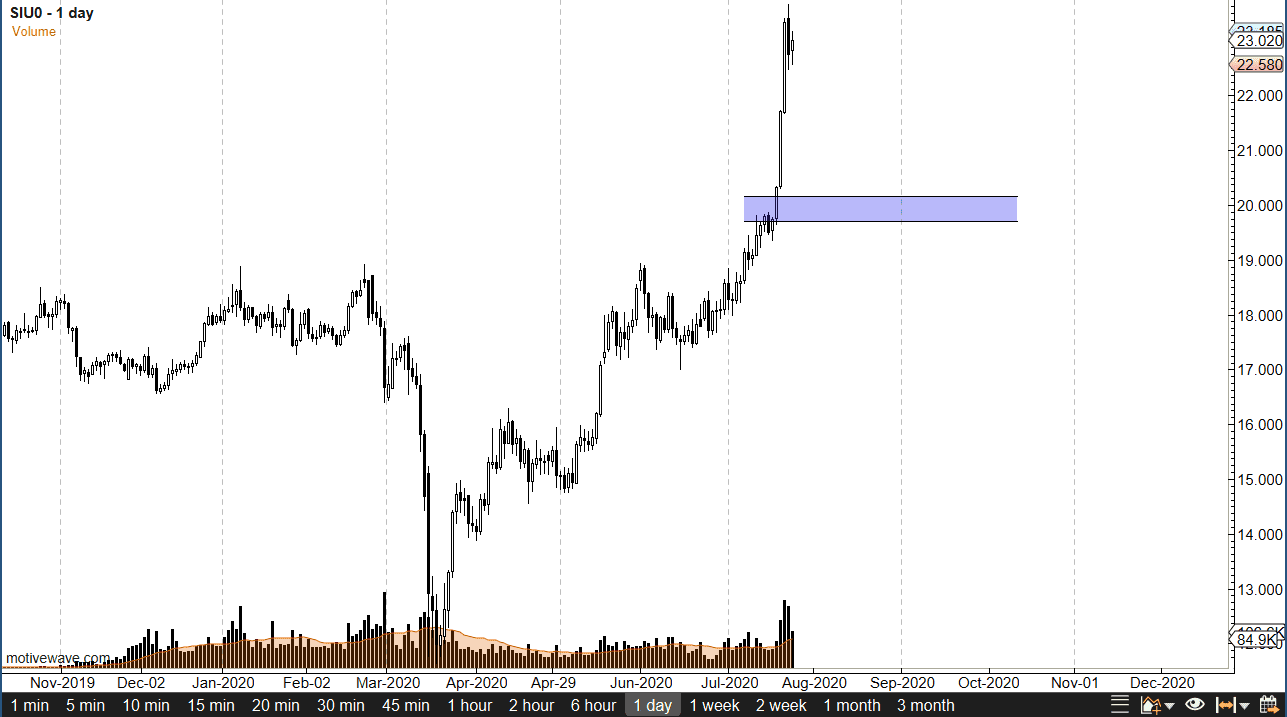

Silver markets have been absolutely parabolic during July, especially towards the second half of the month. Silver is moving for a lot of different reasons, and we have a little bit of a “perfect storm” for higher silver prices. However, much like it is cousin gold, it has gotten far ahead of itself so I think we will initially see some type of pullback in order to find value again. After all, markets cannot go straight up in the air forever, and it is worth noting that Silver gained three dollars during the third week of the month. Ultimately, I think that we are looking at an opportunity to buy value on dips, and it is a perfect example of a “one-way trade” starting to form itself.

I believe that the $20 level will continue to be a “floor” in the market as it was a major level to break, and now should attract a lot of attention. Unfortunately, I do not think that we pull back that far. I would be more than willing to jump into the market at that level, as it would signify “cheap silver.” Furthermore, one would have to think that there are a lot of short sellers it would desperately like to get out of the market if we get back down there. Beyond that, there are people that have missed out on the move higher and are suffering from “FOMO.”

Silver is getting a bit of a boost due to the Federal Reserve doing everything it can to bring down the value of the US dollar as it floods the markets with cheap US dollars, but at the same time there are some traders betting on some type of industrial recovery that will demand more silver. Remember, although silver is a precious metal it is also a commodity first and foremost, one that has a certain amount of industrial demand built into it. If we are going to continue to see a bit of an economic recovery, that could be good for silver as well. That being said, there is also the narrative of the new green deal coming out of Europe that could drive demand higher also. At the end of the day, it is only a matter of the Federal Reserve for me, so I am looking for pullbacks towards the $21 level to get involved.