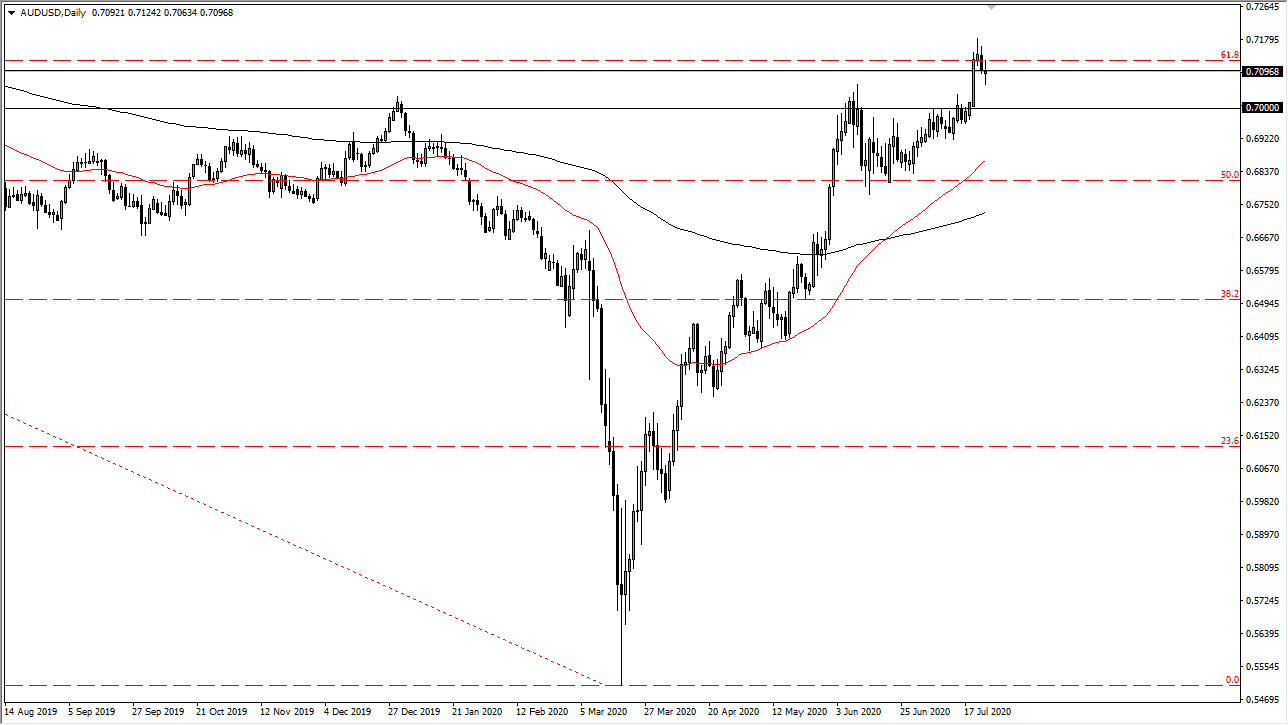

The Australian dollar has gone back and forth during most of the session on Friday as we continue to see a lot of volatility. Quite frankly, the market has been looking like it is trying to find yet another reason to go higher and I fully anticipate that we will start to go to the upside rather quickly. I think that the 0.70 level offers significant support so if we can continue to pull back from here, I would love to buy the Aussie at lower levels, and I have no interest in shorting it right now. Having said that, it is a bit ironic that as the US/China trade relations continue to get worse, the Aussie continues to show signs of life.

This comes down to the Federal Reserve and the fact that most traders do not believe that the US/China situation is going to get to the point where it hurts either contrary economically. After all, they depend on each other far too much, so it makes no sense for either 12 damage the other. With this, I like the idea of buying dips and adding to a longer-term core position, as I believe that we are eventually going to go looking towards the 0.80 level. The market has recently broken above a significant resistance barrier, which is a very crucial event. In fact, I think that we have changed the overall trend of the US dollar and therefore it is likely that the Australian dollar continues to grind due to this.

Pullbacks at this point will not only find support at the 0.70 level, but down at the 50 day EMA which is closer to the 0.6850 handle. In other words, even if we do break down a bit further, I am not willing to sell this market, but I am more than willing to buy it. Beyond that, we also have the gold market rallying which helps the Australian dollar overall. In other words, we have a bit of a “perfect storm” to send this market higher and at this point in time, if we get a little bit of good economic news, that could also throw this into overdrive. We have seen a massive recovery in the Aussie dollar, and this can be directly attributed to Jerome Powell and his acquiescing to Wall Street in order to keep the market flooded with cheap greenbacks.