The US dollar has pulled back slightly to kick off the trading session on Tuesday against the Brazilian Real but has turned around at the 50 day EMA yet again to show signs of life. By doing so, the market looks as if it is ready to continue the overall uptrend that we have been trying to establish of the last several sessions. Ultimately, I think that this is a market that reaches towards the highs again, if for no other reason than there is so much uncertainty when it comes to Brazil itself. Recently, the Brazilian coronavirus figures have been a bit of a mystery, but we know that the favelas are full of infection, and therefore one would have to think that the Brazilian economy will certainly continue to suffer. Furthermore, Brazil is considered to be a proxy for all of Latin America, which on the whole is struggling.

In a world where there is little in the way of risk appetite, it is a bit difficult to imagine that traders will be willing to jump into Latin American currencies over the relatively safe proposition of the US dollar. Because of this, the fundamental certainly line up with the US dollar strengthening, not only due to the safety factor about the recent good news coming out of the United States as far as economic figures are concerned as well and we have an upward bias in this market already.

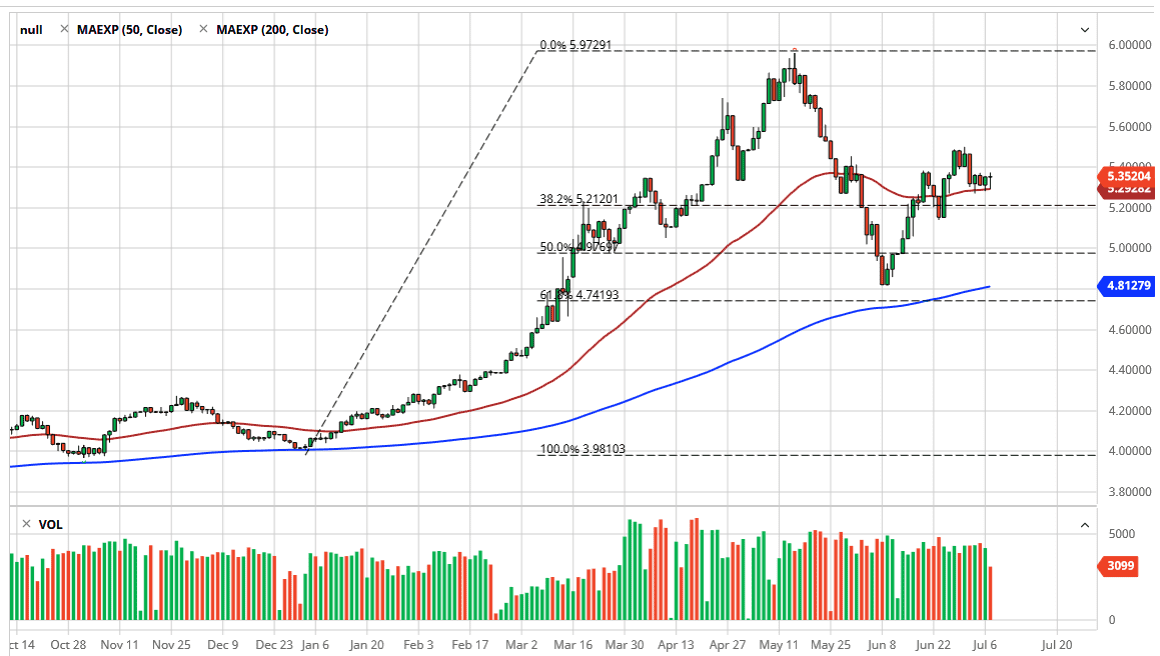

The 50 day EMA offers quite a bit of support and we have seen over the last four days in a row that it shows signs of resiliency. If this level continues to hold, it does make sense that we will eventually turn around and start to rally. The 5.5 area has offered resistance of the last couple of weeks, but I do think that it is only a matter of time before we reach above there. If we do, that opens up a move towards the 5.6 area, and then eventually the highs closer to the 6.0 level. To the downside, I think that the 5.0 level will be a significant barrier that should offer plenty of buying pressure. Ultimately, I think at this point it is much easier to buy this pair than to sell it, due to all of the other risks that are associated with dealing in Brazil and Latin America on the hold.