While venturing into the Pakistani Rupee may seem farfetched for some traders, a look at the currency within the scope of a 3-month chart and the ability to react short term could prove worthwhile, besides absolutely stimulating.

The Pakistani Rupee has actually found a solid dose of momentum since tumbling to lows against the US Dollar like most other global currencies in late March. The resurgence of the PKR however may not be complete and still is weaker than its pre-Coronavirus pandemic trading range. This means the USD/PKR instinctively is still experiencing a test that will be played out over the coming weeks and its daily movements will be enticing for traders with a speculative taste.

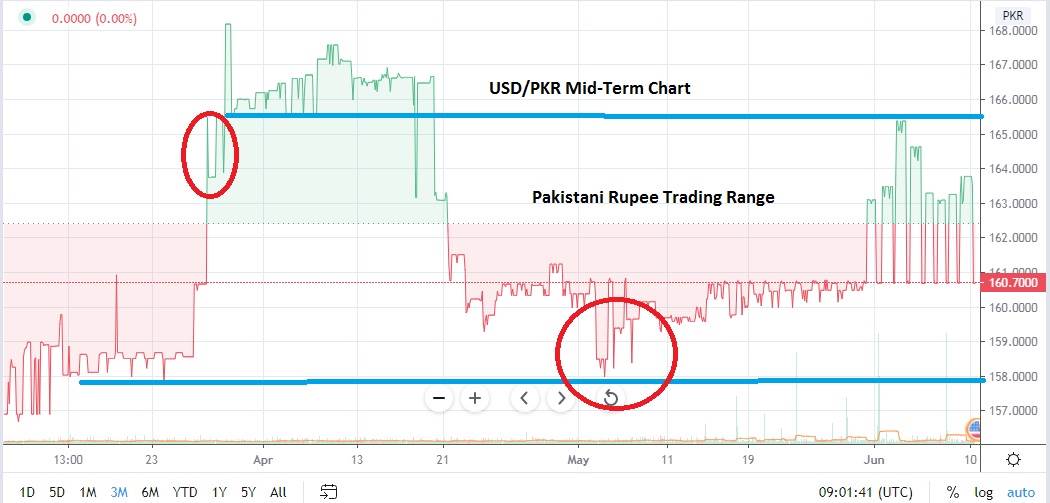

The current trading range for the USD/PKR appears to be from 159.000 to 165.500. This range has been tested consistently since May. The Pakistani Rupee actually gained in value in early May only to lose some value as buyers stepped into the USD/PKR in late May. The USD/PKR has experienced a fairly dynamic range in June, but it has shown a tendency to react to resistance around the 164.00 level and then see sellers of the US Dollar step into the marketplace. Like many exotic forex currency pairs the USD/PKR is low on volume and can be hit by what appears to be sudden short term volatility.

When choosing to trade the USD/PKR traders need to keep their emotions calm and be patient. The resistance level of 164.000 appears to be an intriguing juncture to try and short the US Dollar against the Pakistani Rupee, traders who do not want to wait for this resistance target to be met could speculate on a selling position sooner. Support for the Pakistani Rupee appears to be near the 159.000 mark, which leaves plenty of room for a solid speculative trade.

Because the trend the Pakistani Rupee has shown the past few months does not mirror other global currencies traders exactly, speculators may suspect the PKR has additional room to gather strength against the USD. This can be accomplished by selling the USD/PKR in the short term and monitoring the trade carefully. The trading range for the USD/PKR appears to be stable enough to attempt a selling position without risking the house.

Pakistani Rupee Short Term Outlook:

Current Resistance: 165.000

Current Support: 159.000

High Target: 167.000

Low Target: 157.000