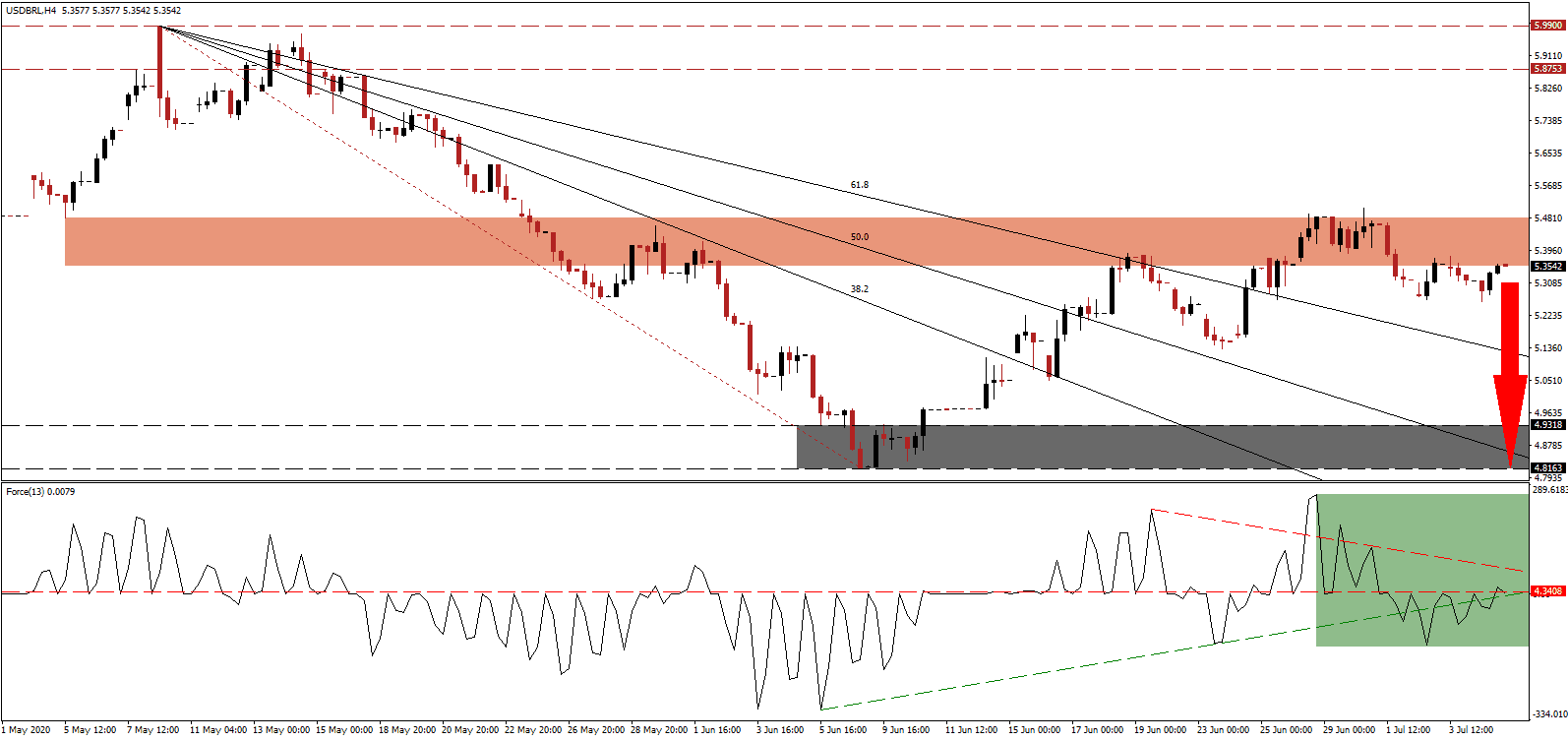

According to the latest monthly poll conducted by the Banco Central de la República Argentina (BCRA), the country’s central bank, the economy will tank by 12.0% in 2020. It is worse than the previous estimate, outlining a 9.4% contraction. The BCRA poll includes 41 analysts, who also forecast a 40.7% annualized inflation rate. Additionally, the official nominal USD/ARS exchange rate is predicted to at 88.000 by the end of 2020 and at 122.500 by December 2021. Presently, price action is resting inside of its resistance zone with intensifying bearish pressures likely to spark a profit-taking sell-off.

The Force Index, a next-generation technical indicator, was rejected by its horizontal resistance level, as marked by the green rectangle, confirming dominant bearish pressures. With a negative divergence in place, more downside is expected after the contraction below its ascending support level. This technical indicator is on the verge of pushing below its descending resistance level, serving as temporary support, and into negative territory, placing bears in complete control of the USD/ARS.

Argentina extended the deadline to reach a debt restructuring agreement with international creditors for a sixth time to August 28th. After defaulting for the ninth time in May by missing an interest payment of $500 million worth of debt, President Alberto Fernández and his government made a new offer. It is rumored to restructure nearly $53 for every $100, up from the previous rejected $39 per $100 proposal. The government seeks to restructure over $65 billion worth of debt, out of a total of $324 billion. The USD/ARS is ideally positioned to complete a breakdown below its resistance zone located between 70.309 and 70.820, as identified by the red rectangle, especially if the new proposal is accepted.

Increasing hopes for an acceptable resolution to the debt stand-off is the preliminary agreement between Ecuador and creditors to restructure $17.4 billion in debt. The same companies in opposition to previous proposals by the Argentine government are supporting the Ecuadorian one. With bearish pressures on the US Dollar expanding, the USD/ARS is anticipated to correct into its short-term support zone located between 68.350 and 68.895, as marked by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level is passing through it, offering a potential reversal point.

USD/ARS Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 70.750

Take Profit @ 68.500

Stop Loss @ 71.200

Downside Potential: 2,250 pips

Upside Risk: 450 pips

Risk/Reward Ratio: 5.00

In the event the Force Index reclaims its ascending support level, the USD/ARS is likely to attempt to push higher. While Argentina renegotiates its debt, the US is adding to an unsustainable one. Annual interest payments exceed $1 trillion and will rise once the government approves more debt-funded stimulus as the economic prospects dwindle. The next resistance zone is located between 71.920 and 72.625.

USD/ARS Technical Trading Set-Up - Breakout Scenario

Long Entry @ 71.600

Take Profit @ 72.600

Stop Loss @ 71.200

Upside Potential: 1,000 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.50