The US dollar has initially tried to rally against the Brazilian real during the trading session on Tuesday but gave back the gains near the 5.20 real level, an area that has both support and resistance on shorter time frames. Keep in mind that this pair is highly sensitive to emerging market risks, as the Brazilian real is a proxy for all of South America. As we have a lot of concerns out there when it comes to the emerging market story, it would make sense for the Brazilian real to get hammered. However, to enter the Federal Reserve, they will do what they can to work against the value of the US dollar.

There are a lot of things going on here, almost none of which have anything to do with Brazil itself. The coronavirus figures out of that country are somewhat unknown but expected to be rather bad. With that in mind, one would expect the Brazilian real to continue to lose value. However, the Federal Reserve has embarked on a massive quantitative easing program and is more than likely going to shove liquidity into the markets until everybody chokes on US dollars. With that being the case, it makes sense that the US dollar loses strength in general. Which would be no different here, because the FX markets have essentially become completely dollar driven, and that means that even the Brazilian real benefits.

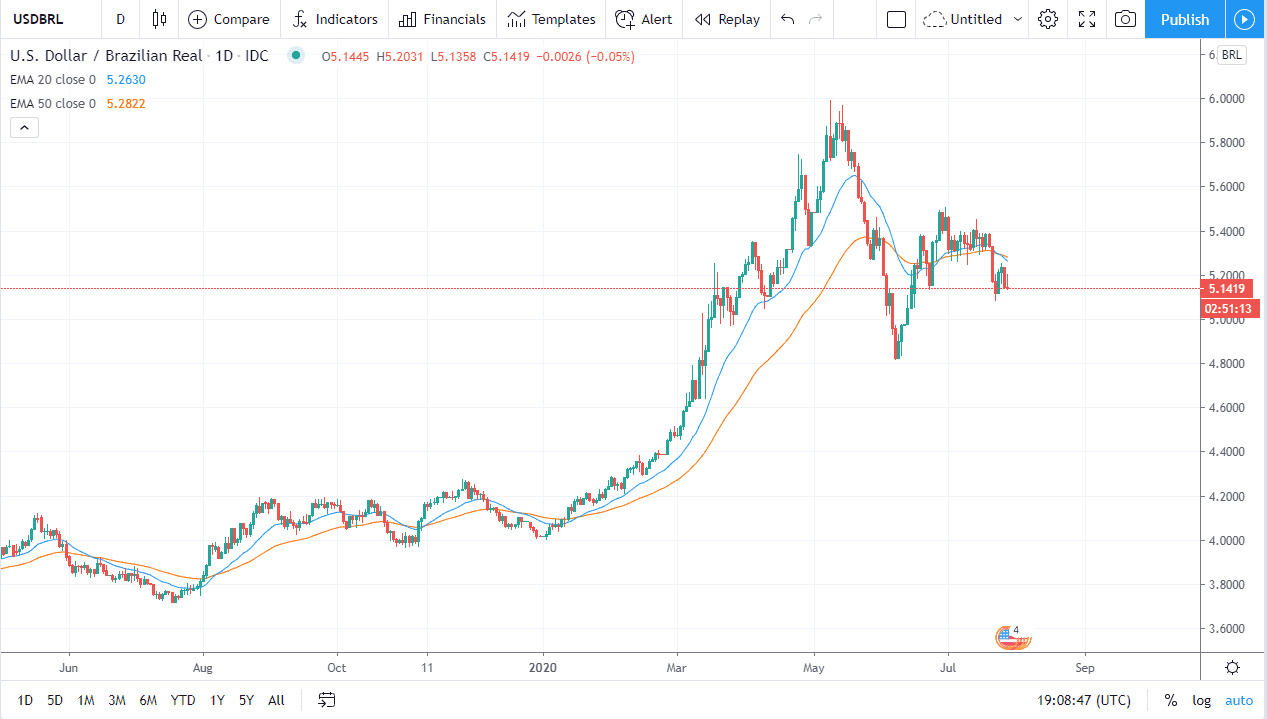

From a technical analysis standpoint, you can see that the 20 day EMA is starting to cross below the 50 day EMA, it looks like we may be ready to roll over if the daily candlestick is to be believed. After all, the daily candlestick is essentially a shooting star, although in the midst of choppy behavior. If we break down below the bottom of the daily candlestick it is likely that we could then go to the 5.00 real level, and then possibly even the 4.80 level. With that being the case, I think that simply fading rallies will more than likely continue to be the way going forward, with perhaps significant resistance beginning at the 5.25 real level, and then the 5.40 level. It is not until we break above there that I would be a buyer of the US dollar against the currency, and right now it looks like we simply fade short-term rallies for small gains going back and forth.