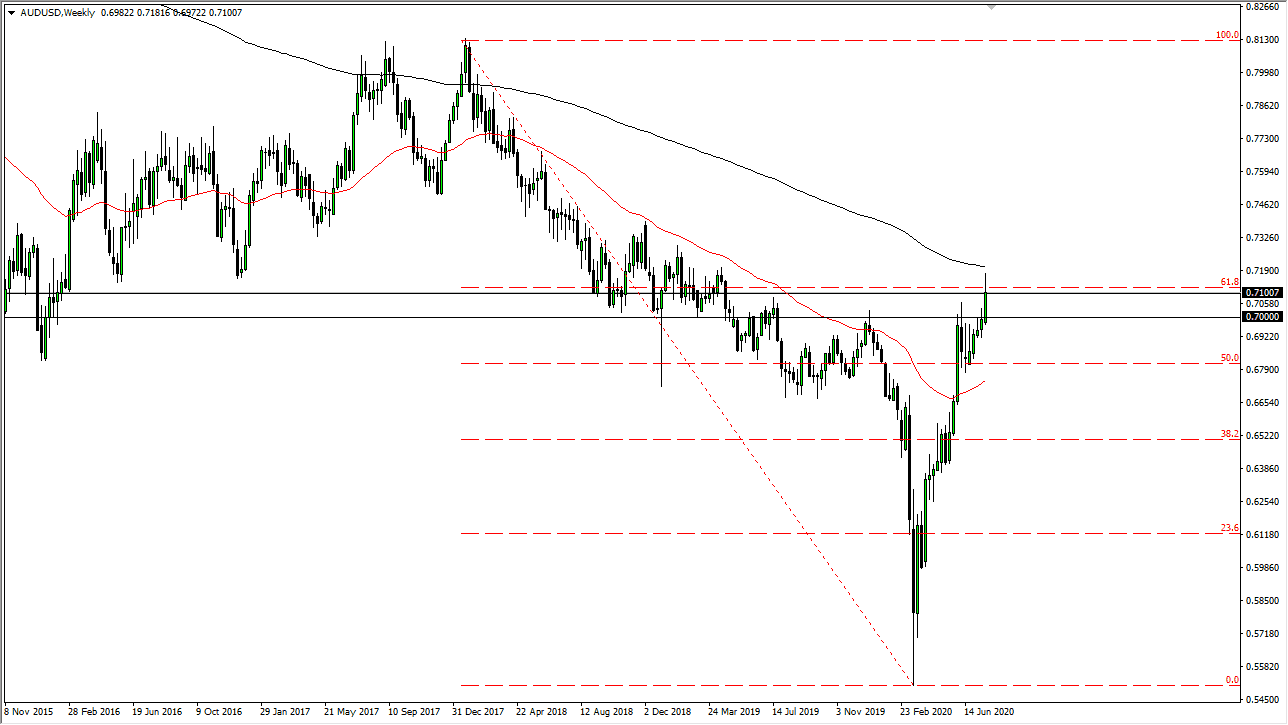

The Australian dollar has been rallying quite a bit over the last several weeks, as we head into the month of August. That being said, we have cleared the 0.71 level, an area that I thought was always going to be a bit of trouble to get above. I think that the Australian dollar has a little bit of catching up to do with the Euro, as the correlation between the two pairs has been rather drastic. At this point in time I am looking for pullbacks to buying the Aussie dollar, just as I am over in the EUR/USD pair.

I think that we have a zone of support just waiting to form between the 0.71 handle and the 0.70 level, so I am a buyer of these pullbacks on short-term charts, with the understanding that we could go much, much higher. In fact, I think that we will end up going towards the 0.80 level, although this is not what I would call a target during the month of August. Rather than that, I simply look to buy dips repetitively, as the Australian dollar might have some headwinds built into it due to the RBA Gov. Philip Lowe suggesting that the interest rate in Austria could drop to 0.10% if necessary. Beyond that though, I think there are also headwinds when it comes to the US/China trade tensions, so it might be a bit of a laggard.

The 200 week EMA is just above and causing a bit of resistance, so do not be surprised at all to see that come into play as well. Regardless, I really like this pair for the longer-term as we have seen such a short “V shaped bottom.” The US dollar of course is suffering at the hands of the Federal Reserve and its quantitative easing policies, as they have flooded the markets with massive amounts of greenbacks. That is probably the biggest story here, that the US dollar is getting hammered against almost everything, so the Australian dollar will of course be the same situation. I believe that looking for buying opportunities on dips will serve you well, and eventually the Australian dollar will play catch up with the Euro and perhaps even the British pound given enough time. This could end up being a very good month for selling US dollars against most currencies, not just this one.