Brazilian President Jair Bolsonaro, who tested positive for Covid-19 after contracting it at the US embassy during a mask-free July 4th event, reiterated his position that implemented restrictions to curb the spread of the virus has harmed the economy and prevent it from recovery. Brazil registered over 2,000,000 confirmed Covid-19 infections, second only to the US, which is expected to cross 4,000,000 cases in the next 48 hours. The USD/BRL entered a sideways trend following the rejection of its counter-trend advance by its short-term resistance zone, while bearish pressures remain dominant.

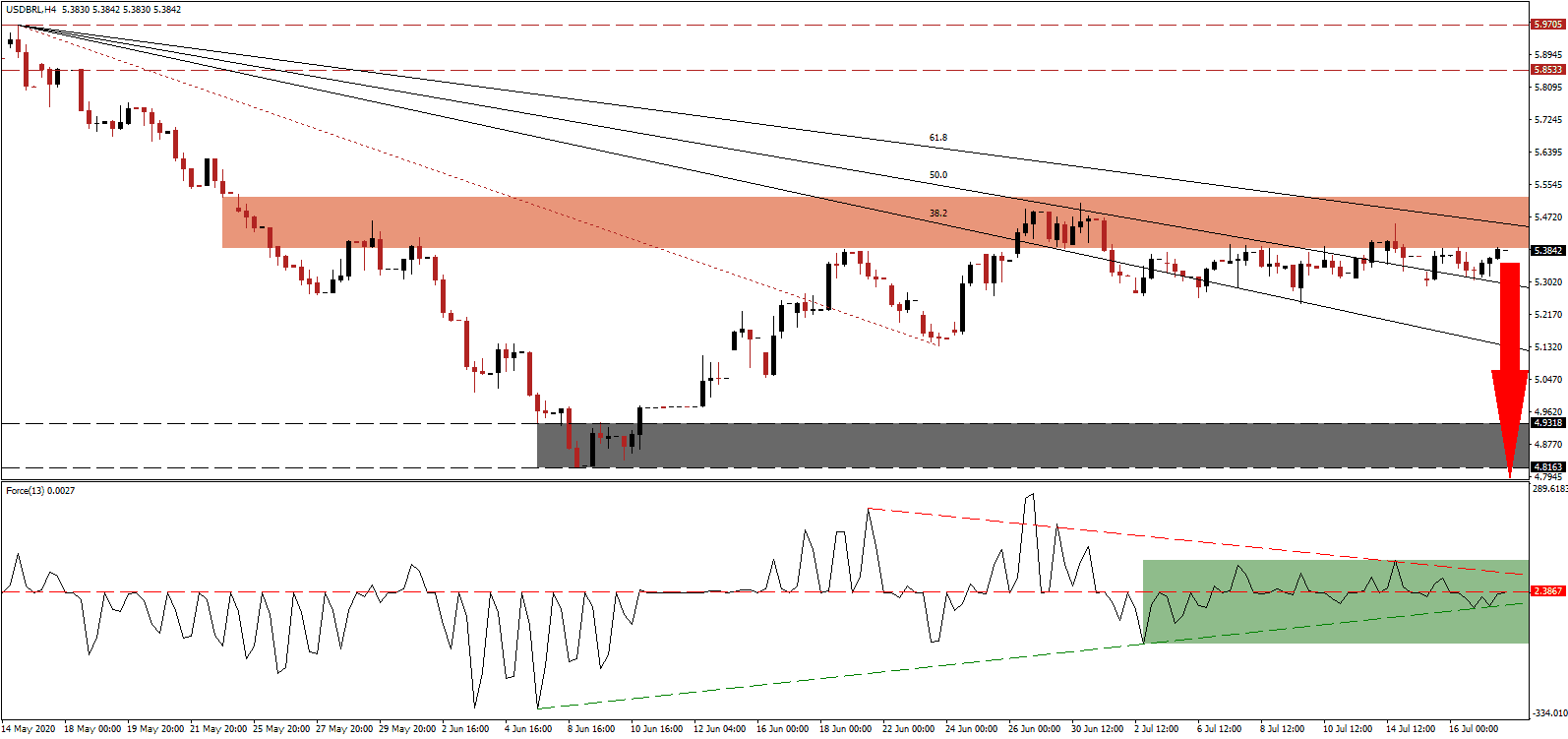

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level, as marked by the green rectangle. Adding to downside pressures is the descending resistance level, which is favored to pressure the Force Index below its ascending support level and into negative territory. It will allow bears to regain complete control over the USD/BRL.

Brazil faced a severe recession from mid-2014 that caused a 3.5% GDP contraction in 2015, followed by a 3.3% slide in 2016. It failed to fully recover with growth rates of 1.3%, 1.3%, and 1.1% in 2017,2018, and 2019, respectively. The Banco Central do Brasil forecasts a drop of 6.1% in 2020, due to the Covid-19 pandemic. It has been revised up from the previous 6.5% prediction with a 3.5% expansion in 2021. The USD/BRL faces breakdown pressures from its short-term resistance zone located between 5.3900 and 5.5222, as marked by the red rectangle.

Adding to downside pressures is the worsening condition in the US, where the Covid-19 virus is out-of-control. The general public ignores healthcare advice and social distancing, and the federal government is unwilling to implement a nationwide response. Present conditions suggest that the economy is likely to suffer moving forward with localized shutdowns expected to accelerate in hotspots. The descending 61.8 Fibonacci Retracement Fan Resistance Level is well-positioned to pressure the USD/BRL into its support zone located between 4.8163 and 4.9318, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.3800

Take Profit @ 4.8000

Stop Loss @ 5.4800

Downside Potential: 5,800 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 5.80

Should the ascending support level pressure the Force Index higher, the USD/BRL may attempt a breakout. Forex traders are advised to consider any advance as a secondary short-selling opportunity, amid a worsening economic outlook in the US. The upside potential remains limited to its downward revised resistance zone located between 5.8533 and 5.9705.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.6300

Take Profit @ 5.8700

Stop Loss @ 5.4800

Upside Potential: 2,400 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.60