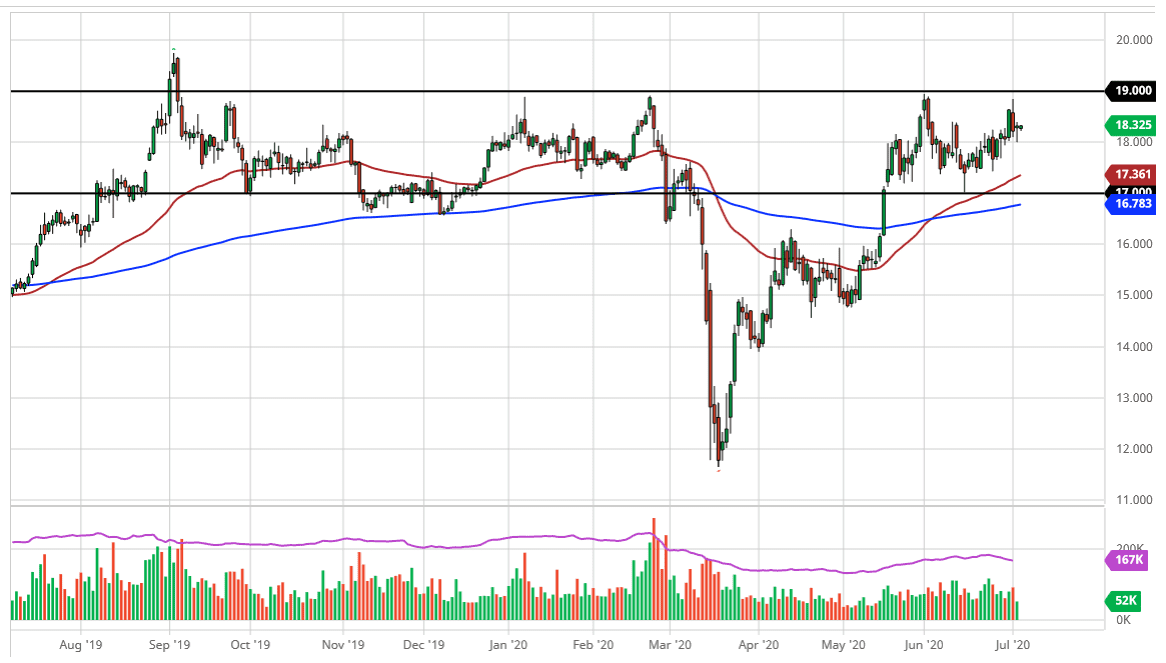

Silver markets have done extraordinarily little during the trading session on Friday which should not be much of a surprise considering that the Independence Day holiday with being observed in the United States. That being the case, the market is likely to simply look at the Thursday candlestick for some type of guidance. If and when it does, then it is going to look at the hammer as a sign that the $18.00 level should continue to offer support. By forming the hammer that it has, it looks like the market is going to try to go looking towards the $19 level again.

Regardless, I have no interest in shorting silver and therefore I think that if we pull back from here you should be looking at silver as it is “on sale.” Looking at this chart, the 50 day EMA is currently trading right around the $70.36 level, so I think that will continue to offer support. Furthermore, you can make a serious argument based upon the weekly chart that we have a range going on right now with the $19 level being the top in the $17 level be in the bottom. Do not be wrong, I would prefer to buy some type of pullback and it certainly will not be afraid to, but I also recognize that it looks like the $18 level is going to offer support at the moment.

Keep in mind that silver does tend to be very volatile and it has multiple things moving it. There is the precious metals trade as far as silver is concerned, as the Federal Reserve continues to print currency as fast as they can. However, there is also the industrial use of each trade, which demands that there is a significant amount of industrial manufacturing to keep lifting the market. Do not be wrong, the precious metal trade can make it rise by itself, but silver tends to take its cues from gold when it comes to that, which has recently tried to break above the psychologically significant $1900 level but failed a bit. I think we will eventually see not only silver, but gold rallied to the upside and take out the resistance, and in this case, silver is likely to eventually reach towards the $20 handle.