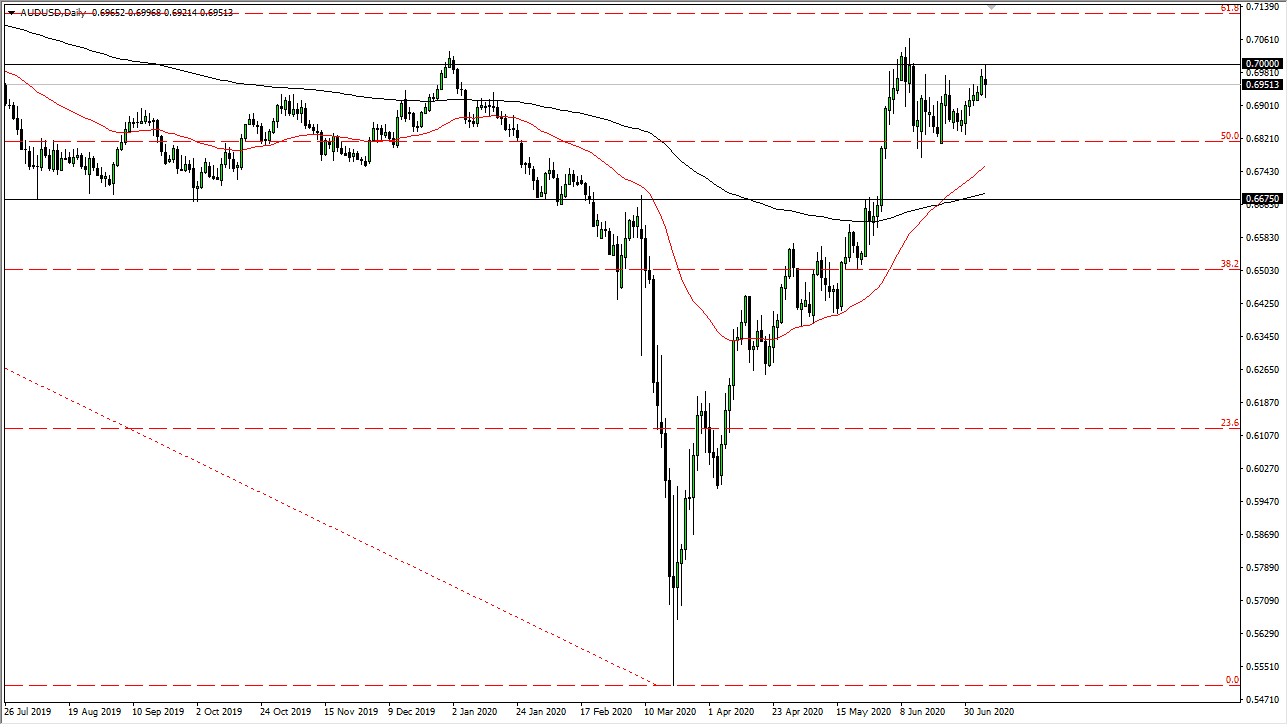

The Australian dollar has gone back and forth during the trading session on Tuesday as we continue to see the 0.70 level cause massive amounts of resistance. At this point, the market is simply chopping back and forth and showing signs of exhaustion that we have seen more than once at the 0.70 level. That is an area that starts a lot of resistance all the way to the 0.71 handle, and as a result, it is likely that we are going to see a lot of selling pressure in that general vicinity. Ultimately, I am looking for signs of exhaustion to take advantage of so that I can start selling. However, if we were to break above the 0.70 level, it is likely that the market is going to be more of a “buy-and-hold” type of trading scenario.

Keep in mind that the Australian dollar is overly sensitive and affected by the overall risk appetite of markets, and as a result, the Chinese market should be paid attention to and of course the other markets such as gold, stock markets around the world, and commodities. If we continue to see a lot of negative pressure on risk appetite out there, it is likely that the Australian dollar will be affected. At this point, I think it is exceedingly difficult to imagine that this market is simply going to take off to the upside, so I think it is only a matter of time before sellers come back. If we turn around and drop from here, I think that the 0.68 level is a significant support level, so breaking down below their opens up the possibility for a move down to the 0.6675 handle.

That is where of the 200 day EMA is currently sitting, so I think there would be a certain amount of buying pressure there. However, I do not think that we are ready to take off to the upside. I believe that we are going to continue to see a lot of back and forth trading between the 0.70 level and the 0.68 level below. Expect a lot of choppiness, as there is a lot of uncertainty out there and therefore it makes perfect sense that we continue to simply climb back and forth out of bullish and bearish markets. If you are a short-term trader, this could be a good market for you.