For the seventh consecutive day, the GBP/USD pair continues to achieve cautious gains, which pushed it towards the 1.2902 resistance, its highest level in more than four months, and settled around the 1.2880 level in the beginning of trading today, Tuesday. As the US dollar is still under great pressure, therefore, the rise of the GBP/USD is not necessarily related to confidence in the pound, as the British currency is expected to perform weaker against many European currencies in the coming days, where some analysts believe that there is no reason for optimism regarding the pound sterling due to stalled trade negotiations between the European Union and the United Kingdom.

In this context, Vasileios Gkionakis, global head of Foreign Exchange Strategy at Lombard Audier & Co., says: “The GBP/USD pair continues to rise. But this is only a result of the dollar’s decline. The British Pound has dropped against most G10 currencies on a monthly basis so far. The UK factor remains negative”. In general, sentiment towards the British pound remains weak in the first place on the basis that the European Union and the United Kingdom are still unable to reach a trade deal after Britain leaves the European Union, which must be reached by the end of the year 2020 if the two economic areas want to avoid defaulting to the trading terms of the World Trade Organization.

The last round of talks ended last week with more confirmation that there are still significant differences between the two sides, especially over future fishing rights in UK waters and rules regarding state aid.

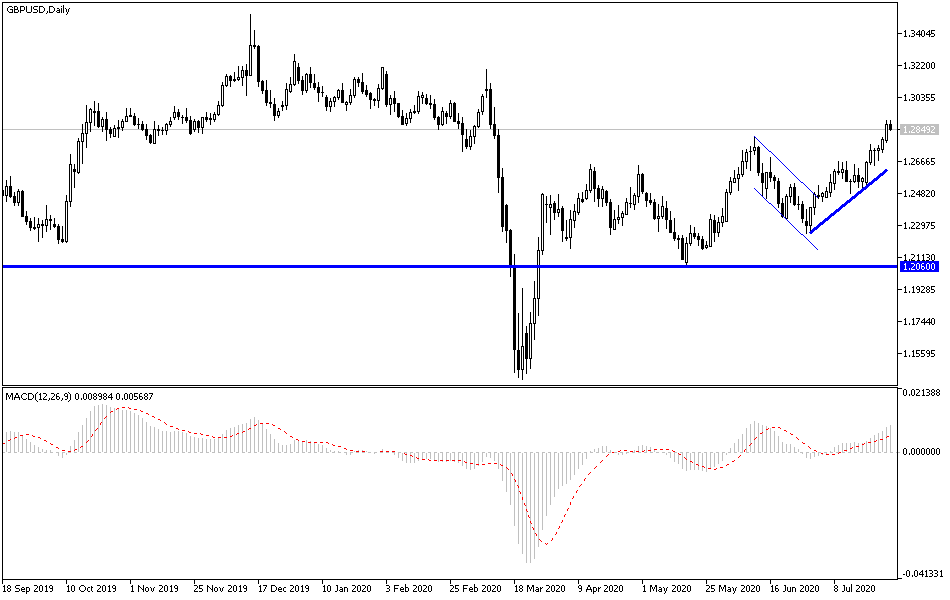

Until a kind of agreement is reached on the pending points, the market expects to remain cautious about the pound sterling, and in return the weakness of the dollar is the main story in the global forex world at the present time, where traders and investors ask whether the selling operations in the dollar will stop this week as It is now looking to be oversold on short-term charts. The Relative Strength Index (RSI) - Momentum Index - is now at 70.5 on the GBP/USD exchange rate, making it officially overbought and due to a temporary pause. (RSI at 70 = overbought, RSI at 30 = oversold).

The United States is struggling to contain a COVID-19 outbreak that would limit the economic recovery over the second half of 2020, just as the European Union and the UK are moving at the same speed. Another worry for the dollar was the November elections, which should inject a dose of political uncertainty into the greenback in the coming weeks. That is why economists see speculation that relations between the United States and China will improve if Biden wins the November presidential election, and amid speculation that the Democratic presidency will increase regulation and taxes, which could lead to a less market-friendly environment, which are also contributing to the dollar's poor outlook.

According to the technical analysis of the pair: The bulls control over the GBP/USD performance is still the strongest, and exceeding the 1.2900 and 1.2975 resistance levels. It pushes technical indicators to overbought areas, and any negative development of the Brexit path as usual will negatively affect the gains of the pound against other major currencies. This will support our expectations of the continued selling of the pair from every upper level. Bears will not regain control again without the pair moving below the 1.2570 support. There are no significant UK economic releases today. During the US session, US consumer confidence will be announced.