The silver markets have broken above a major resistance barrier during the trading session on Wednesday, leaving the $19 level behind. By doing so, it looks as if the market is ready to go much higher, which is what we have been working towards for quite some time. This was helped by the gold market but at the end of the day it is likely that the markets will continue to react to central bank monetary policy more than anything else. Do not get me wrong, I think that silver still lags due to the fact that it has an industrial component built into it, as there is a significant lack of demand out there when it comes to goods and products.

Nonetheless, as central banks continue to flood the markets with currency, it makes sense that the traders out there will be looking towards hard assets to take advantage of, as the markets are looking to protect value by running away from fiat currencies that should be losing value.

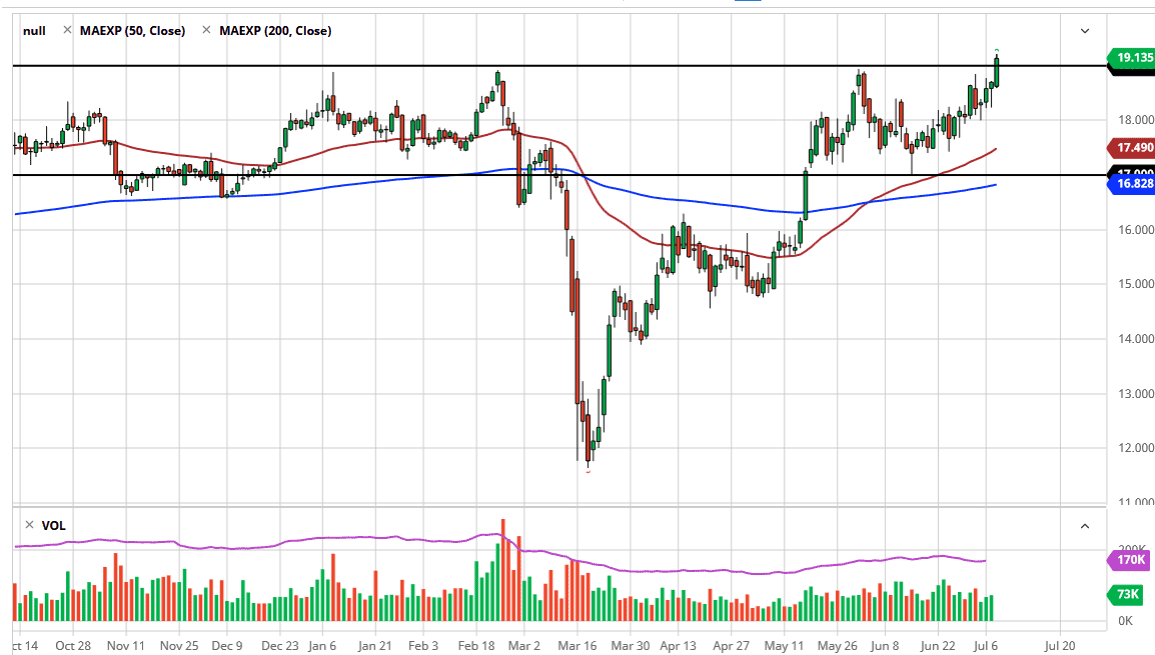

To the downside, the market is likely to reach towards the $18 level, underneath looking towards the support level found in that general region. After that, the market is likely to see the 50 day EMA offer support as well, near the $17.50 level, followed by the $17 level as the 200 day EMA is starting to approach that level as well. Ultimately, I think that the market is going to continue to find value hunters, as we may need to build up enough momentum to reach the $20 level above. That is an area that I think will cause quite a bit of resistance and a lot of headline news. If the $20 level finally gets broken then we have the ability to go looking towards the $50 level over the longer term, as we have seen this market accelerate quite drastically above the $20 level in parabolic breakouts a couple of times over the past. The last time was the Great Financial Crisis, but we are rapidly approaching all kinds of potential problems with the pandemic, and the massive amounts of debt that we find around the world. Because of that, the idea of silver spiking again is not exactly a wild speculative concept. I like buying pullbacks and I think that we will have plenty of value hunters underneath. However, keep in mind that silver is rather volatile so keep your position relatively small and then build as the move works in your favor.