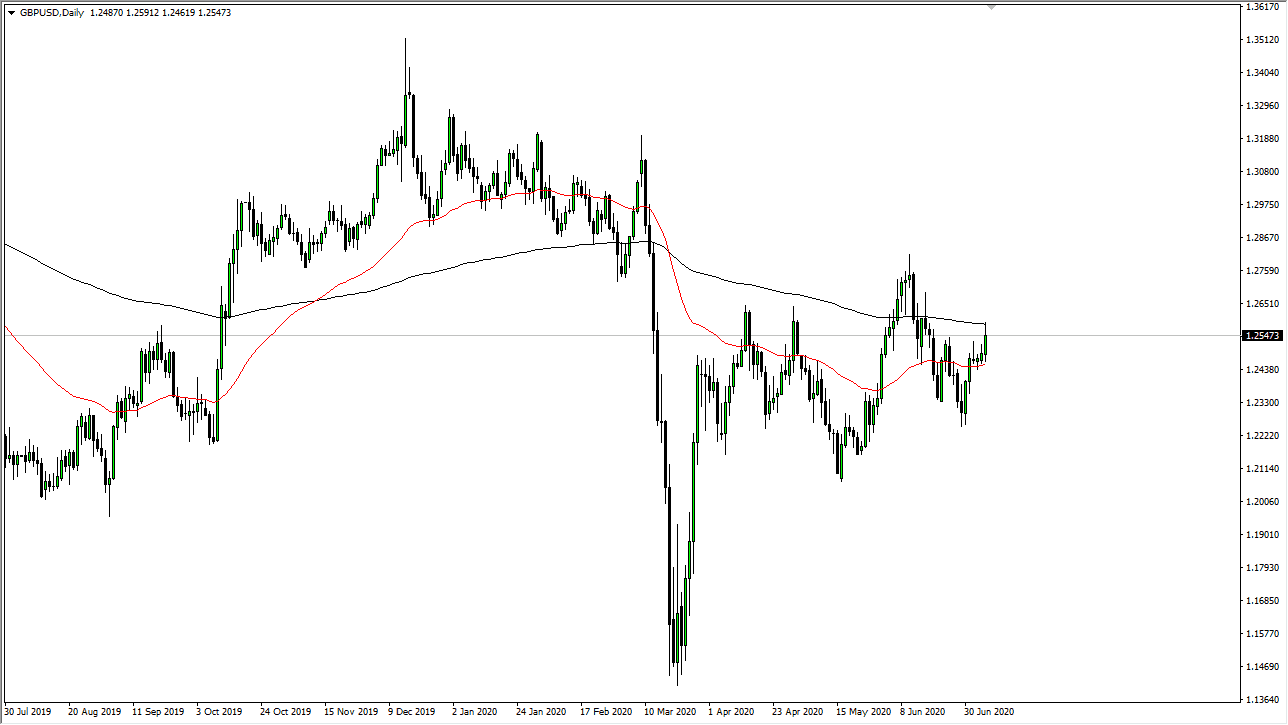

The market continues to be very noisy, as the British pound reached all the way towards the 200 day EMA before rolling over again. At this point, the market is likely to see a lot of noise more than anything else, so I think at this point it is likely that we will see a lot of choppiness. It should be noted that the 200 day EMA has offered solid resistance, and it should also be noted that the 1.26 level is right there as well. As the market is between the 50 day EMA and the 200 day EMA, it is likely that the market will continue to see a lot of back and forth. The candlestick that formed for the trading session was not necessarily a shooting star, but it does show signs of exhaustion in general.

If we were to break down below the 50 day EMA, then it is likely that the market will try to go down towards the 1.2250 level. On the other hand, the market was to turn around and break out above the top of the candlestick for the trading session on Tuesday, then it opened up the possibility of a move towards the 1.2750 level. In other words, this is a market that clearly has a lot of possibilities, but right now as we are between these two EMAs, we have a lot of noise.

It will be difficult to ascertain where we go next because quite frankly there are so many issues out there when it comes to the British pound and of course Brexit. With that, we need to pay attention to the idea of fear coming back into the market because that could be a catalyst to break down and reach towards lower levels. However, it should be noted that the market has shown signs of support in the form that we have three “higher lows” so far so that is very bullish. I think we have high potential breakouts in both directions. However, I am going to use these moving averages as signals as to which direction to go, simply following the market depending on which way we break. Between now and then, I will be out of the market in flat because the British pound has been a huge headache for quite some time.