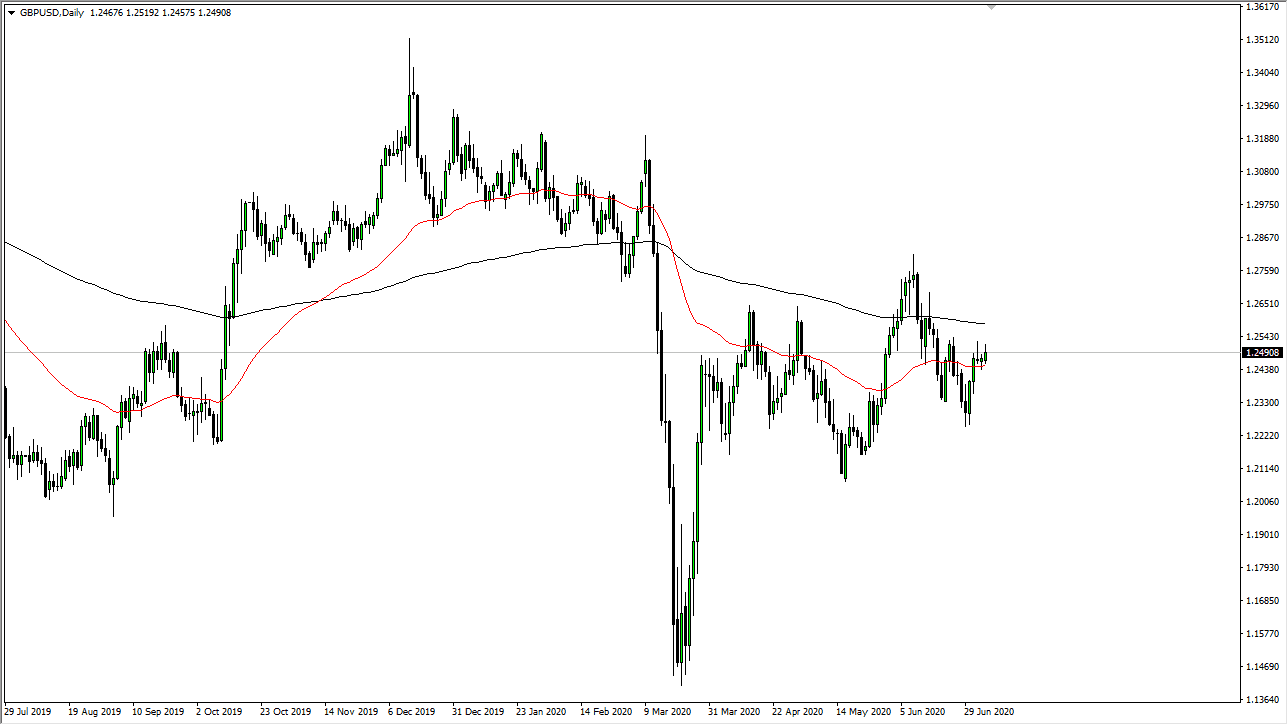

The British pound rallied a bit during the trading session on Monday to kick off the week but gave back some of the gains to form a candlestick that is somewhat reminiscent of a hammer. Looking at the chart, the market has been going back and forth for several days and it is likely that we will see a lot of choppy behavior in the short term. The 50 day EMA sits just below, and it is an area that should offer a certain amount of support. To the upside, we have the 200 day EMA that will cause a certain amount of resistance. In fact, between the 50 day and the 200 day EMA indicators, there is quite often a lot of noise which expresses itself in the form of resistance or support.

If we break down below the candlestick from the previous session, then I think we could have the market unwind a bit. The 1.2250 level underneath might be a significant target over the course of the next several sessions, because it has been important more than once. This is a market that I think will continue to favor short-term back-and-forth trading because quite frankly we do not have much out there in the realm of clarity when it comes to risk appetite or even with going on with the US dollar.

Further compounding the issue is the fact that the British pound has to deal with Brexit, and a lot of uncertainty when it comes to the British economy beyond that. Coronavirus numbers continue to rise in various parts around the world and it is likely that the markets will remain jittery due to that fact. If we were to turn around a break above the 200 day EMA, then the market could go looking towards 1.2750 level which is an area that has been important in the past and could bring in fresh selling. I think at this point the British pound is going to be difficult to trade and I do not see a catalyst going in either direction at this point. I think we simply will chop back and forth in trading that is going to be an exceptionally good opportunity to do serious damage to your account if you try to hang onto a trade for more than a few minutes.