Silver markets rallied during the trading session on Monday to kick off the week yet again, as we reached as high as $18.75 before pulling back a bit. Ultimately, the $19 level above continues to offer a lot of resistance and it looks as if it is going to be difficult for silver to overcome. That being said, the signal for the silver market may appear in the gold market, as it leaves the idea of $1800 an ounce behind. After all, both of these markets tend to move in the same general direction, and gold is the initial place people put money to work when it comes to safety, and there are plenty of reasons to look for safety by investors around the world.

The coronavirus numbers increasing in the United States will continue to have people worried about global growth. Furthermore, the Federal Reserve is going to increase its balance sheet going forward, with likely the idea of $10 trillion being tested. If that is going to be the case, silver should in fact move in an exponential and parabolic manner given enough time, like what we had seen during the Great Financial Crisis over a decade ago. Silver is considered to be the “poor man’s gold”, so it will have a separate move once we finally take off and gold for the bigger move.

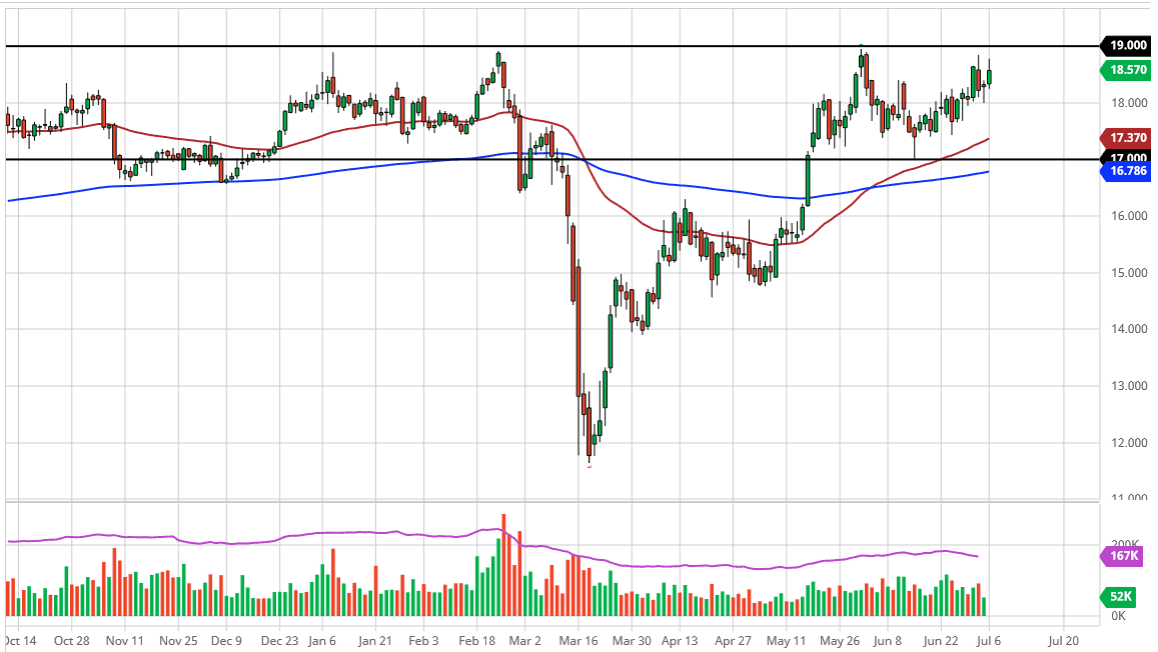

In the short term, the $18 level underneath should be supportive, just as the 50 day EMA which is currently trading at the $17.31 level should be. I have no interest in trying to get cute and short this market, I simply buy dips as they occur. Once they do, I am more than willing to jump in and take advantage of it. Furthermore, if we broke above the $19 level, then we will probably go looking towards the $20 level after that. I am perfectly comfortable buying the breakout as well because I realize that the fundamental reasons and the technical patterns are starting the lineup to tell the same story, which is typically what happens when you get a major move in the market, albeit a certain amount of patience will clearly be needed in order to take advantage of this. With that in mind, I am a buyer of dips and definitely interested in the $18 level, the 50 day EMA, and of course the $17 level. I would add slowly to positions that move in my favor.