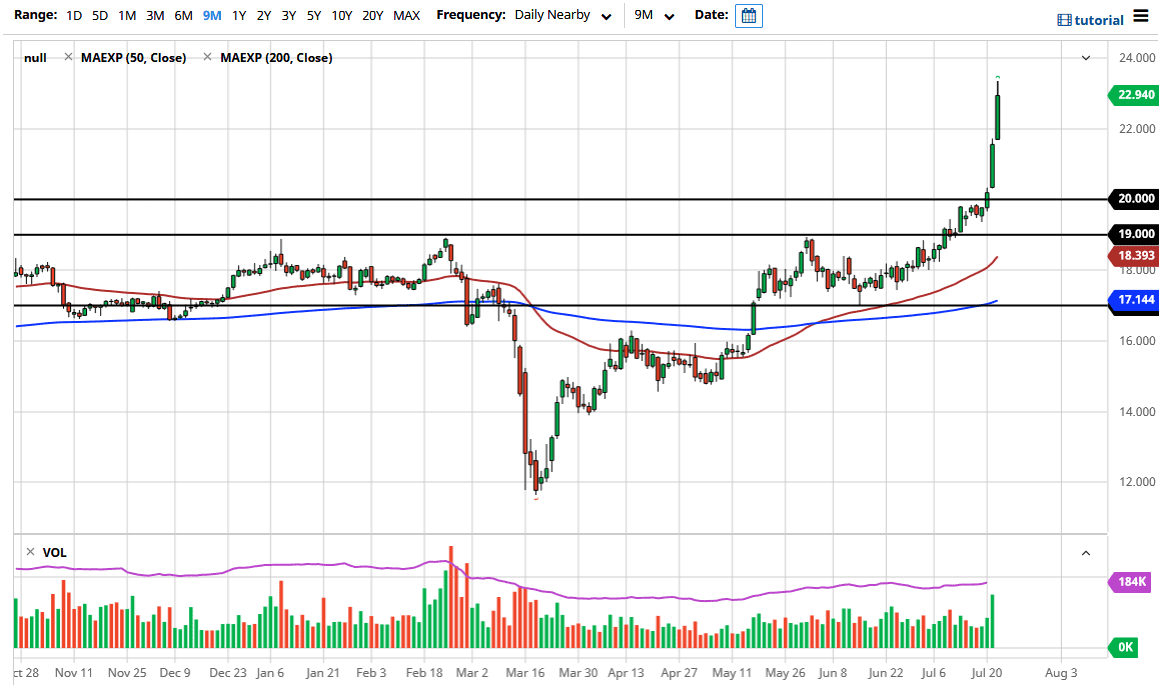

Silver markets rallied rather significantly during the trading session on Wednesday, breaking above the $23 level. At this point, the market has gotten itself way ahead of what momentum can continue to carry, so if you are not already long in this market, you certainly have no business buying appear. After all, we have just made in today’s what this market generally makes in about two or three months. This is not the type of momentum that can keep up, and at this point, it is more or less going to be a major short-covering rally than anything else. Because of this, I think that there is plenty of value to be found underneath, and it is only a matter of time before you will have a couple of different groups of traders looking to go long.

After all, we have just seen a massive move that a lot of people will have missed. There is a lot of fear of missing out there right now, but those who are a bit more professional will be waiting for a pullback in order to take advantage of what has been an extraordinarily violent move, and a clear representation of a large breakout. Underneath, I would anticipate that there will be several potential areas of support, not the least of which of course will be the $20 level. It is quite often that we will see markets break out like this and then come back to test the original resistance and see if it is supported. Unfortunately, that is going to take a significant amount of patience to wait on, but ultimately is exactly what you will have to do in order to make the correct trade. Somewhere in that general vicinity, you will see traders that have missed out on the trade get involved, and those who got caught short trying to get out of the market with as little damage as possible.

To the upside, I think that we will eventually hit the $25 level, but it is going to take a certain amount of time before we get to that level, just as it will probably take some time before we get back down to the $20 level. If you are not involved, you probably have a couple of days’ worth of waiting ahead of you. As long as the US dollar continues to fall in value overall, that will work in favor of the silver markets.