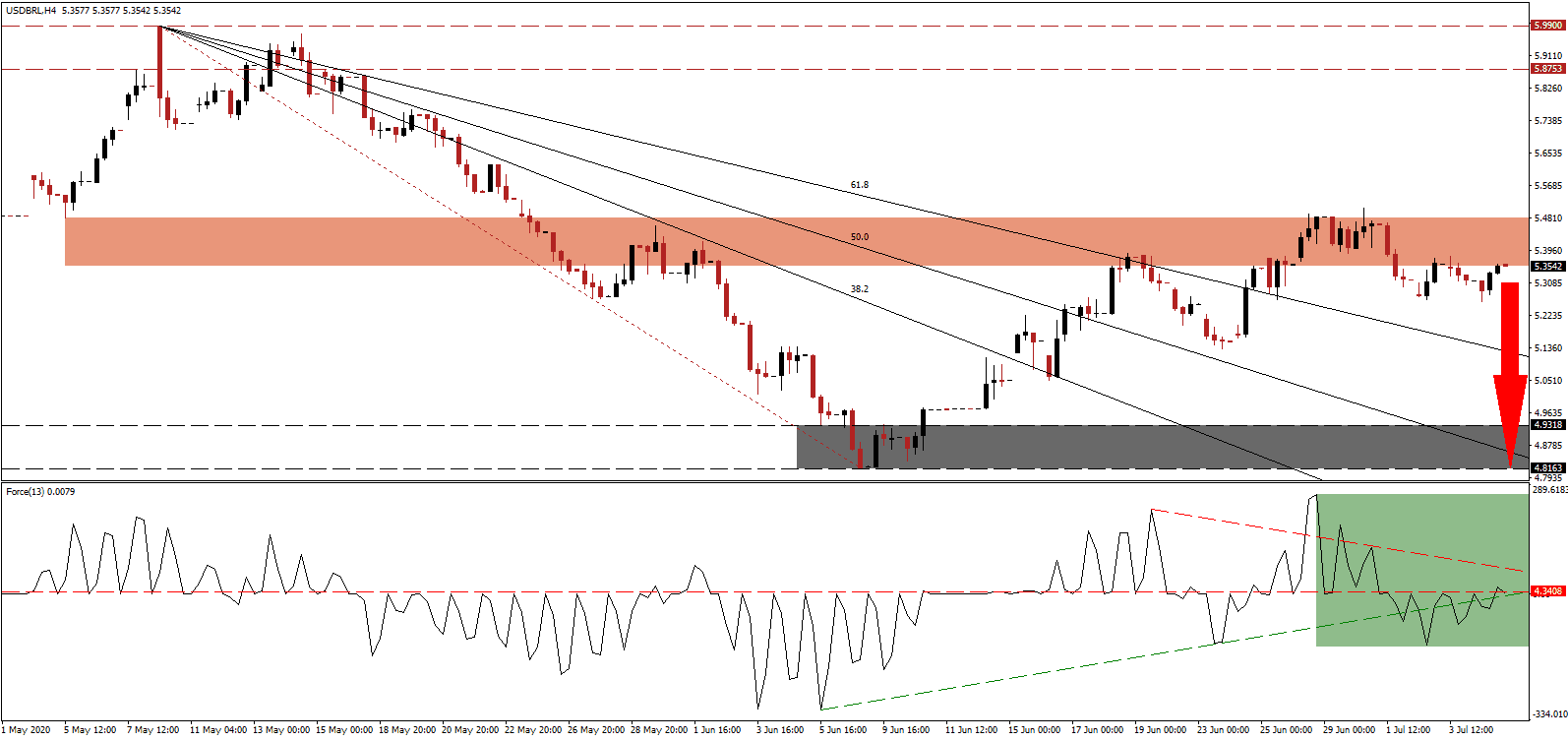

Brazilian Central Bank President Roberto Campos Neto reiterated his assessment that the economy is recovering quickly and that the base of the Covid-19 shock is formed. He cited an improvement in income, traffic, and energy consumption data as the foundation of his upbeat outlook. The bullishness is replicated by Spanish-based international baking giant Banco Bilbao Vizcaya Argentaria (BBVA), which notes that 2020 full-year GDP projections are improving, with the most optimistic scenario doubling the 2019 growth rate. The USD/BRL completed a breakdown below its short-term resistance zone from where an accelerated sell-off is favored to materialize.

The Force Index, a next-generation technical indicator, briefly pierced its horizontal resistance level before contracting again, as marked by the green rectangle. With the descending resistance level exercising intensifying downside pressure, a collapse below its ascending support level is expected to restart the correction. Bears await for this technical indicator to slide below the 0 center-line to regain complete control over the USD/BRL.

Delivering a more bearish outlook is the Brazilian Senate Independent Fiscal Institute (IFI). It forecasts as base-case scenario 2020 GDP contraction of 6.5% year and an increase of 2.5% in 2021. Brazil witnessed a constant outflow of foreign capital, excluding China, since the 2016 recession from where it never fully recovered before the Covid-19 pandemic struck. The outlook is improving, and President Jair Bolsonaro is committed to reforms, which can accelerate the positive trend. Rejection in the USD/BRL by its short-term resistance zone located between 5.3536 and 5.4815, as identified by the red rectangle, is anticipated.

Another positive catalyst is tax-free dividends in Brazil, while consumer companies are rapidly adjusting to the likely permanent change in consumer behavior. Two prime examples are swift adjustments by hotel operator Oyo and the demand for delivery of fine dining. While the economy has a challenging path ahead, it is positioned to emerge a positively adjusted one. The USD/BRL is favored to move below its descending 61.8 Fibonacci Retracement Fan Support Level before dropping into its support zone located between 4.8163 and 4.9318, as marked by the grey rectangle. More downside potential exists.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.3540

Take Profit @ 4.8000

Stop Loss @ 5.4700

Downside Potential: 5,540 pips

Upside Risk: 1,160 pips

Risk/Reward Ratio: 4.78

A breakout in the Force Index above its descending resistance level could entice the USD/BRL to seek more upside. Forex traders are recommended to view any advance from current levels as a secondary short-selling opportunity. The US Dollar is under growing bearish pressures with slowing economic potential and an increasing debt load. Price action will challenge its next resistance zone between 5.8753 and 5.9900

USD/BRL Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 5.6250

Take Profit @ 5.8700

Stop Loss @ 5.4700

Upside Potential: 2,450 pips

Downside Risk: 1,550 pips

Risk/Reward Ratio: 1.58