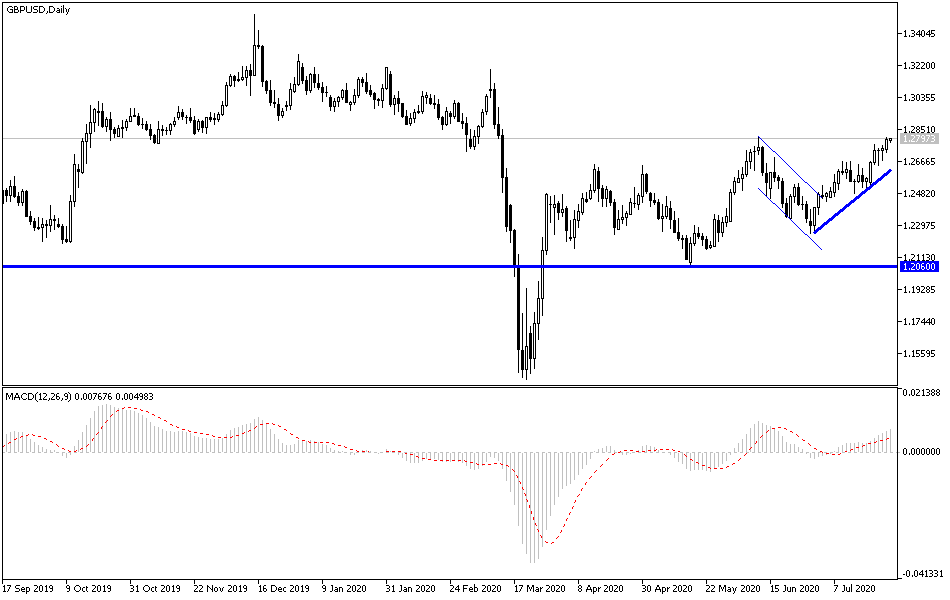

Throughout last week’s trading, the GBP/USD pair was in an upward correction range taking advantage of the decline in the US dollar. Gains remained under great caution and the pair moved towards the 1.2802 resistance, the highest level in more than a month and a half, and closed the week’s trading near that. Gains may be affected negatively by Brexit talks not having made significant progress on the FTA, and the increased tensions between the United States and China after China ordered the closure of the US consulate in the southwestern city of Chengdu.

Commenting on the Brexit negotiations, European Union negotiator Michel Barnier said that "there has been no progress" on the main proposals for state assistance and fisheries and that the two sides are still "far apart". Barnier added that the European Union will not enter into an agreement that would harm fishing. For his part, UK negotiator David Frost said the bloc's proposals had failed to meet the government's request to treat it as an independent country.

On the other hand, global stock markets fell after Beijing ordered Washington to close its consulate in Chengdu. This came days after the United States requested the closure of the Chinese consulate in Houston after allegations of espionage.

On the economic side, UK retail sales rose in June while IHS Markit PMI surveys indicated that manufacturing and services firms operating in the volatile British economy had slumped ahead of their Eurozone competitors in July, despite economists warning that retail data could potentially be overestimating broader economic recovery. According to official results, retail sales rose 13.9% last month, based on gains of 12.3% from May and recovered much of the -23.1% drop in March and April. Gains were led by food and non-store retailers like those doing business online, although non-food and fuel sales also saw strong increases.

Non-food sales increased by 45.5% from May levels last month, although sales in non-food stores were still -15% lower than February, indicating that a lot of the estimated expenditures were online. Food sales have risen 54% since their decline and increased by 5.3% in June from February. This has left retail sales for June down just -3.2% compared to the same period last year and -2.7% when compared to the level of sales volumes seen in February 2020, although economists have warned that this recovery is likely to overstate the broader economic recovery.

"This is impressive given that unnecessary retail stores in the UK were only open for two of the four weeks of the survey in June," says Ruth Gregory of Capital Economics. "But the retail figures exaggerate the speed of the recovery because they absorb substitution away from non-retail spending and the rebound in non-retail spending was much quieter." She added.

The British economy contracted -5.8% in March and an additional -20.3% in April as the country entered the policy of "closure", while only May brought a slight recovery of 1.8% in the GDP, leaving the broader economy collapsed for this year. Retail sales are a meaningful part of household spending, which accounts for a majority share of economic output, so the June recovery may bode well for this month's GDP data, although the recovery has been slower in other parts of the economy and economists fear that it could back off.

According to the technical analysis of the pair: the GBP/USD pair is slowly going inside the formation of its recently formed bullish channel, and in general, I still prefer to sell the pair from any higher level, and the nearest resistance levels are currently 1.2835, 1.2900 and 1.2985, respectively. The return of movement within its descending channel, as is the long-term performance, depends on the price moving towards the 1.2425 support again.

As for the economic calendar data today: There are no significant British economic releases today. From the United States, Durable Goods Orders will be announced.