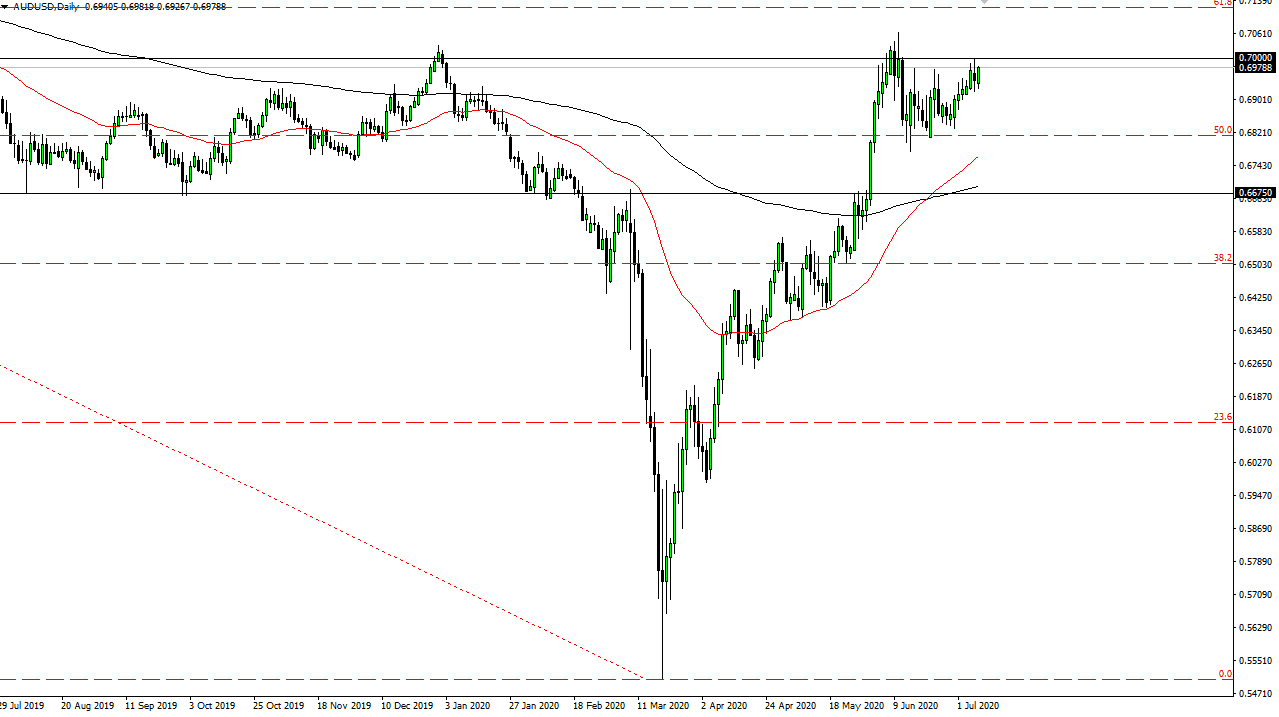

The Australian dollar has rallied again during the trading session on Wednesday, testing the 0.70 level. This is an area that continues to be a major barrier, so at this point I think that at any signs of exhaustion will probably be looking to short this pair again. To the downside, if we break down from here it is likely we go down to the 0.68 handle, an area that has been supportive before. All things being equal, we are still very much in a range, so we should keep that in the back of your mind when we start trading this pair.

Expect volatility, and as a result, it is likely that we should keep the position size relatively small. Keep in mind also that the market is likely to see the Australian dollar react to the Chinese situation as far as exporting is concerned, and as a result, it is likely that the Aussie will move back and forth depending on the latest headline. With this being the case, I think it is only a matter of time before we get a significant pullback, but if we do rally there is a whole huge area of resistance above that is going to cause selling pressure. In fact, the market is likely to find sellers all the way up to the 0.71 handle.

Looking at this chart, although we have a lot of upward pressure I think we still have a lot of work to do before we can start buying from a longer-term standpoint, but a move above the 0.71 handle would be more of a “buy-and-hold” type of scenario. This will more than likely be a reaction to the Federal Reserve flooding the market with liquidity, but this is a market that is going to continue to see a lot of concerns out there. Ultimately, this is a market that I think is going to try to break out sooner or later, but I would also point out that we have tried multiple times and still cannot do so. Looking at this chart, I think that it still is easier to fade signs of exhaustion more than anything else. All things being equal I think that it is only a matter of time before we have to make a bigger move. It is going to be difficult at first, but eventually, we should get some type of clarity, and then we will be able to jump all over it.