Yesterday’s May ADP data out of the US showed 2.76 million job losses, well below the 9.00 million predicted. It allowed risk-on sentiment to expand further, but ADP data has an inconsistent record in predicting government non-farm payroll data. Factory orders plunged 13.0% in April, and while PMI data for May recovered, it remains deep in contractionary conditions. Intensifying riots across the US are dampening prospects of the reopening of the economy, increasing the likelihood of a spike in new Covid-19 cases. With the long-term outlook for the USD/SEK bearish, a temporary breakout on the back of a bullish momentum recovery is likely to precede more downside.

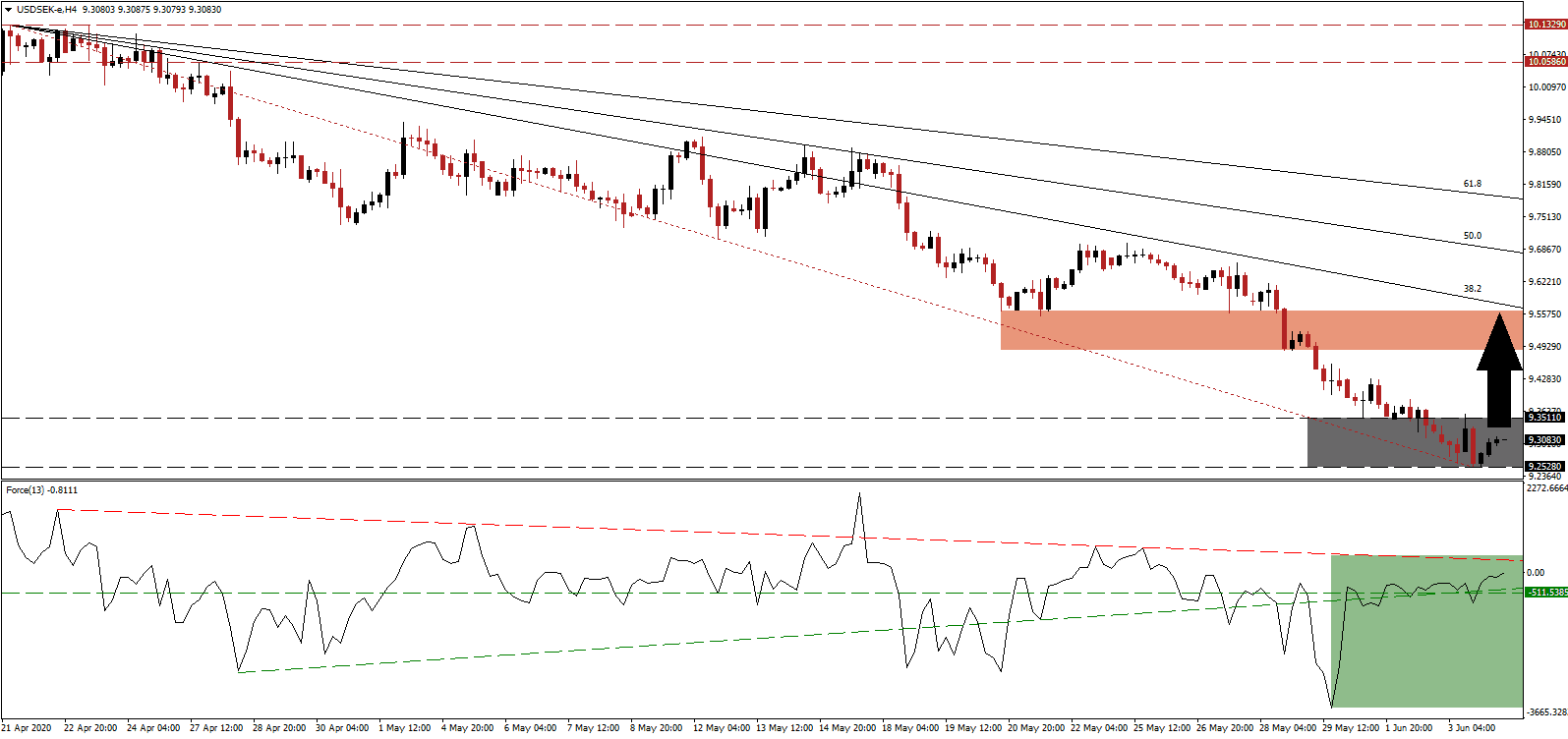

The Force Index, a next-generation technical indicator, recovered from a new multi-month low, suggesting a minor count-trend advance is pending. After converting the horizontal resistance level into support, the Force Index reclaimed its ascending support level. It is now faced with its descending resistance level, expected to maintain the long-term downtrend, but a brief breakout is probable. Bears remain in control of the USD/SEK with this technical indicator in negative territory.

Sweden opted against a nationwide lockdown and reported an increase in its first-quarter GDP of 0.4% annualized. It defied the average forecast for a 0.6% decrease. The Riksbank, Sweden’s central bank, predicts a 2020 GDP contraction between 6.9% and 9.7%. Anders Tegnell, the state epidemiologist and architect of the no lockdown strategy, who has defended the approach for months, is now changing his mind. Data shows the death rate per capita is highest in Sweden, suggesting changes are imminent. It adds to breakout pressures in the USD/SEK for a brief advance out of its support zone located between 9.2528 and 9.3511, as marked by the grey rectangle.

Norway and Denmark dropped border controls, as well as eased restrictions on travelers from Iceland and Germany, but excluded Sweden due to its relaxed approach to the Covid-19 pandemic. Despite growing issues surrounding the export-oriented Swedish economy, the long-term outlook for the USD/SEK remains bearish, driven by US policy. Any breakout remains limited to its continuously downward adjusted short-term resistance zone, currently located between 9.4853 and 9.5650, as identified by the red rectangle. The descending 38.2 Fibonacci Retracement Fan Resistance Level is enforcing the dominant bearish trend.

USD/SEK Technical Trading Set-Up - Temporary Breakout Scenario

Long Entry @ 9.3080

Take Profit @ 9.5080

Stop Loss @ 9.2480

Upside Potential: 2,000 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 3.33

In case the descending resistance level rejects the Force Index, the USD/SEK is anticipated to resume its long-term downtrend. While a brief counter-trend rally is healthy, ensuring the longevity of the bearish chart pattern, a combination of US monetary and foreign policy adds essential breakdown pressures. Forex traders are advised to take advantage of any price spike with new short positions. The next support zone awaits between 9.0159 and 9.0999.

USD/SEK Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 9.2180

Take Profit @ 9.0180

Stop Loss @ 9.2780

Downside Potential: 2,000 pips

Upside Risk: 600 pips

Risk/Reward Ratio: 3.33