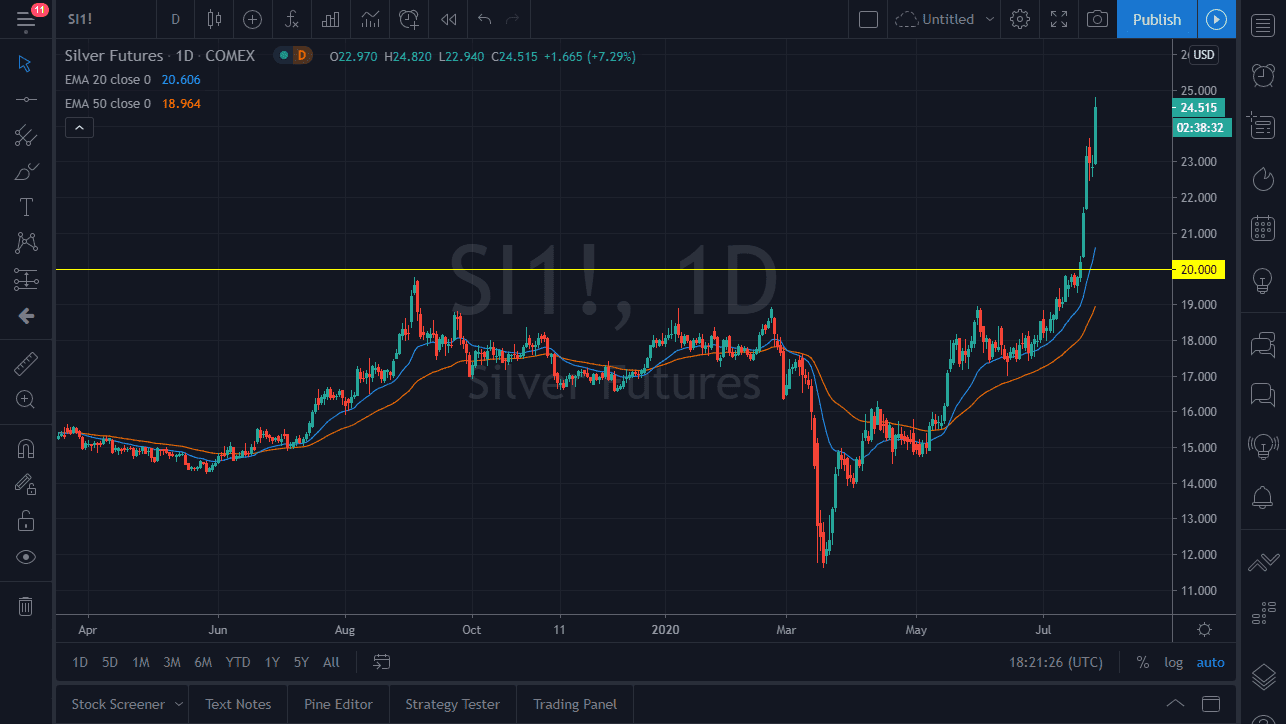

Silver markets have shot straight up in the air again during the trading session on Monday, reaching towards the $25 level. At this point, we are so overextended it is not even funny. At this point in time we are due for a pullback, perhaps even a major one. The market had gained over 7% during the day on Monday, which is a bit ridiculous regardless of the reasons. Silver has further to go long term, but I think at this point we need to find value in order to attract more buyers.

If we were to break above the $25 level without some type of pullback, at that point things become even more dangerous, as there would be an even more overextended condition. I think at this point we need to see this market drop back down to at least the $23 level, maybe even the $22 level before you can seriously contemplate the idea of buying. I would also need to see some type of supportive daily candlestick to buy that pullback. Silver is a very thin market most times, and if we get a major pullback it could be rapid and devastating for those who are caught buying silver up in this region. There is a reason why most traders focus on gold, it is because silver can be extraordinarily dangerous.

At this point, it is all about playing the waiting game, as the market needs to offer some type of value that you should be involved in. It is very difficult to imagine a scenario where you would be willing to buy the market up here and actually be profitable for any decent amount of time. The $25 level obviously is a large, round, psychologically significant barrier, and the fact that we have gone up to that level and then almost straight down is something worth paying attention to. I fully anticipate that this market will pull back rapidly sooner or later, but it cannot be sold. This is because sooner or later people will be looking to get involved, and it might be rather suddenly. I do think sooner or later we will get the pullback that people will be waiting for, and the trend has changed. Looking at historical charts, it would not be a huge surprise to see silver reach towards the $50 region eventually, after picking up some new passengers.