The Australian dollar went back and forth during the trading session on Wednesday as we had broken above the 0.69 level. However, we have given back quite a bit of the gains, so at this point, it looks like we are going to continue to struggle in the same area that we have for some time. As we head into the jobs figure on Thursday, the Aussie dollar will be greatly influenced by what happens with the greenback, which of course is going to be highly influenced by that announcement.

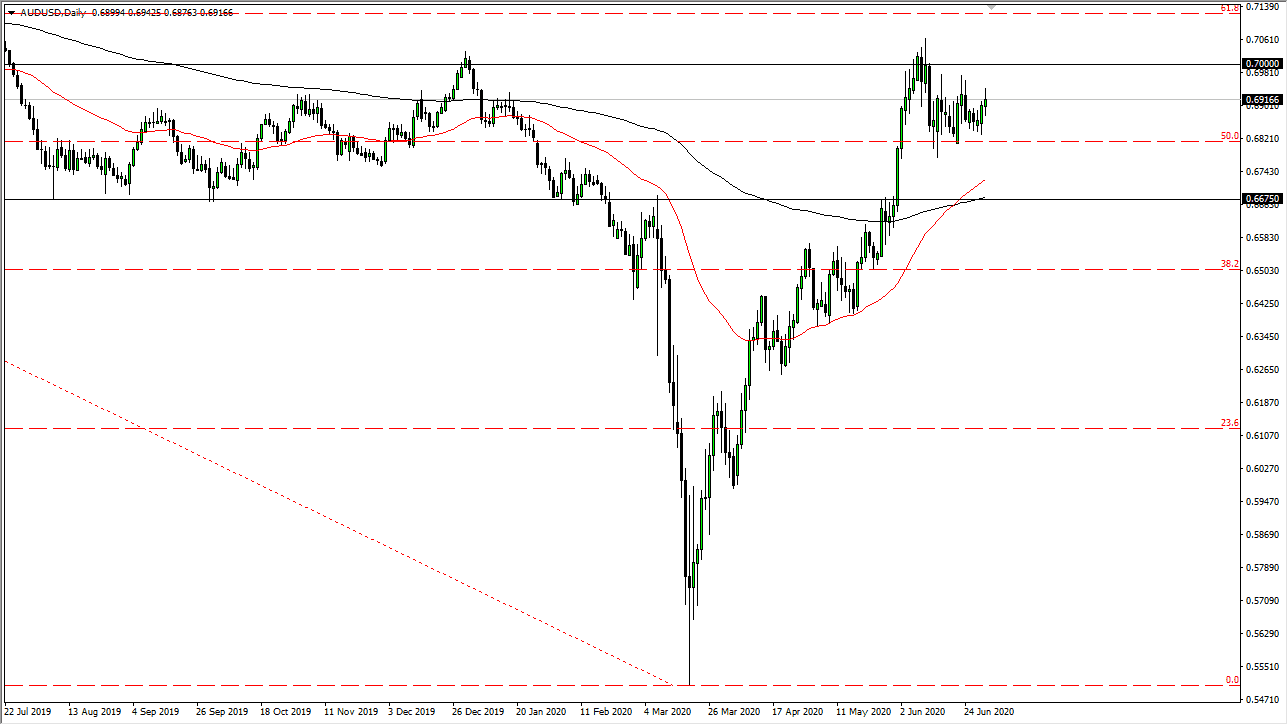

The United States will be heading into a holiday weekend, so it is likely that we will see a lot of action early in the day, and then later in the day things will get extraordinarily quiet. That being said, the Aussie dollar is forming a bit of a symmetrical triangle in this area and I think that it is only a matter of time before we roll over and start selling off again. I am especially interested in a break below the 0.68 level, because I think it then opens up another move of about 125 points down to the 200 day EMA which is sitting at the 0.6675 handle.

To the upside, I believe that there is massive resistance starting at the 0.70 level, which extends all the way to the 0.71 handle. There is a lot of noise in that general vicinity so the closer we get to that area the more likely we are to see sellers jump in. However, if we were to break above the 0.71 level then we could see a bit of a trend change that could send this market much higher. In fact, that becomes more or less a “buy-and-hold” scenario and therefore it would change the entire complexity of how I would trade the Aussie.

The Aussie is extremely sensitive to the idea of global trade and the Chinese economy, which of course is overly sensitive to it as well. Looking at the chart, I think that it is only a matter of time before the sellers come back in, so I am looking to fade rallies. That being said, even if we do break out to the upside for the bigger move, I am perfectly content, because I think that the market will probably go looking towards the 0.80 level above.