The USD/PKR is testing important resistance near 166.0000 as the currency markets are being pressured by sharp losses on major international stock indices, as the Asia trading session operates and futures markets in the US suggest a day of losses on Wall Street. Vital short term resistance is certainly being targeted and if the juncture of 166.0000 is broken through upwards with buying of the US Dollar within the USD/PKR pair, speculators may target April values near 166.5000.

Speculators within the USD/PKR need to remember low volumes and a tendency to trade near critical support and resistance levels persists within this forex pair. Yet, the Pakistani Rupee is certainly a tradable currency for those who are willing to tests the USD/PKR’s value realm as international business affairs are affected by global events.

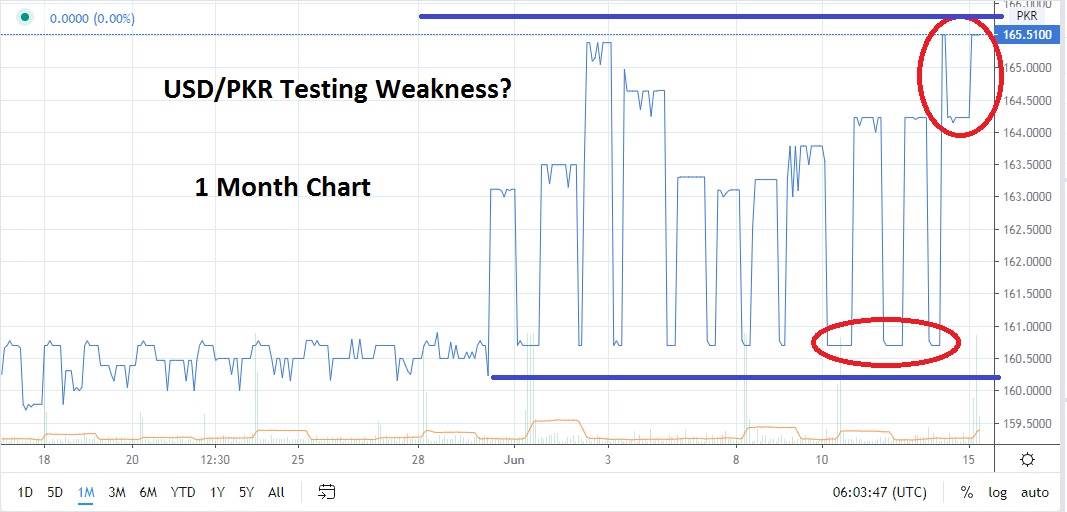

Concerns about a second wave of Coronavirus appear to be gaining voice within the media worldwide. Traders have shown a reaction to worries about the potential impact of a second wave taking a toll economically. Last Thursday saw risk begin taken off the table as pressure mounted in financial markets around the world. After testing support near the 160.7000 level last week with strength, the Pakistani Rupee did experience a reversal as buying of the US Dollar occurred. The PKR lost value as safe havens were sought and it began to battle critical important resistance.

The month of June has given speculators an opportunity to take advantage of the range within the Pakistani Rupee. The volatility within the USD/PKR is certainly not going to disappear, a lack of huge volume within the currency appear to allow for a constant test of technical boundaries. A look at a three-month chart for the Pakistani Rupee gives insights for short term traders seeking a window to the future.

Traders need to pay close attention to resistance levels today and tomorrow which are being approached near the 166.0000 level. A look at the short term indicates if this level is broken the Pakistani Rupee may face additional selling pressure against the US Dollar in the short term. If global stock indices remain under pressure early this week it could certainly create a test of weaker values for the Pakistani Rupee until global trading sentiment calms on stock indices.

Pakistani Rupee Short Term Outlook:

Current Resistance: 166.0000

Current Support: 163.0000

High Target: 167.0000

Low Target: 160.0000