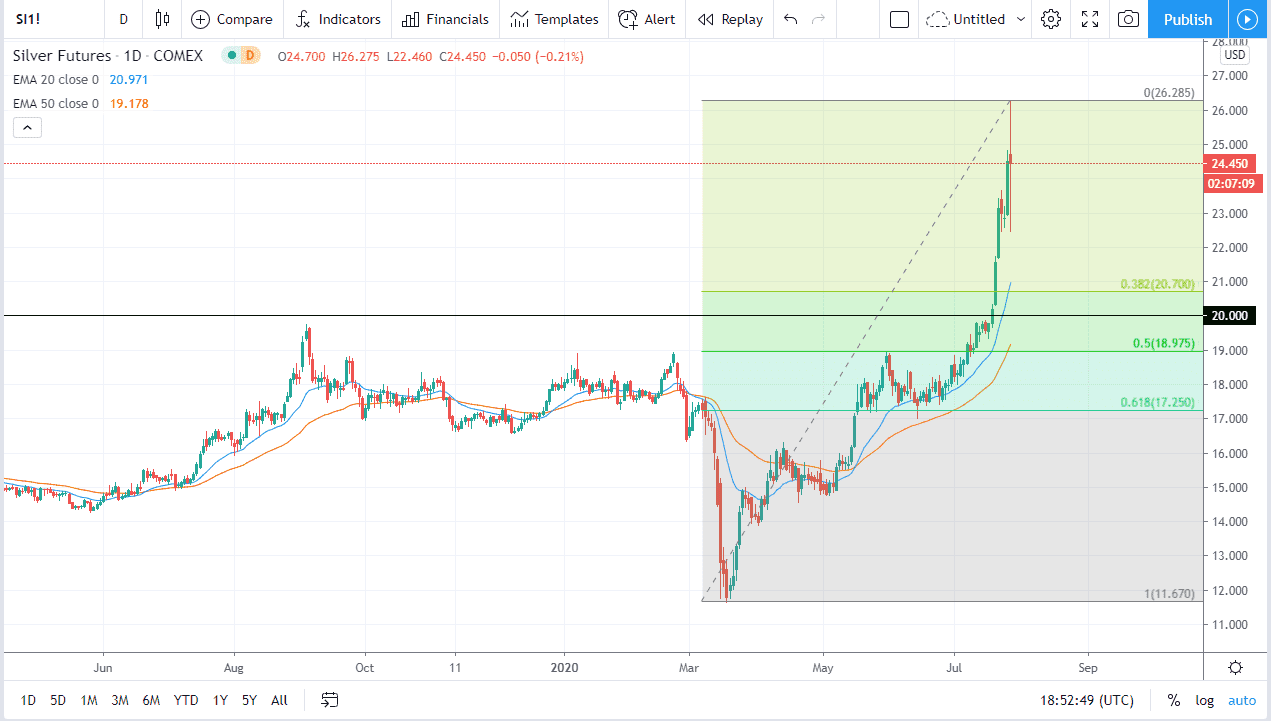

The silver markets have been all over the place during the trading session on Tuesday, as we broke above the $26 level during the Asian session, only to turn around a break down below the $23 level. As the United States is closing down business for the day, we are above the $24 level. This ended up forming a massive “long-legged doji”, which is typically a sign that at the very least we are going to try to form some type of range. This would be a pretty large range, but it would make quite a bit of sense as we are overdone. That being said, once we break outside of the range of the ridiculous Tuesday candlestick, then we may have the next trade in front of us.

If we break down below the bottom of the candlestick, then I am going to be looking towards the $21 level for some type of buying opportunity. Overall, this is a market that has gone parabolic so it is not a huge stretch to think that we could pull back significantly. The $21 level is right around the 38.2% Fibonacci retracement level, and the $20 level underneath there will also offer support which gives me a good area from which to try to pick up silver again. Buying it at this elevated level is a great way to lose money and therefore something that I have no interest in doing. Anybody buying at this point is essentially “chasing the trade”, which is probably the most self-destructive thing a trader can do.

If we did somehow break above the top of the range for the trading session on Tuesday, then the market will form a major “blow-off top”, which would be a very negative sign, as that is typically the end of the run. I do think at the very least we need silver to come back down in order to pick up enough momentum to go higher. Even if you told me that silver was going to break down over the next 24 hours, I would have absolutely no interest in shorting it. The US dollar continues to get beat up, and that is good for precious metals in general, including silver. Expect volatility, but look for value.