Brazilian President Jair Bolsonaro tested positive for the Covid-19 virus on Tuesday but confirmed that he is in good health. He attributes it to hydroxychloroquine, the malaria drug without medical evidence as an effective coronavirus treatment, which he is taking. US President Trump has also claimed numerous times that it is proper treatment. President Bolsonaro was infected during a July 4th celebration at the US embassy, where face masks were not required. The US and Brazil are the most infected countries globally, accounting for over 40% of all confirmed cases. Following the rejection in the USD/BRL by its short-term resistance zone, breakdown pressures are expanding.

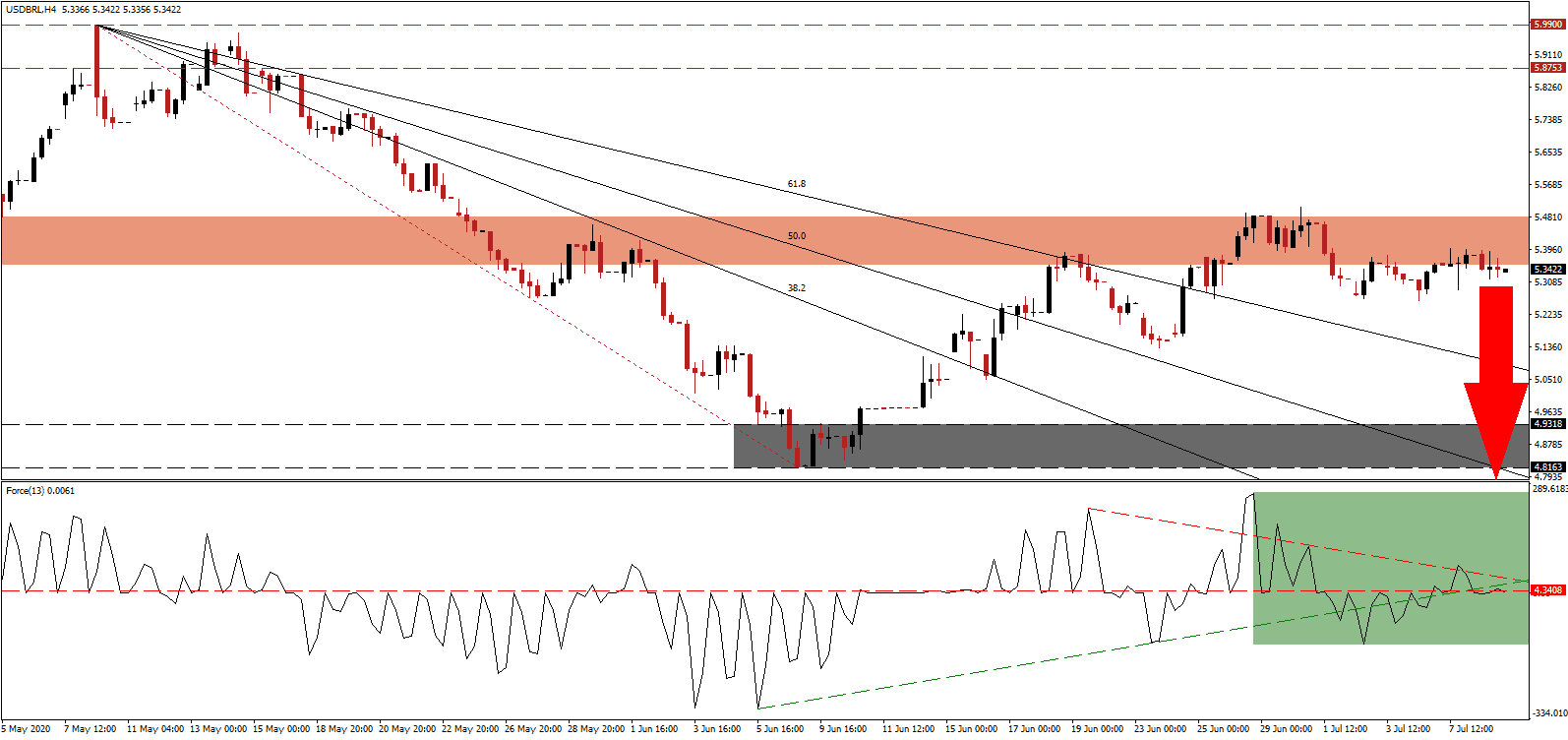

The Force Index, a next-generation technical indicator, was also rejected by its descending resistance level, suggesting an end to the temporary counter-trend advance. A breakdown below its ascending support level, as marked by the green rectangle, was followed by a dip below its horizontal resistance level. This technical indicator is on the verge of a retreat below the 0 center-line, granting bears complete control over the USD/BRL.

Signs that the Brazilian economy has bottomed are produced by a series of economic reports, following similar developments across the world. After May industrial production clocked in above expectations and its second-biggest monthly increase, retail sales for the same month surprised to the upside with a record expansion. Economists predicted a 6.0% increase for May, while official data showed a 13.9% surge. It added bearish pressures to the USD/BRL, which drifted below its short-term resistance zone located between 5.3536 and 5.4815, as marked by the red rectangle.

Optimism for June data out of Brazil has increased with consumer durable goods production up 92.5% compared to April. Auto and auto parts led the capital goods production recovery, surging 244.0%. US data for June beat on the headline expansion, but the labor market showed signs of intensifying weakness. The end of the weekly $600 government subsidy on initial jobless claims will expire this month, adding uncertainty to the future outlook. With the descending Fibonacci Retracement Fan sequence pointing towards more downside, the USD/BRL is well-positioned to accelerate below its support zone located between 4.8163 and 4.9318, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.3425

Take Profit @ 4.8000

Stop Loss @ 5.4700

Downside Potential: 5,425 pips

Upside Risk: 1,275 pips

Risk/Reward Ratio: 4.26

Should the Force Index spike above its descending resistance level, the USD/BRL is likely to attempt a push higher. Forex traders are recommended to consider any advance from present levels as a secondary short-selling opportunity, with the US expected to add to its unsustainable debt load. The upside potential remains reduced to its resistance zone between 5.8753 and 5.9900, which is pending a downward revision.

USD/BRL Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 5.6250

Take Profit @ 5.8700

Stop Loss @ 5.4700

Upside Potential: 2,450 pips

Downside Risk: 1,550 pips

Risk/Reward Ratio: 1.58