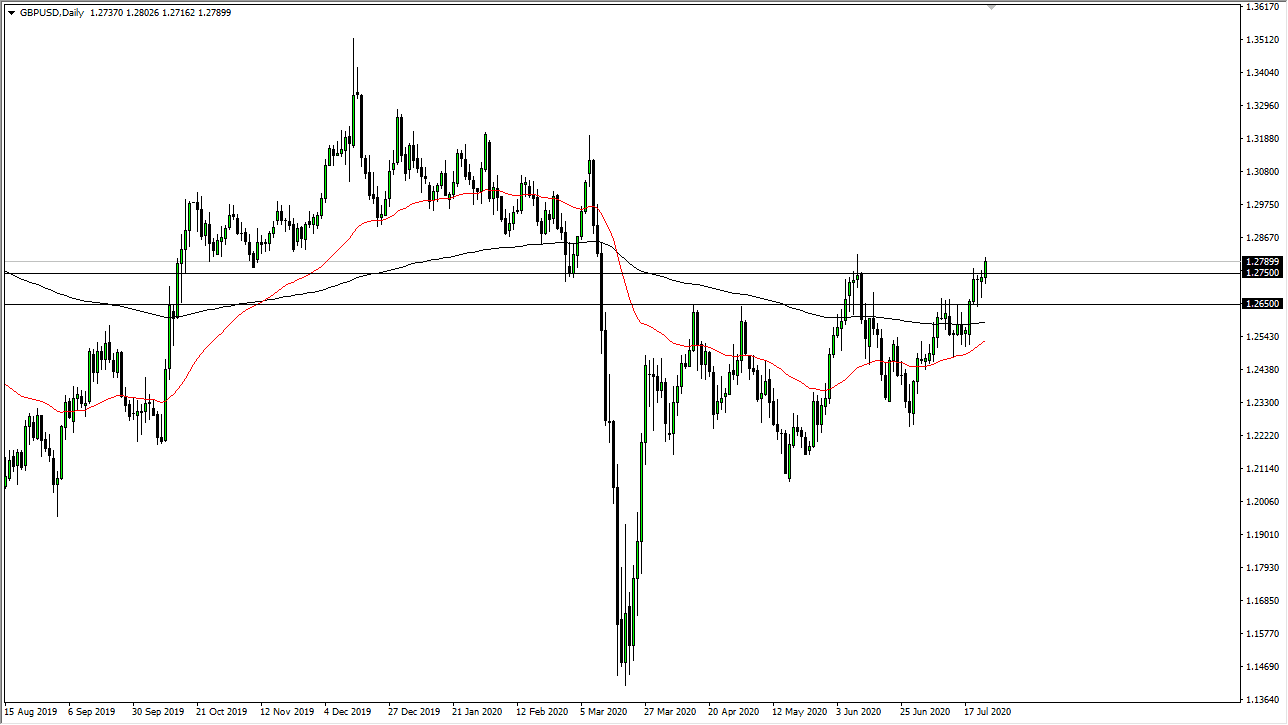

The British pound has rallied significantly during the trading session on Friday but failed to break out above the high from several weeks ago where we had formed a shooting star. That being said, we are closing towards the top of the range overall on the candlestick, so this tells me that we are more likely than not to find buyers in this market to break out to the upside. Having said that, there is nothing wrong with looking for a short-term pullback, or simply waiting until the Monday session to go long of this market. Once we do break out, I believe that the 1.30 level will be the target overall.

Pullbacks all the way down to the 1.2650 level will be supported, as we had seen a couple of hammers form recently between the 1.2750 level and that level. There is a lot of buying pressure underneath and a lot of this is probably driven by the weakening US dollar. I do not even know that this is more about the British pound than anything other than the Federal Reserve flooding the market with cheap dollars. At this point, Brexit is all but an afterthought, which is funny considering that we spent all of those years worrying about it. Beyond that, we also have to worry about the idea of Brexit blowing things up over the next couple of months, because not much is settled at this point. However, it is obvious that the market is focusing more on the Federal Reserve than anything else right now.

With all of this potential black clouds over the horizon, it is likely that the British pound might underperform some of the other currencies out there longer-term, but I do think that we are very likely to go looking towards the 1.30 level, possibly even higher than that. I have no interest in shorting this pair, at least not until we break down below the 200 day EMA, something that is quite far below us. Notice that we continue to make “higher lows” and therefore it is likely that we will continue to see this uptrend form itself as the economic backdrop which continues to look very anti-greenback more than anything else and at this point that is the only thing that seems to matter at this point. Buying dips is the way forward.