The US currency weakens temporarily, while the GBP/USD attempts upward correction, at a time when there still needs to be a positive development at the Brexit front, which has been the most influential factor on the Sterling in years. The pair's recent retracement gains stopped at the 1.2520 resistance. What contributed to sterling recent gains were gains of global stock markets and investor’s improved risk. In general, gains in stocks and commodities indicate that investors are in a “risky” mode, which is usually negative for currencies like the USD, the yen, and the Swiss franc, which are considered safe havens, but they tend to be positive for currencies likes of the Australian, New Zealand and Canadian dollars.

Commenting on the latest pound gains, Reuters market analyst Paul Spergel said: “The pound rose above 1.2500 as Chinese stock gains boosted global risk sentiment and the weakened the USD and turned attention away from UK weaknesses that still threaten the pound. However, the risk associated with Brexit’s difficulties persists – which may fuel the BoE's negative interest rate speculation – which in turn would curb the Pound’s gains, especially against the Euro.”

In general, it must be taken into account that the foreign exchange markets are still concerned about the results of the trade negotiations between the European Union and the United Kingdom, which will continue in London this week. Tomorrow, Wednesday, Chancellor Rishi Sonak will announce more details on how the British government will face the devastating effects of the pandemic.

The European Union and the United Kingdom concluded talks last week earlier than expected in the middle of Thursday, indicating how deep the rift between the two sides has been. However, news agency reports indicated that this is not necessarily the case and that the two sides actually have a chance to compromise. According to a Bloomberg report, officials familiar with the negotiations said the two sides are starting to fuse around a general "landing zone" that could form the basis of an agreement on trade and other areas of cooperation. Another source told Bloomberg that the two sides are heading to a mere agreement that includes a free trade agreement that eliminates tariffs and quotas, but it is likely to be less than the broader agreement originally proposed by the bloc, according to an official in the European Union who wished to remain anonymous.

Standard Chartered analysts have told clients that the Brexit deal is again in its basic condition as both sides are intensifying trade talks and outlining the possibility of reaching an agreement. Those details and the formal announcement will determine the fate of the Pound.

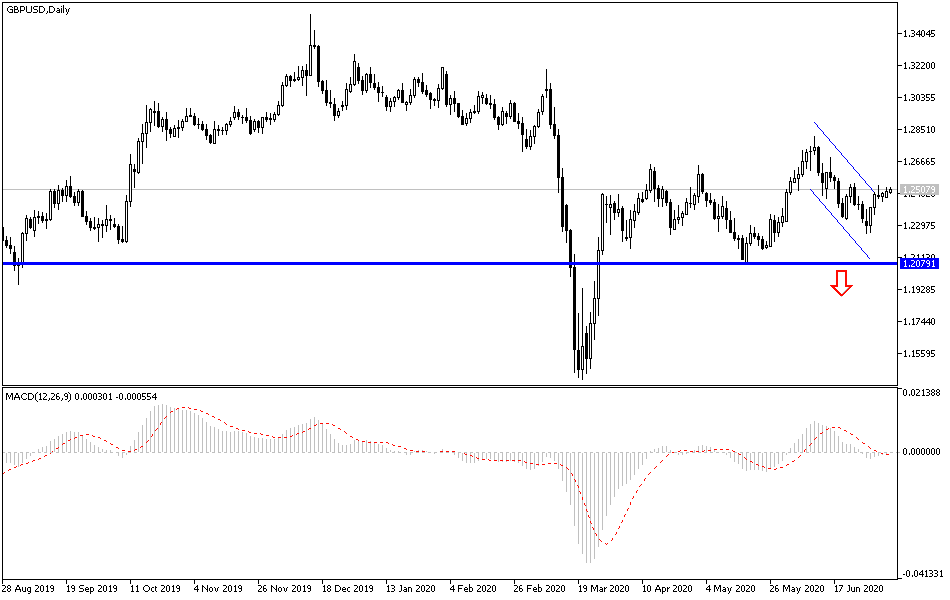

According to the technical analysis of the pair: On the daily GBP/USD chart below, there is a new break of the bearish channel, which brought it down to the 1.2250 support. However, this break still needs to move towards the 1.2585 and 1.2660 resistance levels to confirm the reversal and give the bulls the opportunity to move higher. On the other hand, the 1.2320 support is still important for the bears to complete the downside path, which is still the strongest in the long run.

Brexit developments are the most influential to the pair, especially since the economic calendar today has no important announcements affecting the pair.