The US dollar has initially fallen during Thursday trading but found buyers against the Brazilian Real as we touched the 50 day EMA. This of course is a very commonly follow technical indicator, so it is worth paying attention to anyway. The fact that the market turned around to form a bit of a hammer is a bullish sign and it does suggest that we are ready to recover and continue going higher.

The jobs number in the United States which was much better than anticipated of course accelerated the move into the US dollar, but also once you keep in mind that there are a lot of concerns about the coronavirus infection rate in Brazil, which is not even reporting accurate numbers at this point. With that being the case, and most of Latin America in real trouble when it comes to the pandemic, it makes sense that money would flow into the greenback and away from Latin currencies such as the Real and the Peso. We have seen this against the Mexican peso, Colombian peso, Argentine peso, and now the Brazilian Real.

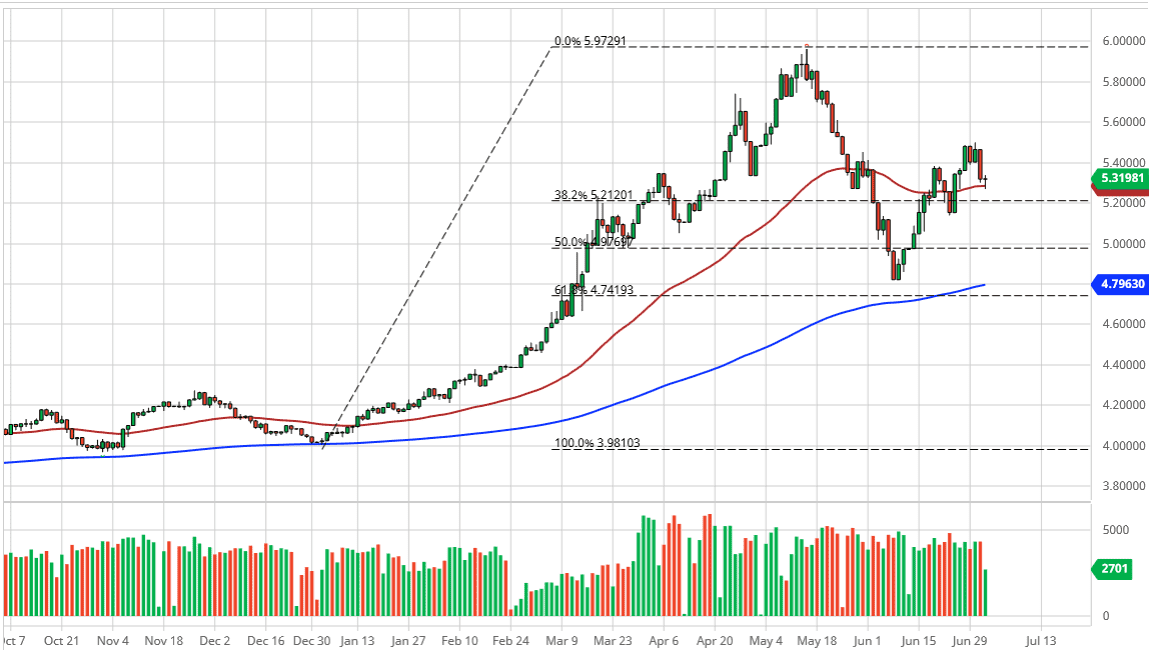

Looking at the chart, it appears that the 5.50 Real level that I was talking about the other day did in fact offer significant resistance but after a quick pullback we have shown signs of life again on Thursday. With the jobs situation getting better in the United States and of course the mortality rate of coronavirus being better than it is in South America, it makes quite a bit of sense that this pair should continue to go higher. Beyond all of that, the Brazilian economy has taken a massive hit, and will take some time to recover. As the United States was starting from a position of strength when the outbreak happened, it should in theory be able to weather the storm quite a bit better than other places like Brazil. At this point, the market looks likely to go back towards the 5.50 Real level and breaking above their opens up a move towards the 5.60 level, followed very quickly by the 5.80 level. I do believe that ultimately, we are going to get back to the 6.00 Real level again, which was the most recent swing high. We have been in an uptrend for some time, and even though we had a pretty shocking pullback in May, we still have plenty of strength underneath.